- Digital Beans

- Posts

- Digital Beans- Bitcoin's 4/20 moment

Digital Beans- Bitcoin's 4/20 moment

Digital Beans- Bitcoin's 4/20 moment

Before we get into this, two quick requests I would want to make:

If you like the my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 54rd weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Bitcoin's 4/20 moment " Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

4/20 - The Bitcoin Halving

We are approximately 2 weeks away from the Halving event. It is slated to occur on April 20th and will drop the daily incoming supply of bitcoin from 900 bitcoin per day to only 450

1} Each for the simple reason that each prior Bitcoin halving has launched Bitcoin’s price to new heights.

No other event comes close to the halving’s significance on the horizon, the hard part is understanding why this happens & waiting for the next halving.

Luckily, for all of us at this point, the next Bitcoin halving is just weeks away. And I am super excited. But what makes it so significant. The beauty of it lies in the math that runs the protocol.

2} Bitcoin’s protocol is driven by a simple mathematical expression

This is all in terms of the monetary policy of Bitcoin. Its hardcoded and no one can tinker with it. Not even the FED, not the INDIAN govt. and that is powerful for us individuals if you think of it.

Here’s what this function says.

First, the code counts how many halvings have occurred. A halving is pre-set to occur every 210,000 blocks (~4 years, since there is a new block every 10 minutes on average)

Next,

The amount of new Bitcoin to be issued for each new block is determined. This is calculated by dividing 50 by 2, for each halving that has occurred

The result is that,

For the first 4 years, 50 new Bitcoin were issued to the miner of each block. After the first halving, 25 Bitcoin were issued per block until the next halving (4 years later), when it was cut to 12.5 Bitcoin per block. And this pattern of decreasing Bitcoin issuance every 4 years continues until 2140, when no more Bitcoin will be issued ever again

3} In April 2024, the 4th halving will happen and suddenly, Bitcoin’s supply inflation will drop to 450 BTC per year

This will make Bitcoin a “harder” asset than gold, whose supply grows 1.5-2% every year from global gold mining efforts.

Now all this is based on the assumption that the world will go digital and understand the value of intangible assets that exist on chain, which if we still don’t think will not happen, then might as well call ourselves BOOMERS.

Adoption brings demand and halving reduces supply rate, this leads BTC into price discovery and then SKY IS THE LIMIT

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $2.71 Trillion

Daily change: 2.55% | Yearly change: 120.97%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $1,370 Billion.

Bitcoin price today: $69,300

Weekly change: -0.99% | YTD change: 63.73%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

Historically, Bitcoin leads the rest of the crypto market off the cycle lows and into the next bull market. BTC dominance increases early in cycles and decreases later as the wealth effect sets in and long-term holders rotate into altcoins for more upside.

Bitcoin dominance: Current Year: 52.83% | Last year (Apr 2023): 46.33%

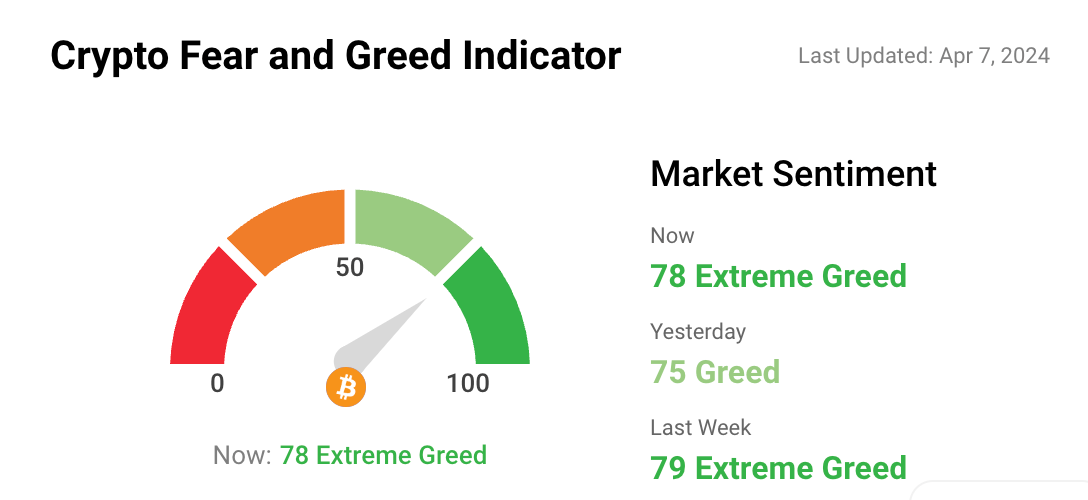

Greed and fear index

The market sentiment says that the greed levels are pilling up hard with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

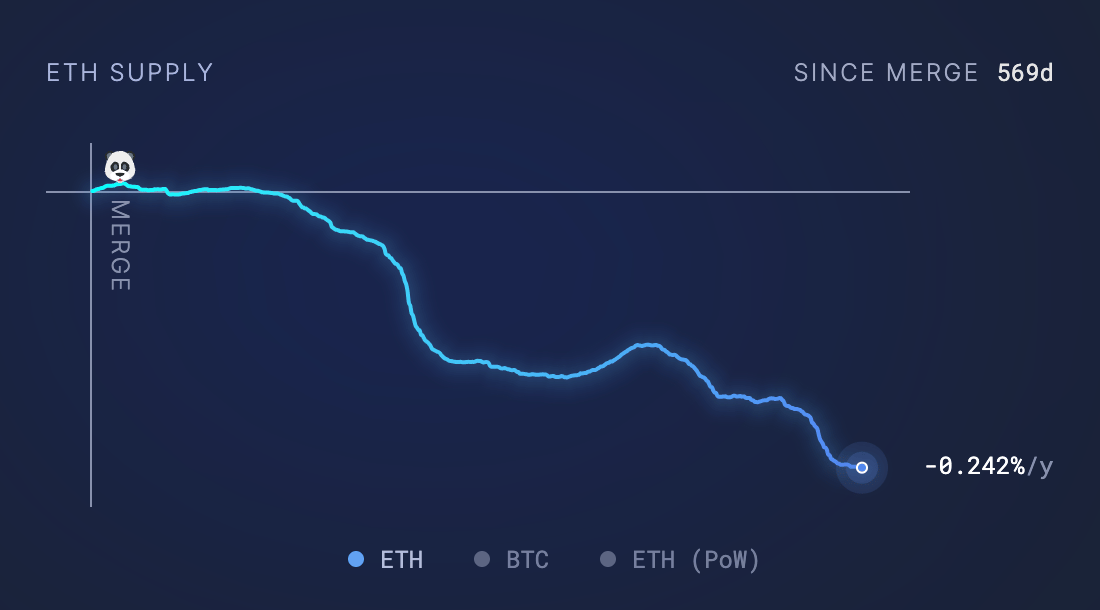

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain. Long term gives a sense of where the supply is headed

Supply change since merge POS -456,198 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Did Strong Bitcoin ETF Demand Kill Halving's Potential Bullish Rally? The much stronger-than-expected inflows into the spot bitcoin exchange-traded funds (ETFs) have already caused concerns about a supply shock in the bitcoin market, potentially taking away some of the impacts of the halving.

What the Ethereum Community's Staking Argument Is Really About The Ethereum community is debating the power and responsibilities of the Ethereum Foundation, which some think is playing central banker by suggesting changes to the ether issuance formula.

What’s my tweet of the week?

Till we all understand this, we keep posting

The greatest #Bitcoin explanation of all time.

— Watcher.Guru (@WatcherGuru)

3:45 PM • Mar 16, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research