- Digital Beans

- Posts

- Digital Beans- Silver vs Bitcoin

Digital Beans- Silver vs Bitcoin

Digital Beans- Silver vs Bitcoin

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 53rd weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Silver vs Bitcoin" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Today we tackle the surpassing!! Silver vs Bitcoin

1} Bitcoin last week surpassed the market cap of Silver!

A digital asset class with 15 years of history has taken over centuries old asset. The value is flowing into new age assets as they take over proven stores of wealth.

Why are so many people buying bitcoin? There are some macro factors at play.

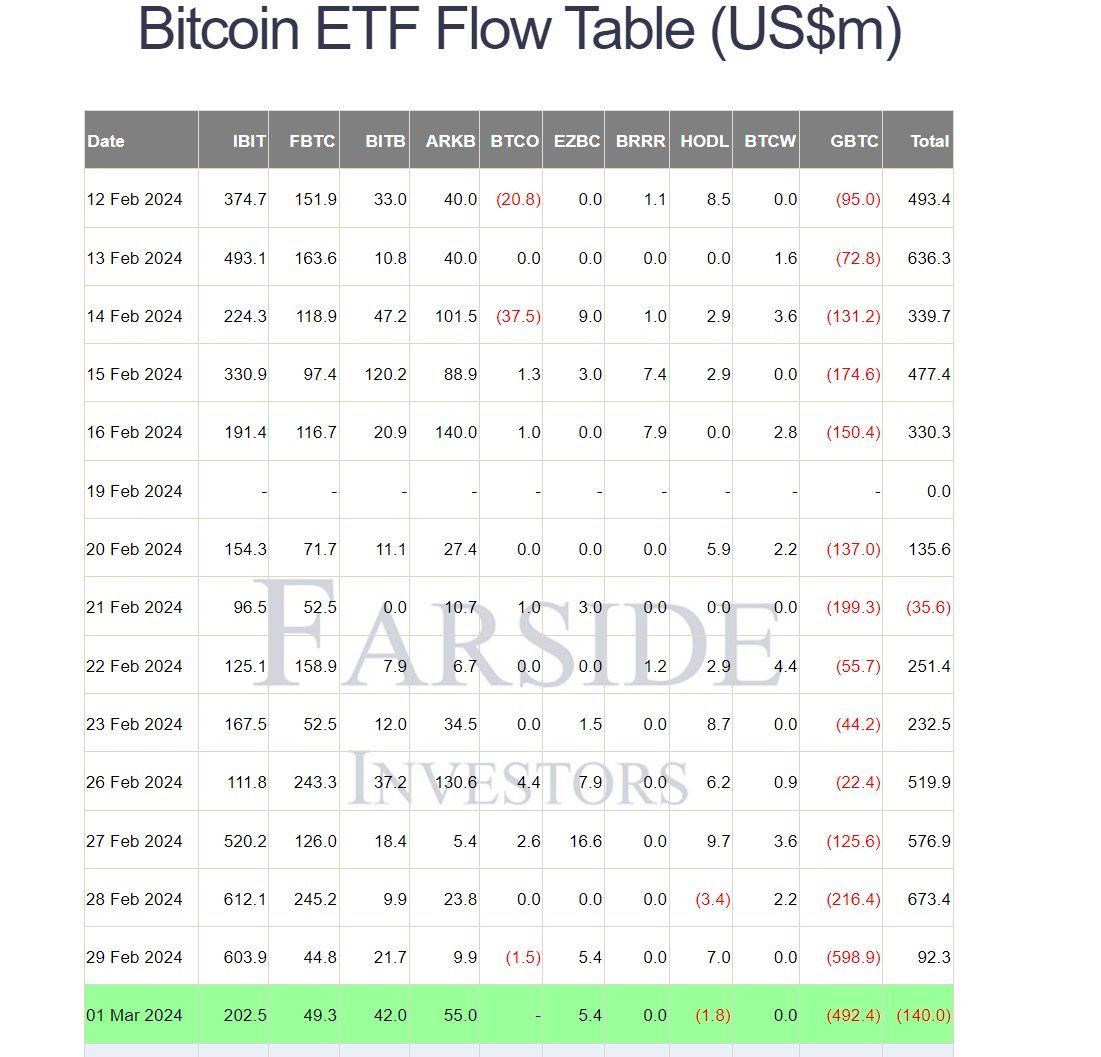

1} ETF Flows are massive into Bitcoin

Last week Bitcoin ETF products experienced a net inflow of $2.23 billion dollars. This morning, BTC reached new all time highs, surpassing Silver in market capitalisation.

2} Companies are buying/holding Bitcoin

Furthermore, it was announced that between February 26th 2024 and March 10th 2024, MicroStrategy acquired roughly 12,000 bitcoins, spending approximately $821.7 million in cash.

In other Bitcoin related news, Arkham has disclosed the supposed BTC holdings of Tesla and SpaceX, marking the first public identification of these assets on-chain. Tesla is estimated to hold 11.51K BTC across 68 addresses, while SpaceX's holdings amount to 8.29K BTC distributed across 28 addresses.

3} Nations have Bitcoin on their balance sheets

President Bukele announced that El Salvador would be moving their bitcoin to cold storage and holding the cold storage device within the country’s borders.

This development alone would be newsworthy. A country’s leadership was taking custody of their bitcoin, which shows how well they understand the value proposition of bitcoin.

But there was a new detail in this announcement — Bukele tweeted the country’s bitcoin wallet address and it was revealed that El Salvador has 5,689 bitcoin which are worth more than $400 million today.

All these factors along with market pricing in Bitcoin halving is catalyzing the recent price discovery Bitcoin has entered into, and this is great for the ecosystem. Next few months are going to be super interesting to say the least

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $2.71 Trillion

Daily change: 2.56% | Yearly change: 127.17%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $1,350 Billion.

Bitcoin price today: $67,900

Weekly change: -6.04% | YTD change: 60.66%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

Historically, Bitcoin leads the rest of the crypto market off the cycle lows and into the next bull market. BTC dominance increases early in cycles and decreases later as the wealth effect sets in and long-term holders rotate into altcoins for more upside.

Bitcoin dominance: Current Year: 51.63% | Last year (Mar 2023): 46.17%

Greed and fear index

The market sentiment says that the greed levels are pilling up hard with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain. Long term gives a sense of where the supply is headed

Supply change since merge POS -446,781 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Meme Coins Going Legit Is the Worst Thing for Meme Coins Institutions like Franklin Templeton are taking meme coins increasingly seriously this cycle. But will these joke-y projects run afoul of regulators?

DePIN: Crypto's Biggest Sector of 2024 The ability for individuals to generate passive income from the tokenization of the real-world data generated by their devices and apps presents an enormous opportunity.

What’s my tweet of the week?

Chad post by Balaji, enjoyyyy

AI for creation, crypto for monetization, social for distribution.

— Balaji (@balajis)

1:18 AM • Mar 16, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research