- Digital Beans

- Posts

- Digital Beans- More money chasing Bitcoin

Digital Beans- More money chasing Bitcoin

Digital Beans- More money chasing Bitcoin

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 53rd weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "More money chasing Bitcoin" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

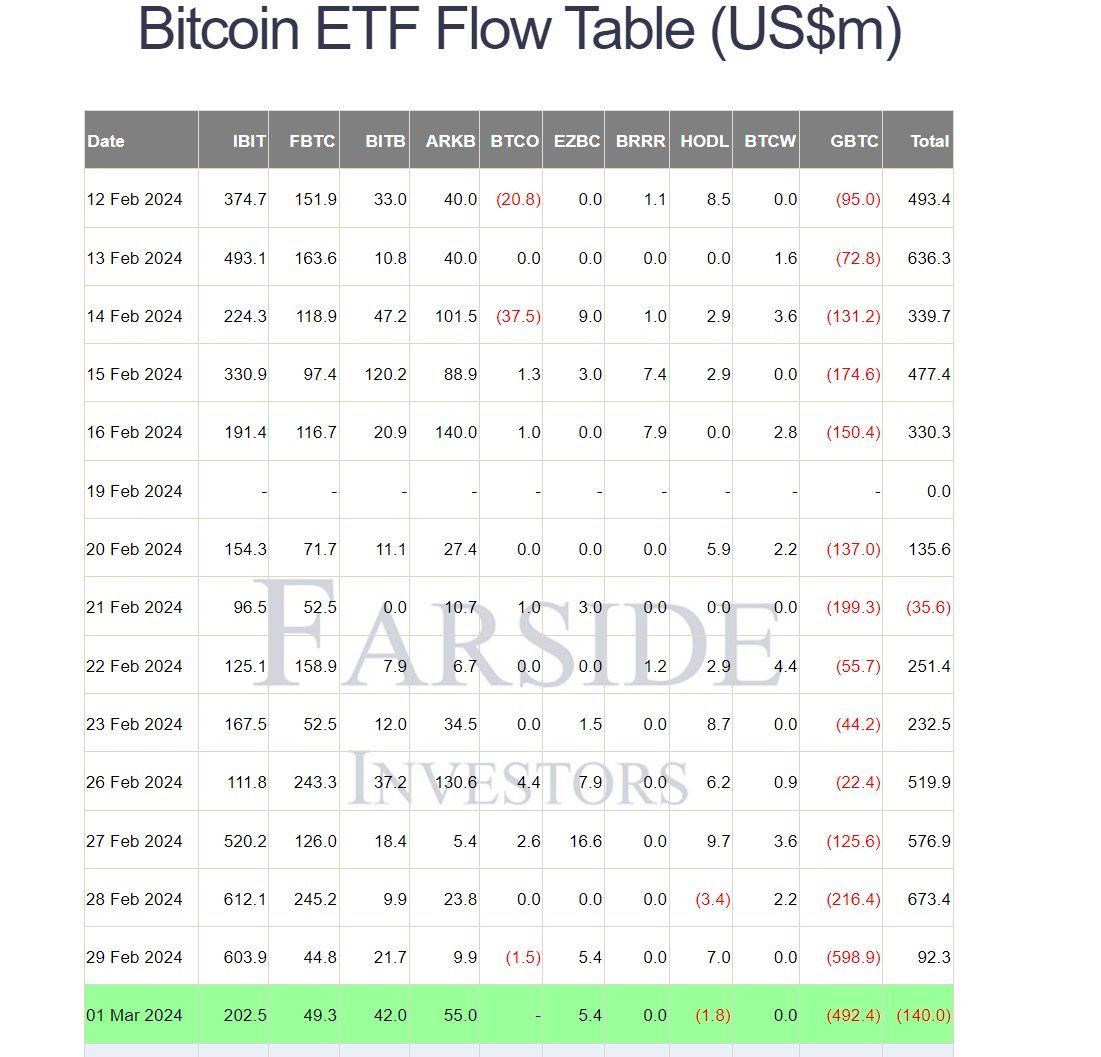

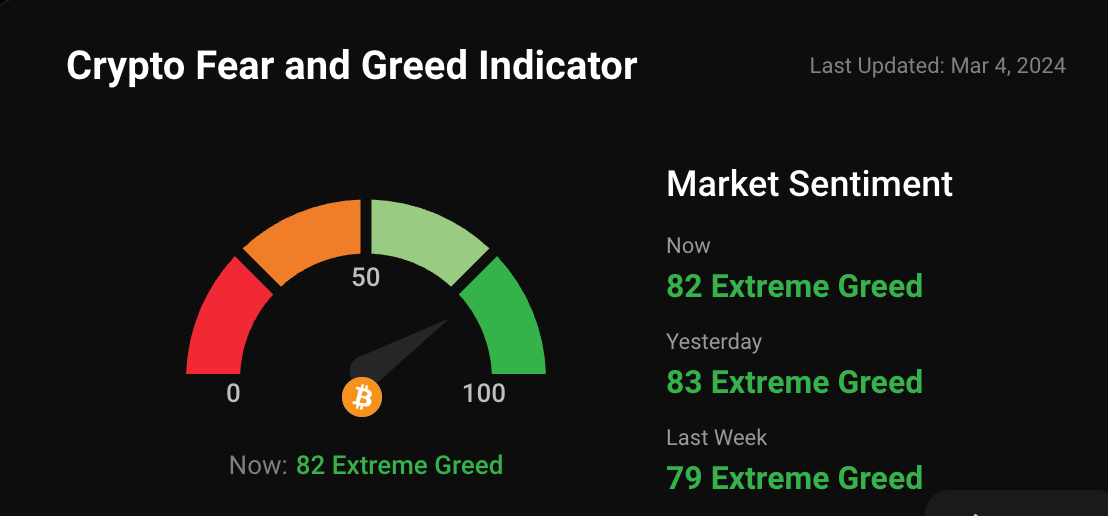

Bitcoin ETF flows are going crazy

1} Something special is happening with Bitcoin right now

It feels like the global financial world has started to understand what the asset is and why it is important for them to own it. Last week we've seen a net inflow of $1.72 billion which is a big number from even an ETF standpoint.

2} Why are so many people buying bitcoin?

