- Digital Beans

- Posts

- Digital Beans- Stablecoin is the real P2P king

Digital Beans- Stablecoin is the real P2P king

Digital Beans- Stablecoin is the real P2P king

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 53rd weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Stablecoin is the real P2P king" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Stablecoin is the real P2P king

The promise of bitcoin has been that it will replace fiat currencies for store-of-value AND medium-of-exchange. It is obvious that hundreds of millions of people are using bitcoin as a store-of-value, but the medium-of-exchange vision is becoming harder to see with each passing day.

In order for any asset to become electronic cash (translation: medium-of-exchange), it must first become a store-of-value. So bitcoin has checked that box.

The next step is to get users of bitcoin to transact with it to purchase goods and services. This happens in certain situations, but it has not become the dominant use case for bitcoin. In fact, other digital assets have become the de-facto asset for peer-to-peer transactions.

Let me explain.

It is true that the total number of transactions on bitcoin’s layer one blockchain have continued to increase over time. Today the number hovers per day between 300,000 transactions and 600,000 transactions.

To put these numbers in context,

Visa does 750+ million transactions per day and 8,750 transactions per second. Paypal does ~ 74 million transactions per day and 850 transactions per second. The Paypal comparison is probably better because it was founded within 10 years of bitcoin’s launch (1999) and has about the same number of users as bitcoin (less than 500 million people globally), yet Paypal’s transaction volume is almost 150x higher on a daily basis.

Now, let’s look at Stablecoins.

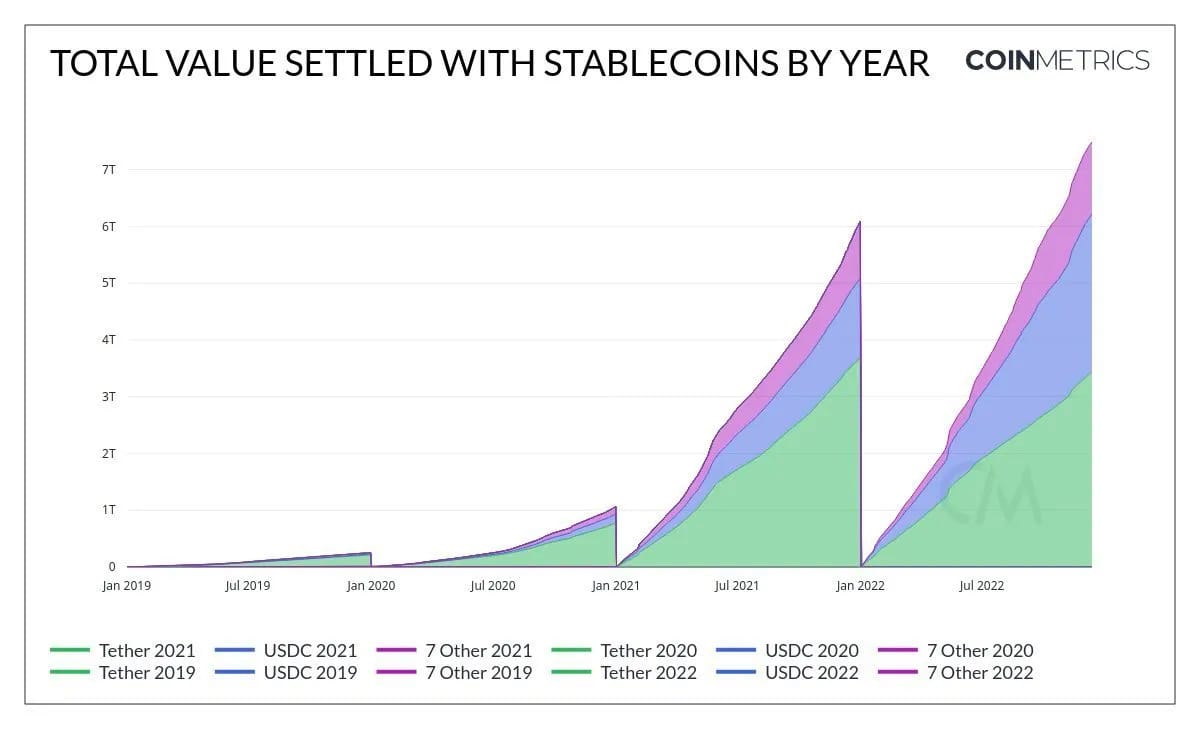

Stablecoins are doing more than $300 billion in weekly transaction volume, which is more than $15 trillion annual transaction run-rate.

Why is this number important?

Because Visa does $15 trillion in annual transaction volume.

Where is the demand coming from?

From anyone looking for dollars in a high inflationary global environment. Infact, Argentina has a black market to get dollars.

On the store-of-value front, bitcoin is a trillion dollar asset that has approximately 80% of the circulating supply which has not moved in the last 6 months. If you expand the timeline out to 1 year, the percentage of coins being held for the long-term is approximately 70%.

Why would you sell an asset that is likely to appreciate in price in the future? You wouldn’t. This is the same reason that people hold real estate or gold. The assets appreciate as the dollar, which the asset is priced in, gets devalued.

Everyone expects bitcoin to become the electronic peer-to-peer cash, but it is becoming more of a store of value. Stablecoins are seizing payments opportunity so far

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $2.07 Trillion

Daily change: 0.08% | Yearly change: 75.56%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $1010 Billion.

Bitcoin price today: $52,270

Weekly change: 3.03% | YTD change: 22.17%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 51.94% | Last year (Feb 2023): 42.19%

Greed and fear index

The market sentiment has greed levels in the higher range with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain. Long term gives a sense of where the supply is headed

Supply change since merge POS -360,702 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Bitcoin ETFs See Record $2.4B Weekly Inflows; BlackRock's IBIT Leads: CoinShares Inflows accelerated last week, indicating increasing demand for the new spot-based exchange-traded funds, CoinShares head of research James Butterfill said.

Ether Could Be the Next 'Institutional Darling,' Bernstein Says The second-largest cryptocurrency is probably the only digital asset other than bitcoin likely to get spot ETF approval from the SEC, the report said.

What’s my tweet of the week?

Tools to help take degen level risks and make it big

10 helpful tools for degens to #100x 🚀:

• Finding trending pairs - @dexscreener

• Market insights - @Cointelegraph

• Finding holders of a token - @bubblemaps

• Trading / Sniping bot - @MaestroBots /@BananaGunBot / @UnibotOnSolana

• Call analyser Bot-… twitter.com/i/web/status/1…— Dami-Defi (@DamiDefi)

4:29 PM • Feb 13, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research