- Digital Beans

- Posts

- Digital Beans- Bitcoin will change your world

Digital Beans- Bitcoin will change your world

Digital Beans-Bitcoin will change your world

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 49th weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 4 mins

In this edition, the article I explore is titled "Bitcoin will change your world" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Bitcoin will change your world

Hey everyone,

As I reflect back on some of the things that shaped my curiosity and learning journey this year, I do believe that nothing comes close to anything like Bitcoin. It's a portal that has opened doors to understanding money, financial systems, macroeconomics and history like no other.

I think Bitcoin is going to change the world! And what I feel is that over the course of years and decades, Bitcoin is going to exist with the financial system. I say this because the cost of us having to transition to a system that is ruled by Bitcoin is just too high. I mean, the financial world in itself is very complex, right? And if you bring Bitcoin into the equation, and a whole different set of economics principles driving the ethos of Bitcoin (The Austrian school of Economics) can be overwhelming to a normie like me as well.

We have grown to think of inflation as a necessary evil but not a root cause issue with current financial system. But the Austrian model of economics is totally different than that, right. You basically see current system and Bitcoin as different extremes of two economic ideologies, but there would be a time when we would have a hybrid middle ground, the world I believe, would still be run by the current model of economics, but Bitcoin will be much more relevant.

I recently thought of an analogy that may make sense to some of you. Imagine you just have 21 bars of gold in the world. And this is, let's say, going back to the old ages, when we just had let's say, 21 bars of gold. And then there's this king (Egyptian King) who owns high number of these total 21 bars of gold. Now, there was this tradition in those times where the king would eventually be buried with most of the possessions for its journey to the other world. The king dies and the people decide to bury the king with 5 gold bars out of let's say 10 that he owns. Everyone understands the importance of gold, but at the same time those 5 bars of gold have now been buried with the king. And that cannot be stolen.

Let's take that assumption and apply to Bitcoin as it works like that. If your coins are stolen, if your coins are lost, no one can sort of bring those back just like the 5 bars that are buried with the king. Imagine the amount of worth the other 16 bars of gold are going to have. Now those 16 bars of gold high are going to be repriced to the worth of 21 bars and that is exactly what is going to happen with Bitcoin. As the world progresses, people are going to lose Bitcoin or it may be stolen. Some people are going to die and they won't be able to transfer them to the next generation. So in totality the Bitcoin in the system would decrease. And that's such a powerful indicator of how things are going to proceed in the coming years and decades. As the wealth flows into Bitcoin, knowing that it is the only definite asset not under control of any entity, to the already lesser supply, it gets repriced just like Gold would. And we think about it, this is huge for digital wealth creation.

I also think the boomers in India and the world are going to be left out because a lot of them do not understand the concept of digital world and digital wealth. And in this case, Bitcoin as well. They're comfortable with cash and that's good for them. They've lived their lives, dealing with cash, but now there is this asset, which is intangible, which exists on a blockchain and people don't even understand blockchain. People cannot touch or feel blockchain and hence it becomes difficult for them to have an understanding of this asset, which does not exist in the real world.

That is where people who get this early are going to make money and generate wealth. This final week for the ones who feel interested do read about #Bitcoin. And that's your alpha.

If you are looking for folks that help you understand it better, follow the following folks on Twitter to get started

@LynAldenContact @saifedean @saylor and get started on the journey.

Happy Holidays.

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $173.6 Trillion

Daily change: -0.38% | Yearly change: 104.5%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $834 Billion.

Bitcoin price today: $42,644

Weekly change: -1.05% | YTD change: 157.70%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 50.72% | Last year (Dec 2022): 39.91%

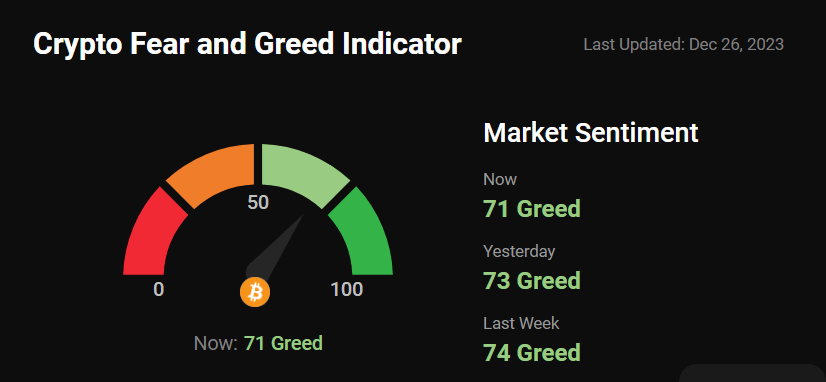

Greed and fear index

The market sentiment has greed levels in the higher range with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

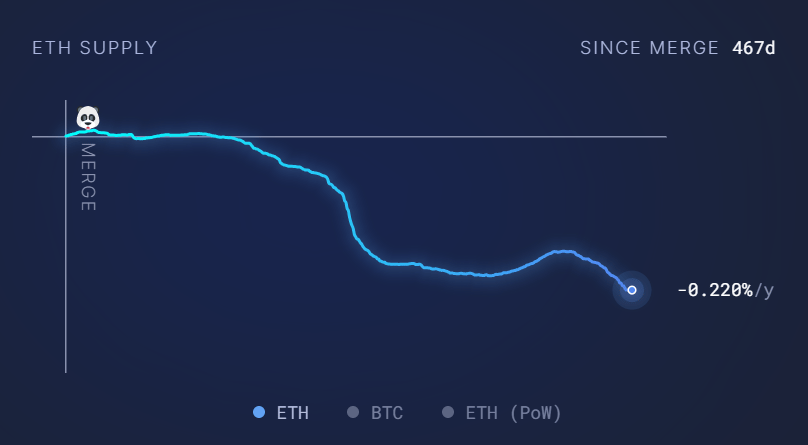

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain

Supply change since merge POS -338,825 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Who Won Crypto in 2023? The CoinDesk Market Index Broken Down in 6 Charts Tokens from Injective, a layer-1 blockchain in the Cosmos ecosystem, and Render, a GPU rendering network that migrated this year to Solana from Ethereum, dominated the year's return rankings among the CoinDesk Market Index (CMI) benchmark index of 184 digital assets.

Solana Flips Ethereum in DEX Volume and NFT Sales The network registered $10B in DEX volume in the past seven days, while Ethereum processed $8.8B.

Whats meme-ing Or is it a chart of the week?

Here’s a something funny for this week,

I trust you've all got this memorised and ready to recite to your family

— Thomas | heyapollo.com (@thomas_fahrer)

11:36 PM • Dec 24, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research