- Digital Beans

- Posts

- Digital Beans- Bitcoin's price post halvings

Digital Beans- Bitcoin's price post halvings

Digital Beans- Bitcoin's price post halvings

Before we get into this, two quick requests I would want to make:

If you like the my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 55th weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Bitcoin's price post halvings" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Bitcoin's price post halvings

By the time this post reaches your inboxes the Halving event has already occured, and that’s great but let’s talk about one important thing that has always occupied a larger mindshare of the crypto community and Bitcoiners post halving,

The way Bitcoin price action works post halving

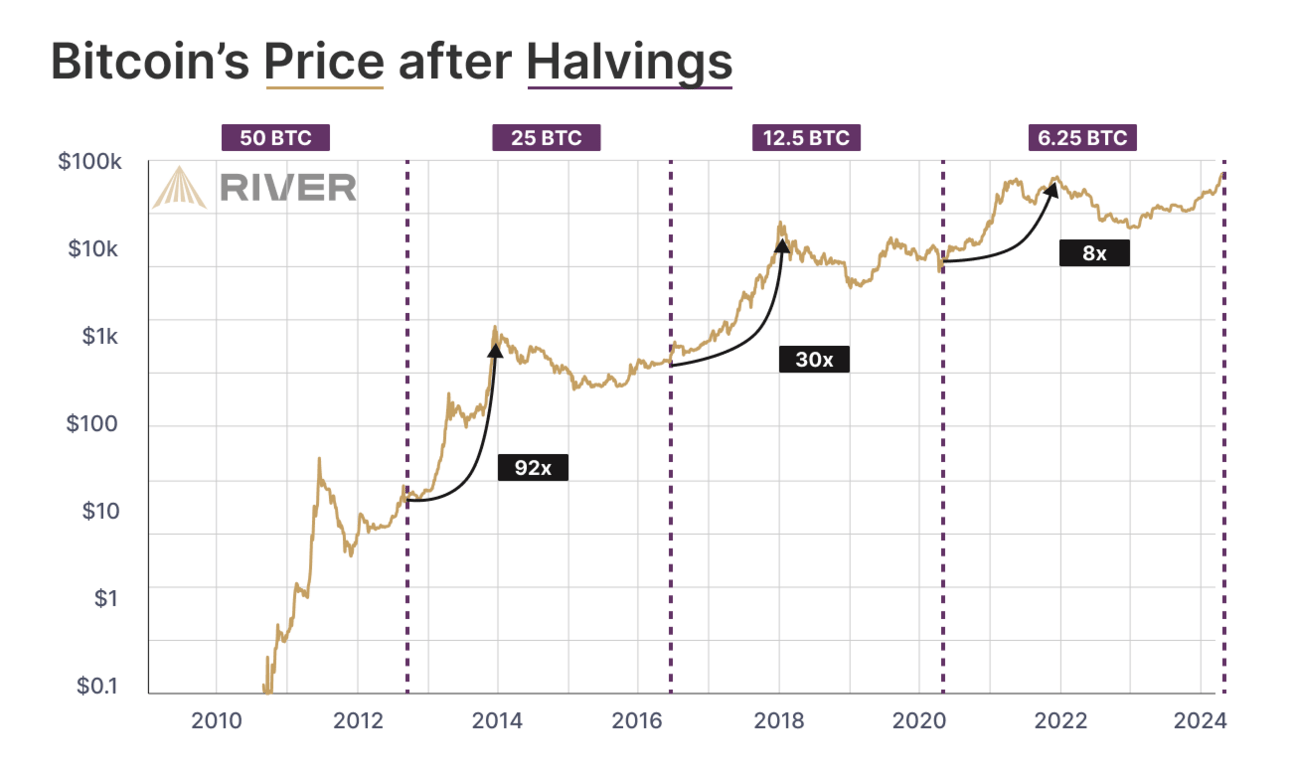

1} Bitcoin has soared to greater highs post halving every time

One of the biggest digital asset goes through a phenomenon every 4 years, reducing it's supply inflation. Every reduction leads to a price discovery. In the past, the price action has been huge

1st - 90x

2nd - 30x

3rd - 8x

The returns as you can see have come down significantly for each new halving and that is because the base effect, as the market cap of Bitcoin prior to each new halving is significantly higher than the previous halving

2} Is it going to be the same this time as well?

The phenomenon is a consequence of two major things that have worked out in favour of Bitcoin before every halving

Demand explosion

Supply inflation reduction

This is something we read about in our Micro 101, but what’s interesting is that this time,

3} These two factors are aligning up nicely just like stars do in the horoscope of someone who is about to get lucky in life 😛

Why I say so is because if you have been following the newsletter, I have already talked about some of this stuff but just to brush up again

Demand comprises of institutions coming in to buy Bitcoin and that has happened due to Bitcoin ETF approval in the US and now in Hong Kong as well, the AMC giant Blackrock has already accumulated $10b+ of Bitcoin due to high demand of investors to expose them to this asset

Supply inflation rate is a basically the %age with which the asset is supposed to grow in quantity/volume. So as a benchmark GOLD grows at roughly 1.5-2% every year, which means that it is difficult to mine more gold than this percentage very year, thus making it a safe bet for countries and investors.

This inflation rate for Bitcoin after this halving is going to be just 0.9% which is less than that of GOLD, so if you think that Bitcoin is an investible asset, then probably it is the one of the safer bets as it cannot be mined more than what is intended by the Bitcoin code which was written in 2008, and has been working perfectly well over 15 years now.

