- Digital Beans

- Posts

- Digital Beans- Starbucks Web3 Loyalty Program

Digital Beans- Starbucks Web3 Loyalty Program

Digital Beans- Starbucks Web3 Loyalty Program

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 46th weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 4 mins

This week I was off to Hyderabad to attend my friend’s weeding (from my 1st job in Alstom) which was a banger, relieved the good times with my buddies and rekindled some of the old relationships, overall Good Vibes

With that nice memory, in mind, In this edition, the article I explore is titled "Starbucks Web3 Loyalty Program " Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Starbucks Web3 Loyalty Program

1} Starbucks’ loyalty program “Starbucks Odyssey” was launched in December 2022 and has been very successful

What it does it, it lets users collect stamps by completing gamified, branded journeys. These stamps generate points that unlock rewards for the users.

Odyssey still runs in “beta” and this experiment has been isolated from the traditional Loyalty Rewards Program, and has about 35,000 members. That’s 0.04% of its 75m Starbucks Rewards members. It generated ~$1m revenue in the first year and shows impressive revenue potential once rolled out to a broader user base.

Key strengths have been its simplicity and focus, the user experience, the mechanism around collecting and gamification which has kept the user base engaged.

2} Starbucks executed its Web3 go-to-market exceptionally well by using a staged roll-out, infrastructure partnerships, and separation from its core business.

The transactional relationship of many loyalty programs fail to establish meaningful, long-term relationships with customers. They often fall short of the demands of hyper digitized younger consumers seeking richer digital experiences. This results in low engagement. In fact, 61% of consumers switched some or all of their business from one brand or provider to another in the last year.

This is why, in recent years, brands started to experiment with more sophisticated forms of loyalty, such as richer storytelling and experiences and a shift the focus from shop-to-earn to participate-to-earn.

Thanks to Web3 and blockchain technology, users can control and transact digital assets without relying on a third-party platform. This facilitates genuine digital scarcity and ownership. This enables two key mechanics of Web3 that allow for unique loyalty experiences.

Owning, collecting, and transacting digital rewards strengthens customer connection, long-term engagement, and buy-in

It also gives consumers more agency in the projects, communities, and ecosystems they participate in. Hence higher engagements.

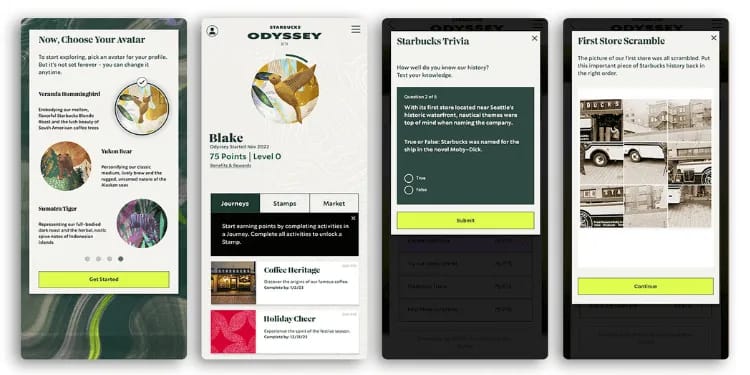

Below is an example of how the current user journey looks like, with features like Avatars, Trivia, Scramble and Stamp collection and reward system to keep high engagement levels

This has been interesting so far, but user acquisition still remains a big hurdle to realize the dream of a fully functioning Web3 Loyalty program that excites the existing Starbucks users and turn them into Super fans.

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $1.6 Trillion

Daily change: 2% | Yearly change: 76.19%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $809 Billion.

Bitcoin price today: $41,400

Weekly change: 4.38% | YTD change: 138.30%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 51.96% | Last year (Dec 2022): 38.61%

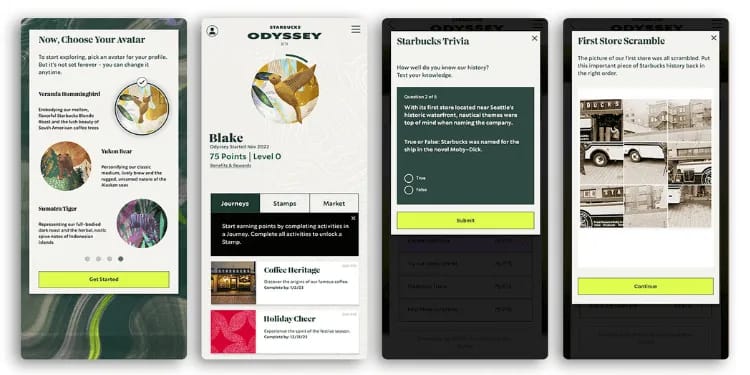

Greed and fear index

The market sentiment has greed levels in the higher range with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

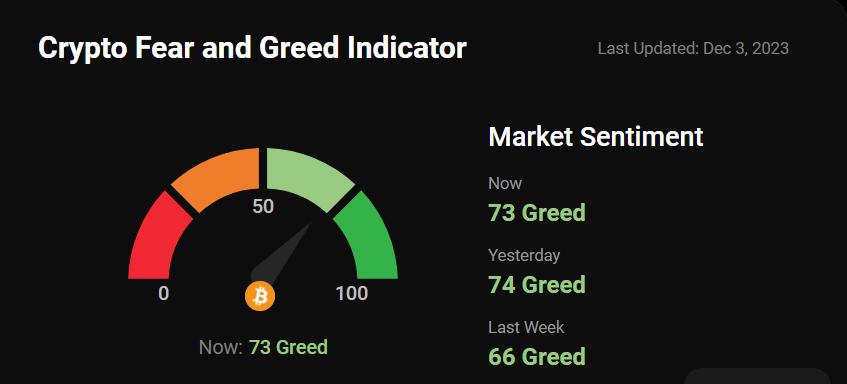

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain

Supply change since merge POS -289,236 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Soccer Star Cristiano Ronaldo Faces $1B Class Action Suit Over Binance Endorsement The suit alleges that Ronaldo "promoted, assisted in, and/or actively participated in the offer and sale of unregistered securities in coordination with Binance."

Cathie Wood's ARK Invest Offloads a Further $4.7M Worth of Coinbase Shares COIN reached its highest level since April 2022 on Monday and remains at 19-month highs

Whats meme-ing Or is it a chart of the week?

Let’s try a meme this week

1 #Bitcoin = 1 #Bitcoin

— Stamp Seed 🔨 (@Stamp_Seed)

9:00 PM • Dec 2, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research