- Digital Beans

- Posts

- Digital Beans-Understanding Crypto Valuations

Digital Beans-Understanding Crypto Valuations

Digital Beans-Understanding Crypto Valuations

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 51th weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Understanding Crypto Valuations" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Understanding Crypto Valuations

1} Successful crypto investing needs a pre-requisite, understanding MARKET CAP and FULLY DILUTED VALUATIONS

Give me 300 seconds of your time to add VALUE to your crypto investing, the only MC/FDV primer you need! 🧵👇

Few terms to get started,

1. Market Cap: MC of a crypto asset is the price multiplied by the amount of coins/tokens that are currently in circulation.

2. Fully Diluted Valuation: FDV is the price multiplied by the total amount of coins/tokens that will ever exist (for that asset).

Takeaway 1: The market cap is always smaller than or equal to the FDV.

Why?

The FDV includes certain locked tokens that are pending vesting or unlocks. These locked tokens are usually from a bunch of different categories

Team tokens, Investor tokens or Tokens in a mining schedule that will be emitted over the next 100 years (Bitcoin)

So essentially, Market cap = demand, Then what is FDV = ??.

FDV is not a measure of demand at all. Instead, it is a measure of supply.

Let me explain,

We know that as demand increases for unlocked coins, the market cap (MC) increases. However, the FDV increases proportionally, even though demand for these locked coins does not necessarily increase.

As a result, FDV increases 1:1 with market cap even if those locked coins could perhaps have sellers at much lower prices. Let's understand this more

2} Imagine a scenario, a project holds a fundraising round, raising $2.5m at a $50m valuation for private investors in January.

Private investors are able to purchase at a price of $0.01 per token, but their tokens are locked for one year (vested). The project launches in February and in March the early users receive an airdrop.

However, the airdrop was for 1% of the total supply -> Only circulating supply till now. Lets say there’s $5m of public buyers wanting to be allocated to this new token at any price (demand)

So, the market cap is $5m,

The FDV is 5m*100 = $500m (since the $5m market cap represents 1%). Token price is now $0.10. The investors are up 10x

Now imagine that by next month, this project is listed on all major exchanges like Binance and Bybit Official

Now lots more public $ wants to be allocated to this token, so they go to Binance to buy it. Let's say the amount of public $ that is willing to be allocated to this token is $100m.

Takeaway 2: No new coins have been unlocked because team and seed tokens are locked for 1 year.

The market cap is now $100m. The price is $2. The FDV is now $10bn and investors are up 200x.

What happens after 1 year when the investor tokens unlock? — Supply increases

If unlocks increase supply but not demand, is the unlock bullish/bearish?

If there is no OTC market and no demand for the locked coins, then the only way for locked investors to realize profits is to dump them into AMMs or on Binance when they become unlocked

Takeaway 3: Supply increases due to more tokens, and if demand stays same.

PRICES GO DOWN

Also important to know the unlocks can lead to more demand (bullish narrative) in which case, The PRICE may GO UP or stay the SAME

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $1.76 Trillion

Daily change: -0.1% | Yearly change: 72.81%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $835 Billion.

Bitcoin price today: $42,700

Weekly change: -5.26% | YTD change: 0.92%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 49.83% | Last year (Jan 2023): 42.18%

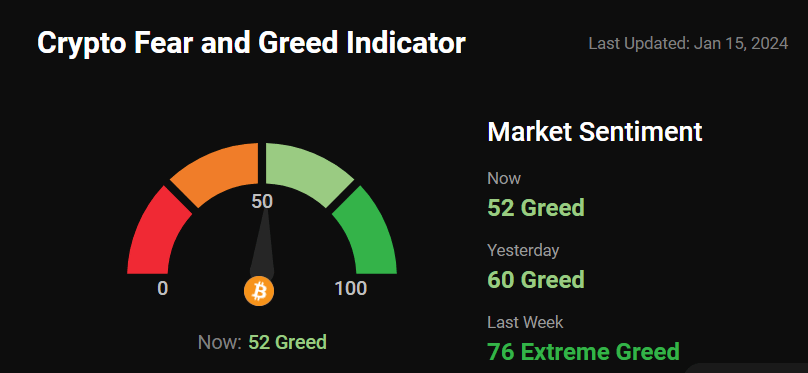

Greed and fear index

The market sentiment has greed levels in the higher range with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

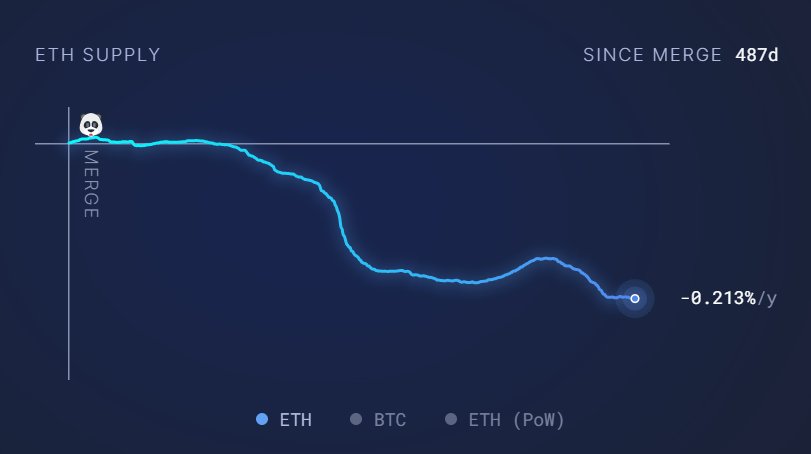

ETH as an ultrasound money narrative!

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain

Supply change since merge POS -342,127 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

JPMorgan Sees Significant Capital From Existing Crypto Products Pouring Into New Spot Bitcoin ETFs The newly created ETFs could attract inflows of up to $36 billion from other crypto products like Grayscale Bitcoin Trust (GBTC), a report said.

BRC-20 growth an ‘important narrative’ for Bitcoin in 2023: Binance Research Binance Research told Cointelegraph that BRC-20 token listings on major exchanges helped propel the market.

What’s my tweet of the week?

Memorize this

I trust you've all got this memorised and ready to recite to your family

— Thomas | heyapollo.com (@thomas_fahrer)

11:36 PM • Dec 24, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research