- Digital Beans

- Posts

- Digital Beans-Watch the paint getting dry!

Digital Beans-Watch the paint getting dry!

Digital Beans-Watch the paint getting dry!

Before we get into this, two quick requests I would want to make:

If you like the my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 57th weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Watch the paint getting dry!" Hope you enjoy it.

Spill the beans (What’s on my mind)

Watch the paint getting dry!

Today I want to talk about a podcast that I listened to this week and was blown away by it, featuring an Indian investor called Mohnish Prabrai who is also called Indian Warren Buffet due to his success in the world of investing.

What really blew me away was how Mohnish uses simple models to think clearly, nothing fancy but just a great understanding of businesses and compounding

One key takeaway rule for me was the Rule of 72 that I would discuss here:

So, Rule of 72, is a basically a mathematical way of understanding the power of compounding.

Imagine you want to invest money and the idea is to generate wealth over some period of time, but then how do you go about it ? There are two key pillars to doing that:

How much return should I generate

How long should I be invested to make the required returns

Now let’s say you want to double your money (2x) in 5 years (time)

Using rule of 72, to calculate the annual returns that you need to make, just divide 72 by 5 which is ~14, and this would be the percentage return annually that you need to make

Let me give you an example:

Let’s say you have $100k to invest, and you want to double your money to $200k in 10 years

So, in that case you will need to be make 72/10 or ~7% CAGR on your invested capital every year. Using a calculator 100,000*(1.07)^ 10 = 196,000 so roughly there

Why I loved this method is because when you think of numbers this way it seemingly becomes easier to chart out a path for yourself.

And which brings me to the title of todays edition - Watch the paint get dry

The calculation I did above just goes to show that making wealth is not so difficult, its just that you need to have patience and a long term mindset.

In todays world even if you put your money in an Index you stand to make 14-20% yearly, which means it is not that difficult to 2x or 4x or 10x your wealth in your lifetime. And this is a safer form of investing. Going down the risk curve can reap you rewards like anything.

For starters, there is Bitcoin - a asset that has had the highest return post 2008 after NVIDIA. Here is a chart that shows that

We live in a new world, a digital age but inspite of that, following simple rules and understanding the game of compounding will take all of us a long way as investors.

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $2.72 Trillion

Daily change: 0.60% | Yearly change: 132.05%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $1,360 Billion.

Bitcoin price today: $68,800

Weekly change: 2.59% | YTD change: 62.75%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

Historically, Bitcoin leads the rest of the crypto market off the cycle lows and into the next bull market. BTC dominance increases early in cycles and decreases later as the wealth effect sets in and long-term holders rotate into altcoins for more upside.