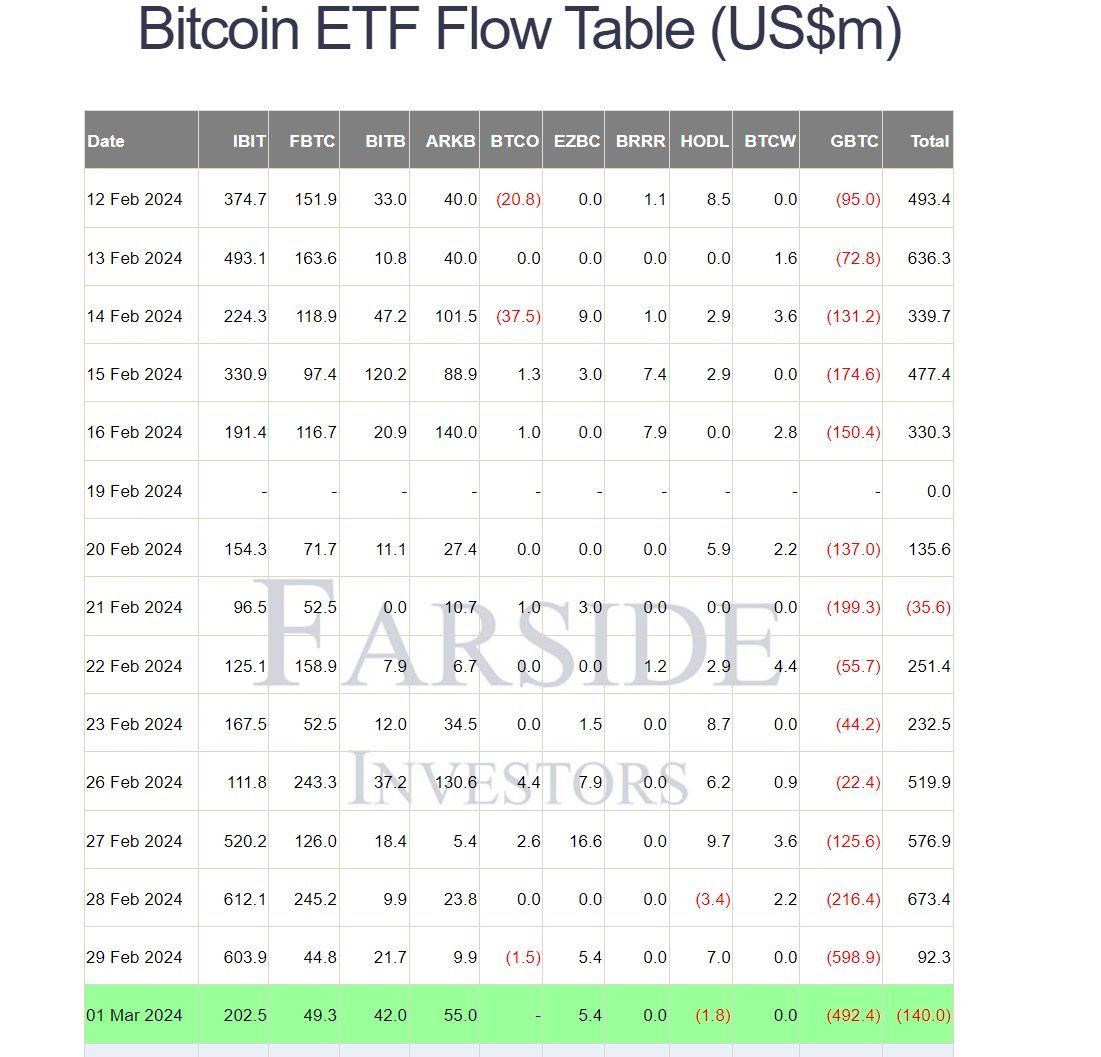

It seems that the risk of inflation is looming on the horizon and traders are betting on substantially stickier inflation in the US for the next few years.

The market understands that if inflation comes back, there are not a lot of places where you can hide. Assets are the safest bet, and when an asset is a hard asset it becomes sort of mandatory to own.

At the end of the day, let the best performing asset over the last 15 years continue to do its thing. It will go up, it will go down, and it will go sideways. But over a long enough time period, bitcoin seems to go up because it serves as an index for global liquidity.

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $2.5 Trillion

Daily change: 2.06% | Yearly change: 133.88%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $1,250 Billion.

Bitcoin price today: $63,300

Weekly change: 22.99% | YTD change: 49.73%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

Historically, Bitcoin leads the rest of the crypto market off the cycle lows and into the next bull market. BTC dominance increases early in cycles and decreases later as the wealth effect sets in and long-term holders rotate into altcoins for more upside.