The convergence of these two factors make me extremely bullish as this time Bitcoin can potentially cement it’s place in the minds of people as a safer asset up there with the likes of GOLD

Over the short term this could be sell the news event as many people have already purchased huge amounts of Bitcoin anticipating the rise in prices but the longer term trend stays UP ONLY

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $2.52 Trillion

Daily change: 2.40% | Yearly change: 110.29%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $1,280 Billion.

Bitcoin price today: $65,100

Weekly change: 0.50% | YTD change: 53.94%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

Historically, Bitcoin leads the rest of the crypto market off the cycle lows and into the next bull market. BTC dominance increases early in cycles and decreases later as the wealth effect sets in and long-term holders rotate into altcoins for more upside.

Bitcoin dominance: Current Year: 54.24% | Last year (Apr 2023): 47.11%

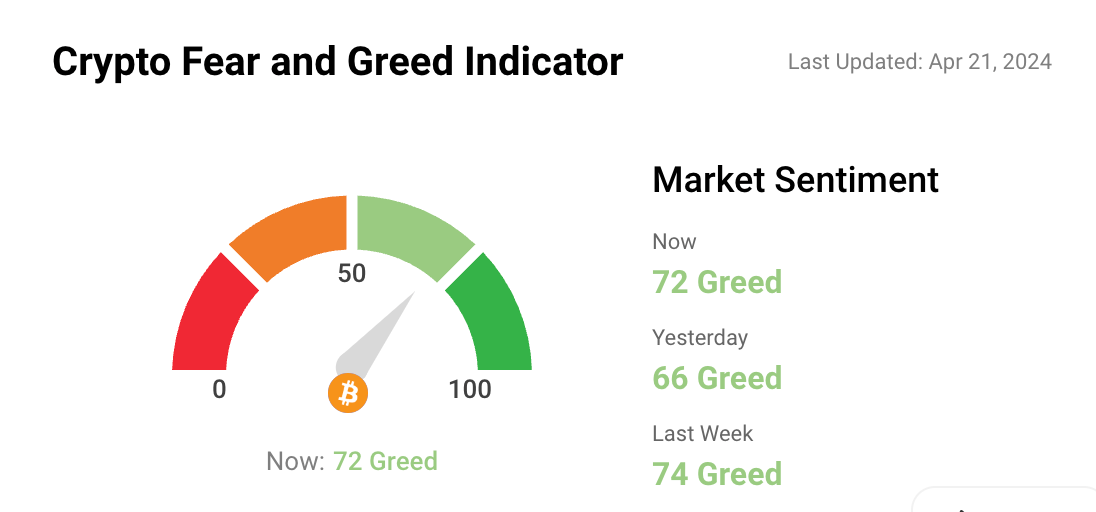

Greed and fear index

The market sentiment was down last week as there was a broader correction with Bitcoin sell off before the halving but looks like the market is recovering now

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

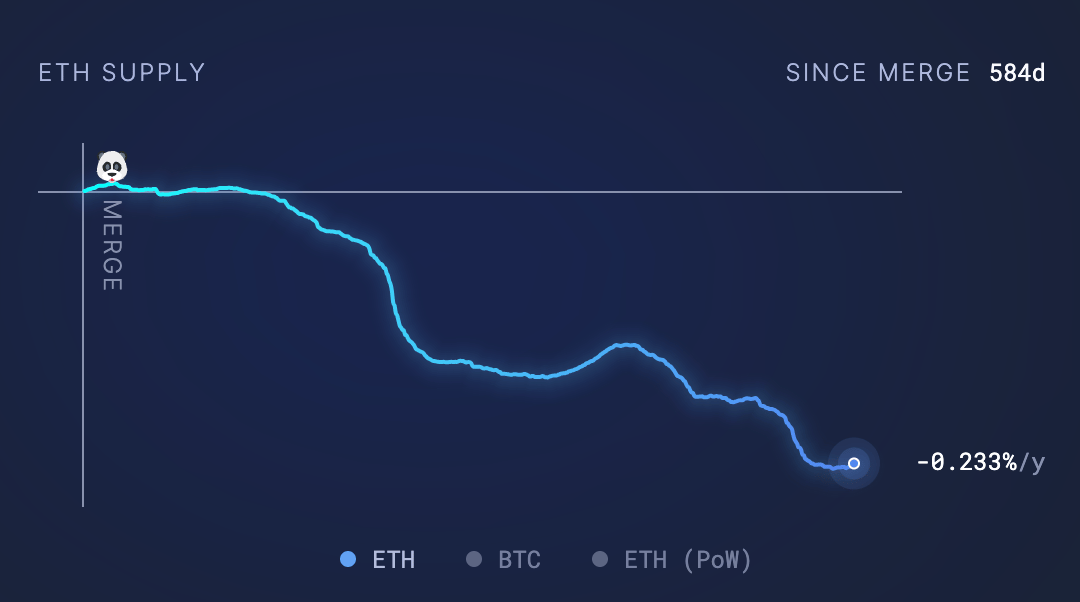

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain. Long term gives a sense of where the supply is headed

Its almost half a million ETH that has been burned.

Supply change since merge POS -449,267 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Bitcoin Miners Are Better Positioned for the Halving This Time Round: Benchmark Bitcoin's rally in the past six months will help cushion crypto miners from the effects of the 50% cut in their earned rewards, the report said.

Why Would Someone Want To Pay With Crypto Anyway? The future of finance will be more affordable, accessible, and borderless, not by eliminating TradFi, but by merging crypto payments with legacy payment rails.

What’s my tweet of the week?

Till we all understand this, we keep posting

JUST IN: Kraken releases new #Bitcoin commercial leading up to the halving 👀

— Bitcoin Magazine (@BitcoinMagazine)

5:19 PM • Apr 15, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research