Bitcoin dominance: Current Year: 52.86% | Last year (May 2023): 45.95%

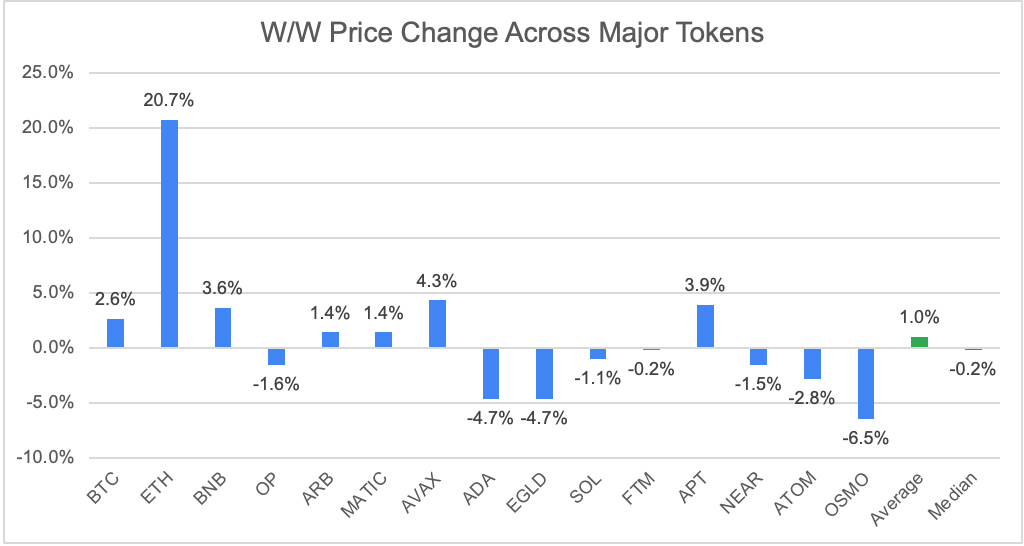

Major Token - Performance

Greed and fear index

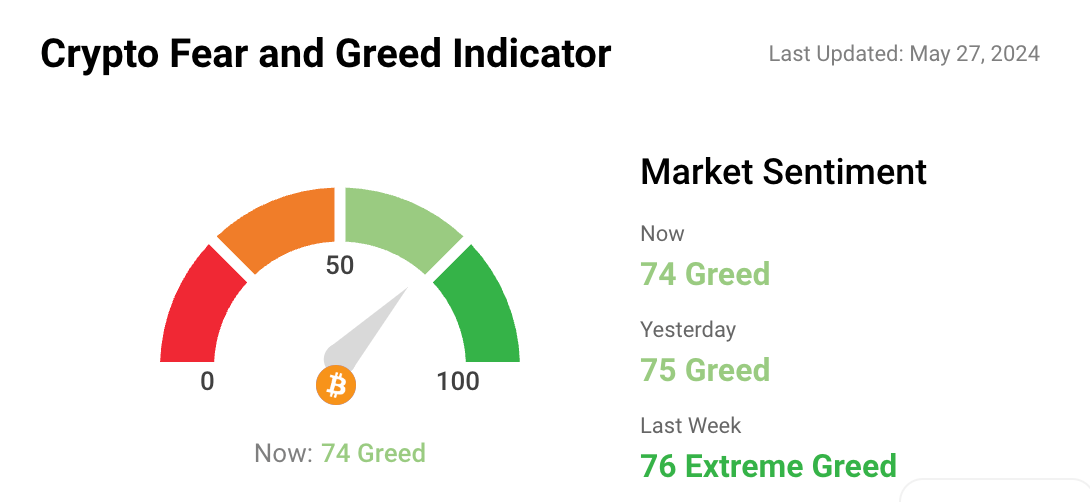

The market sentiment has been up for a few weeks now with Greed levels staying high even as the global economy is in turmoil

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

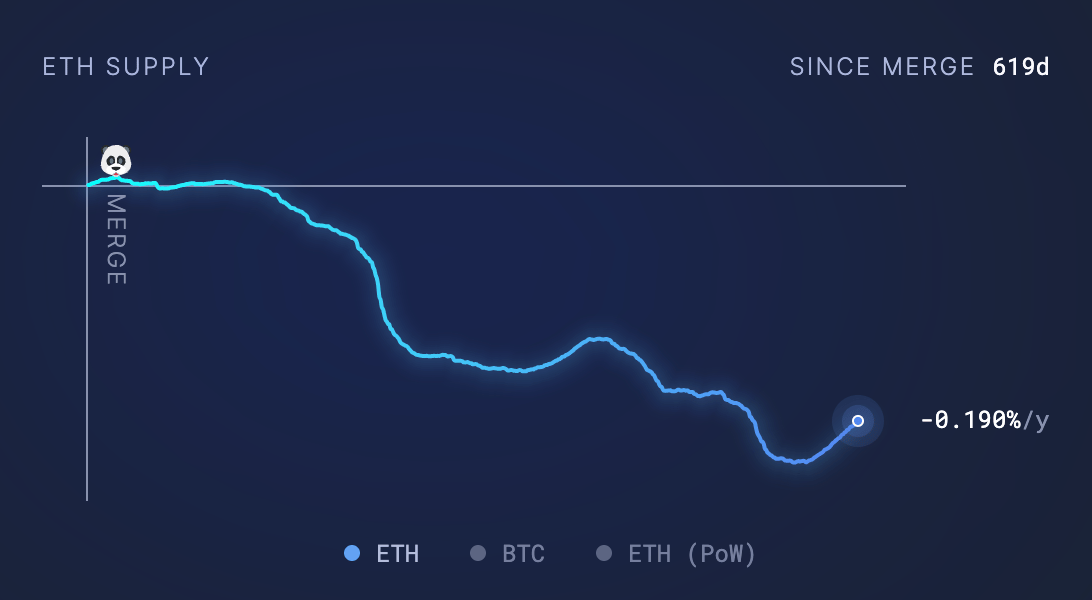

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain. In long term gives a sense of where the supply is headed

Supply change since merge POS -389,076 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Bitcoin Miner Marathon Digital Signs Deal With Kenya to Invest in Green Energy Projects The company will help monetize stranded energy in the African country and help manage its renewable energy production.

Trump Pledges to Free Silk Road Creator Ross Ulbricht If Re-Elected Ulbricht has served 11 years of his sentence of two life terms plus 40 years for creating the darknet marketplace.

What’s my tweet of the week?

Adding to the discussion above, the power of compounding 🤩

Investments 10 yrs ago now worth $1 million:

Nvidia: $5,500

Bitcoin: $7,000

Super Micro Computer: $23,000

AMD: $27,000

Broadcom: $52,000

Tesla: $75,000

Eli Lilly: $80,000

Amazon: $82,000

Netflix: $85,000

Microsoft: $100,000

Apple: $120,000

S&P 500: $375,000— Jon Erlichman (@JonErlichman)

7:32 PM • May 13, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research