Bitcoin dominance: Current Year: 52.35% | Last year (Mar 2023): 41.58%

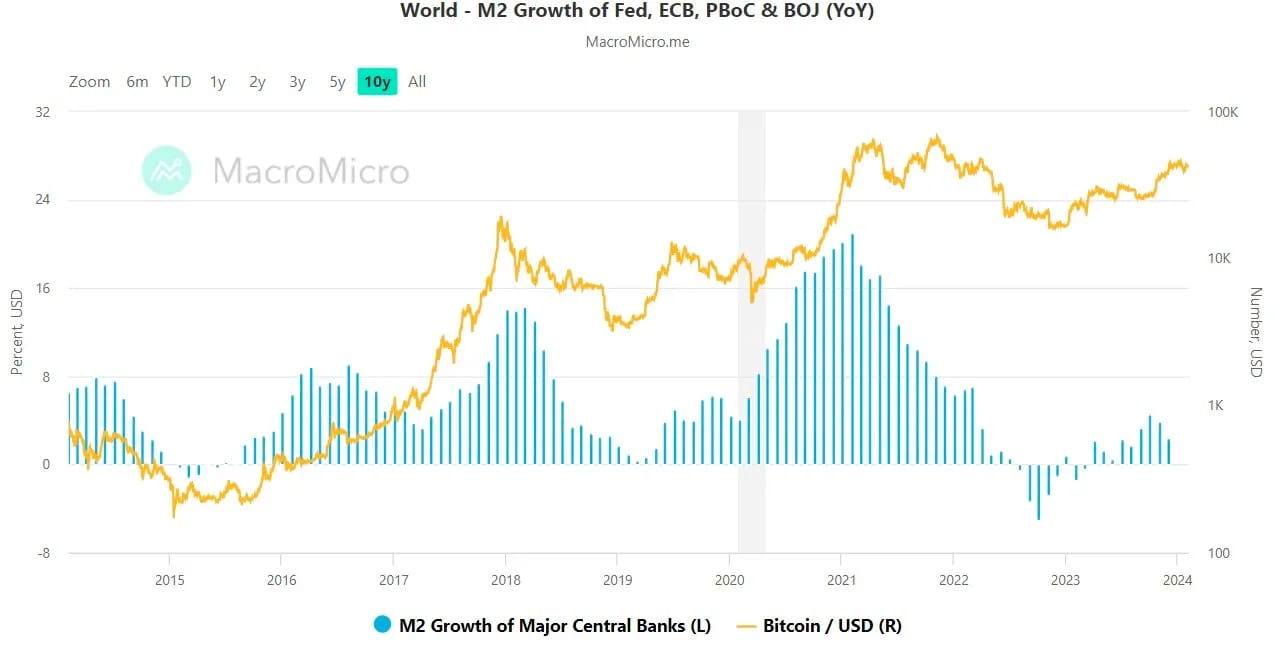

Greed and fear index

The market sentiment says that the greed levels are pilling up hard with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

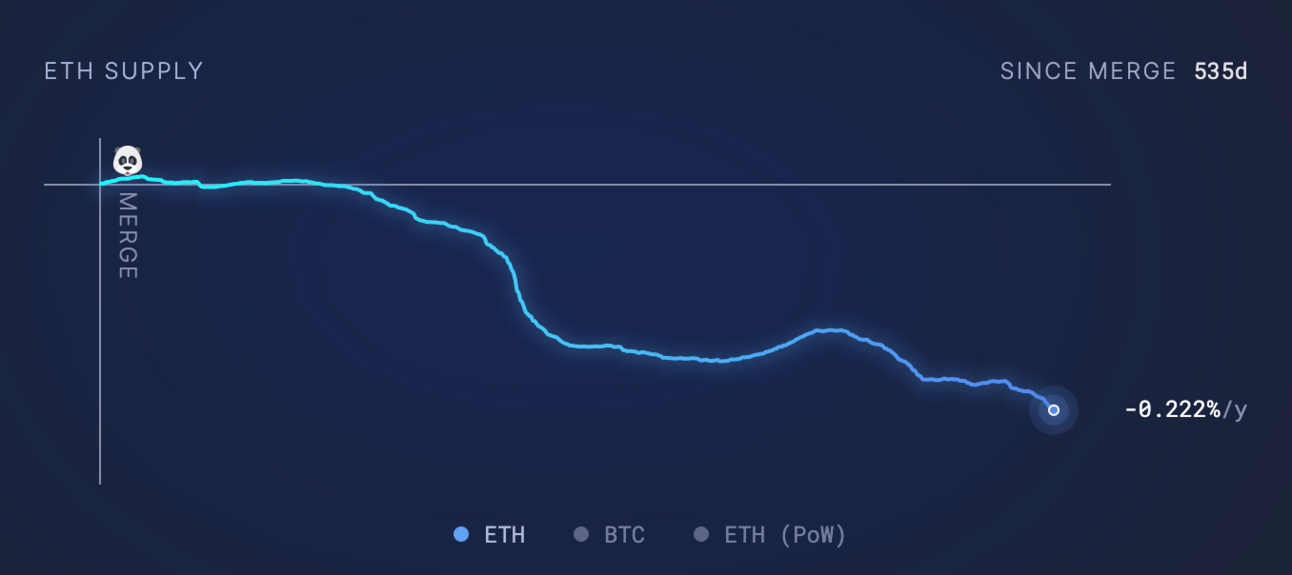

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain. Long term gives a sense of where the supply is headed

Supply change since merge POS -392,233 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Polygon's Plan for a Simplified Blockchain Experience Brendan Farmer, who's the co-founder of Polygon, a project that is focused on scaling Ethereum joins a conversation with an exploration of the foundational elements that constitute the Polygon ecosystem.

Trump MAGA Meme Coins Are the First Experiment in 'PoliFi' One part community, one part prediction market, the meme coin that borrows the former president's likeness is a troll project that became serious

What’s my tweet of the week?

Chad post by Balaji, enjoyyyy

THE PURPOSE OF BITCOIN

The purpose of Bitcoin is to shatter the welfare/warfare state and return power to the people.

Yes, you can understand it as technological innovation — as a better way to hold and send large amounts of money — but at its core it is political revolution.… twitter.com/i/web/status/1…

— Balaji (@balajis)

5:51 AM • Mar 2, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research