- Digital Beans

- Posts

- Digital Beans- It's capitulation but it always gets better

Digital Beans- It's capitulation but it always gets better

Digital Beans- It's capitulation but it always gets better

Before we get into this, two quick requests I would want to make:

If you like the my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 57th weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "It’s capitulation but it always gets better" Hope you enjoy it.

Spill the beans (What’s on my mind)

Macro & Liquidity

In the 1930s, during the Great Depression, farmers were dealing with one of the worst climate events of their time—the Dust Bowl. This period of severe drought ravaged the Great Plains of the U.S., exacerbated by poor farming practices that had stripped the land of its protective grass cover. Without rain and with soil erosion worsening due to strong winds, "black blizzards" of dust buried homes and farmland, rendering the area nearly uninhabitable.

Many farmers gave up during this time, abandoning their homes and farms as their crops failed and livestock perished. They migrated west to places like California in search of work, often facing hostile conditions and poverty along the way. However, those who remained through the darkest years held on to the hope that the land could be rehabilitated.

In 1939, the rains returned, and with new conservation efforts, such as those promoted by Hugh Bennett through the Soil Conservation Service, farmers began to see recovery. The Dust Bowl region, once nearly desolate, slowly returned to productivity. The capitulation of many farmers during this period mirrors the emotional and economic surrender often seen in financial markets, where despair signals the end of a downturn, eventually followed by recovery.

I read this story in another article and the reason I share this is because the situation right now although grim, is a great opportunity for the ones who don’t fold, to buy assets at dirt cheap prices. The pain can be there for some more time but the history of markets has shown that if the market capitulates, it always bounces back.

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $2.01 Trillion

Daily change: 1.10% | Last year: $1.05 Trillion

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $1.06 Trillion

Bitcoin price today: $54,400

Weekly change: 6.98% | YTD change: 56.64%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

Historically, Bitcoin leads the rest of the crypto market off the cycle lows and into the next bull market. BTC dominance increases early in cycles and decreases later as the wealth effect sets in and long-term holders rotate into altcoins for more upside.

