- Digital Beans

- Posts

- Digital Beans-Economies like Debt

Digital Beans-Economies like Debt

Digital Beans-Economies like Debt

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 52nd weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Economies like Debt" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Economies like Debt

Interesting phrasing that I read in an article today: Economies around the world are addicted to cheap money and central banks are more than happy to deliver the drug of choice. Cheap money will lead to higher asset prices. As investors we have to figure our which ones to keep and HODL.

Let’s look into this more: The world GDP growth can be understood through the following equation:

GDP growth = Population growth + Productivity growth + Debt growth

The first and foremost is the population and we all know that the world population exploded and grew at a massive pace in the last century. There were a lot of factors contributing to that but a growth in cures for diseases (penicillin being the most important) is probably the top of the list.

Once the developed nations reached a population peak, and we talk about them due to massive share of world GDP, economies started focusing on debt as a fuel for growth. So, basically you borrow from your future generations in the hope to grow quickly and repay the debt through this excess growth.

Sounds win-win right?

Well not so much, because this is an ideal scenario, debt needs to be used and managed efficiently for it to be able to generate returns. It worked for some and did not for others

But what we did essentially is tell the nations that there is a path of lesser resistance which involves borrowing from future, and who cares about the future right. So, the governments and economies around the world have used this faucet of money for last few decades to fuel their growth. But as they say nothing is free because this debt would eventually grow to become a major burden and it has.

Economies have Debt/GDP ratios above 100% meaning more debt that the entire GDP. Visualize it as a fat person trying to move around, the more the fat, more difficult it is to move around and function well.

Part of GDP goes into servicing debt, so GDP growth is financing debt payments. To understand this, when a government gets to 100% of GDP in debt and the trend rate of GDP is, let's say, 2%, and interest rates are at 2%, then 100% of GDP growth goes to paying interest. With the interest payments that keep growing. The central banks may need to monetize the interest payments or the economy compounds negative forever.

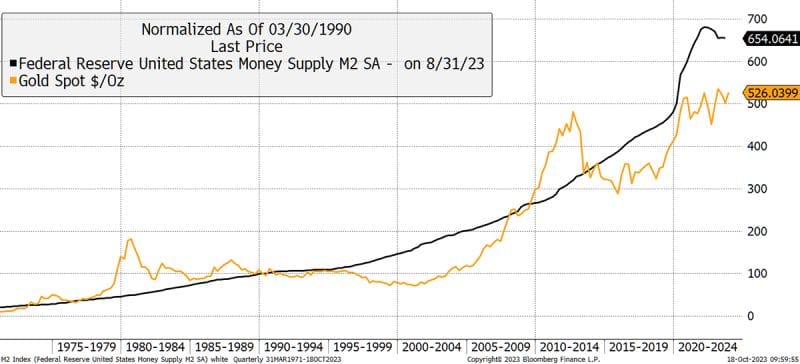

This leads to something interesting, the debasement of currency. You're basically borrowing money to pay off the interest on the other money. What does it do?

Optically makes assets go up in price. Because it's actually the denominator that's falling, and not the asset prices.

So where does this leave us? Into the hands of productivity lever?

We hope for an AI miracle brought to us by Sam Altman’s Chat-GPT and with other leaders jumping the bandwagon, this could be a reality soon. AI means a massive productivity boost.

Think of Amazon - Humans are difficult employees than machines, they work just 8 hours, have emotions, need regular breaks and some day may not be productive as well. But machines controlled by an AI? We can make them work 24×7 365 days a year and this is a massive unlock for businesses. But this is something that may shape up in future and who knows how it will.

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $1.62 Trillion

Daily change: -1.13% | Yearly change: 52.10%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $781 Billion.

Bitcoin price today: $42,700

Weekly change: -7.41% | YTD change: -5.81%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 49.82% | Last year (Jan 2023): 42.32%

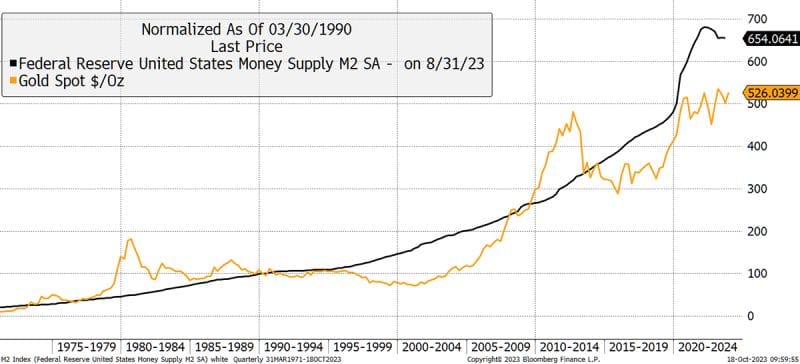

Greed and fear index

The market sentiment has greed levels in the higher range with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

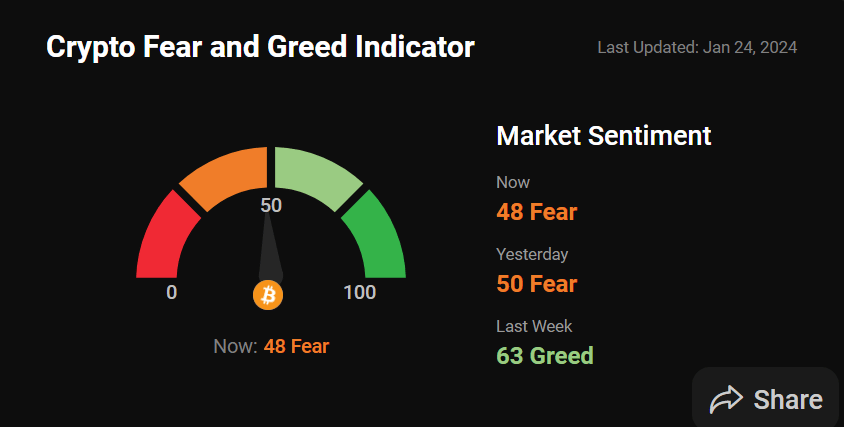

ETH as an ultrasound money narrative!

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain

Supply change since merge POS -345,858 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Bitcoin Under $39K as ETF Debut Continues to Be a ‘Sell-the-News’ Event BTC was down nearly 5% in the past 24 hours, reaching its lowest level in two months. The CoinDesk 20, a liquid index of the highest tokens by market capitalization, fell 7%.

At Davos, Crypto Pushes Case for Decentralized AI With Big Tech set to dominate AI, decentralizers made the case for a blockchain governance layer for the next era of the internet.

What’s my tweet of the week?

Glad if this helps folks

How to get a free MBA on YouTube in 10 days:

— MATT GRAY (@matt_gray_)

6:41 AM • Jan 5, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research