Bitcoin dominance: Current Year: 56.21% | Last year (Sep 2023): 49.10%

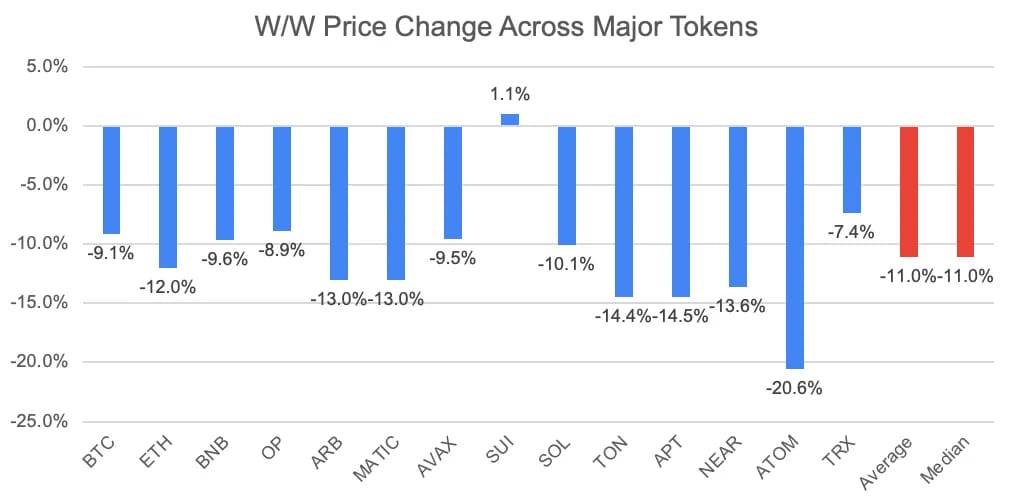

Major Token - Performance

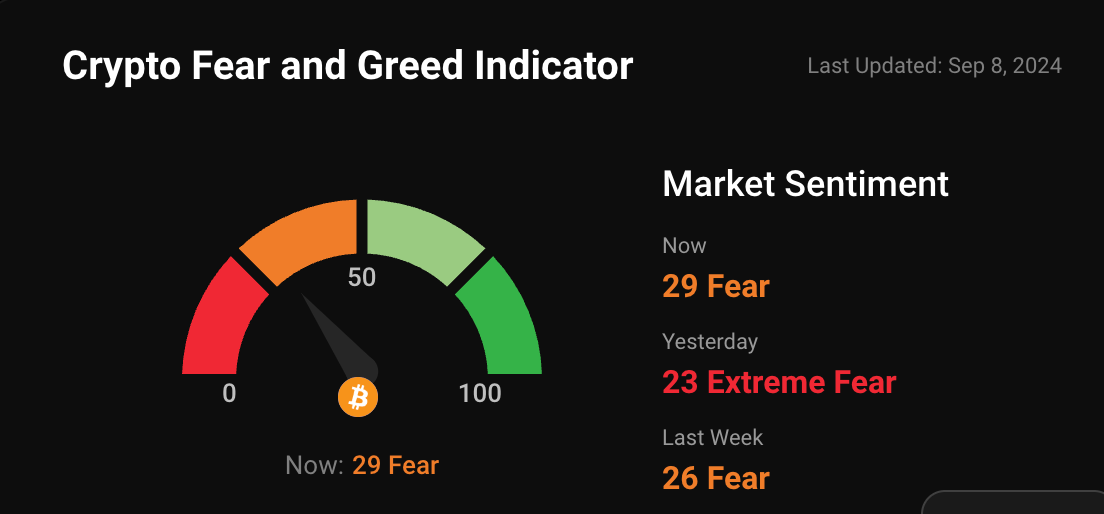

Greed and fear index

The market went down last week but Greed levels remain high even as the global economy is unsure of what is going to happen next

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

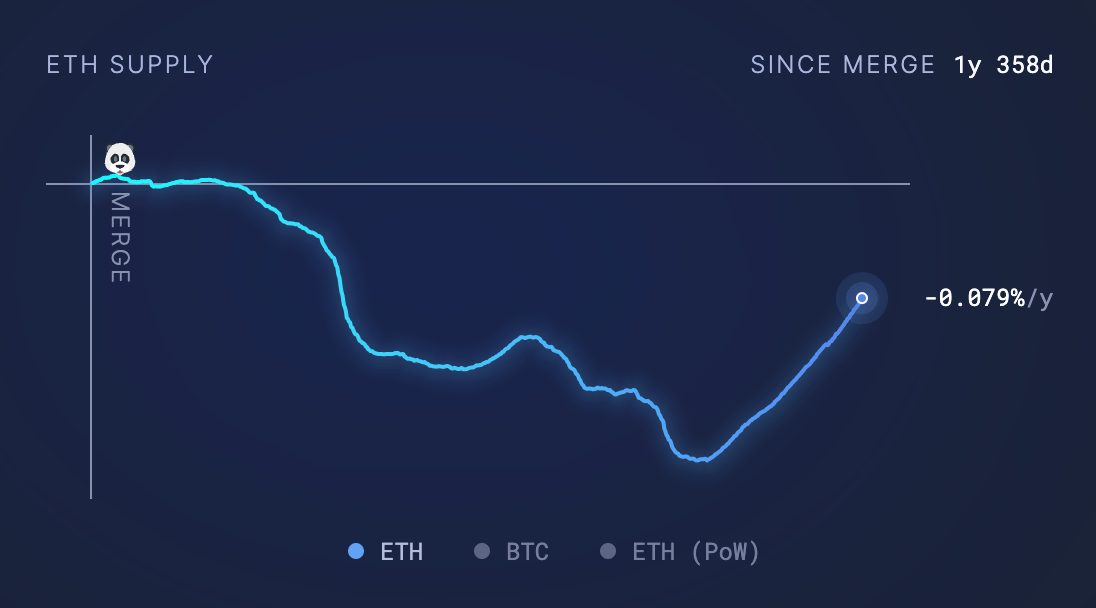

ETH as an ultrasound money narrative!

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain. In long term gives a sense of where the supply is headed

Supply change since merge POS -189,905 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Telegram Is Driving Crypto Adoption, Despite Bad News Telegram's crypto adoption story via TON may be its lasting mark in 2024 despite recent news leaving many with a negative impression, says Daniel Cawrey, a former CoinDesk journalist who is now chief strategy officer of Tonkeeper, a non-custody wallet app for The Open Network (TON) ecosystem

Escaping the Casino: How Tokenized Assets Will Save DeFi From Itself Vitalik Buterin is right: DeFi today is a circular speculative economy. The bigger opportunity lies in bringing traditional capital markets on-chain, so that crypto reaches the mainstream, says Zach Rynes (aka ChainLinkGod), who serves as a Chainlink Community Liaison.

What’s my tweet of the week?

There is silver lining

#Bitcoin is growing faster than the internet.

— Dan Held (@danheld)

5:40 PM • Jun 20, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research