- Digital Beans

- Posts

- Digital Beans- Bitcoin is self love

Digital Beans- Bitcoin is self love

Digital Beans- Bitcoin is self love

Before we get into this, two quick requests I would want to make:

If you like the my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 55th weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Bitcoin is self love" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Bitcoin is self love

Hi all, today is more of an elaborated thought that came to me during on of my morning runs. So usually when that happens, I immediately take a note - ask SIRI to create a reminder to go back to the thought and ruminate a bit more as I dive in to form my thesis around it.

It’s more like asking myself - why the hell did you think of it 😛

This time was no different and hence my thoughts on why - “Bitcoin is a form of self love, self preservation”

There are energy creators and then there are net energy takers in the world and in every interaction you feel that. People, work, things. You name it. Even modern day Physics has taught us that some reactions release energy, some consume energy, basically meaning that there is always an energy exchange during our interactions with surroundings.

Now let’s apply this to wealth

If you think about it, the wealth or money as we call it is a form of energy, which is reward to us for all the efforts and energy we put in (output of your efforts/work). And as our parents did, we believe in storing this wealth, saving money so that we can do something meaningful later in our lives, basically deferring consumption for the future use. SAVING our ENERGY

But then there is a phenomenan like inflation which becomes a net negative for us, given it is taking away our energy converted into money. Why? Because more money which is an account of the energy for us can be created easily by centralised entities like the Govt.

On the flip side, an activity like working out can be net positive for us given it can generate returns in the future or allow us to be productive/create more energy that is spent working out.

In an ideal state, if we store some of our energy into something that grows, it is net positive or creates extra energy that we can use in the future plus preserving the existing energy as well. Land is a great example of that because it's limited. Hence if you own land, you see good returns over some period of time.

Bitcoin similarly protects our energy as it allows us to convert into something that can not be made more of in the future, so as the central entities like govt create more money it does not devalue our share of energy stored because it is stored in a fixed asset just like land. Infact it increases the value of the asset.

The world today is moving in the direction of excessive money creation and when that hits us all. there would be massive inflation, and the assets that are limited would prove massively useful. Bitcoin is one of the assets that is available to all!

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $2.42 Trillion

Daily change: -3.30% | Yearly change: 93.59%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $1,225 Billion.

Bitcoin price today: $62,250

Weekly change: -6.11% | YTD change: 47.13%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

Historically, Bitcoin leads the rest of the crypto market off the cycle lows and into the next bull market. BTC dominance increases early in cycles and decreases later as the wealth effect sets in and long-term holders rotate into altcoins for more upside.

Bitcoin dominance: Current Year: 53.39% | Last year (Apr 2023): 47.52%

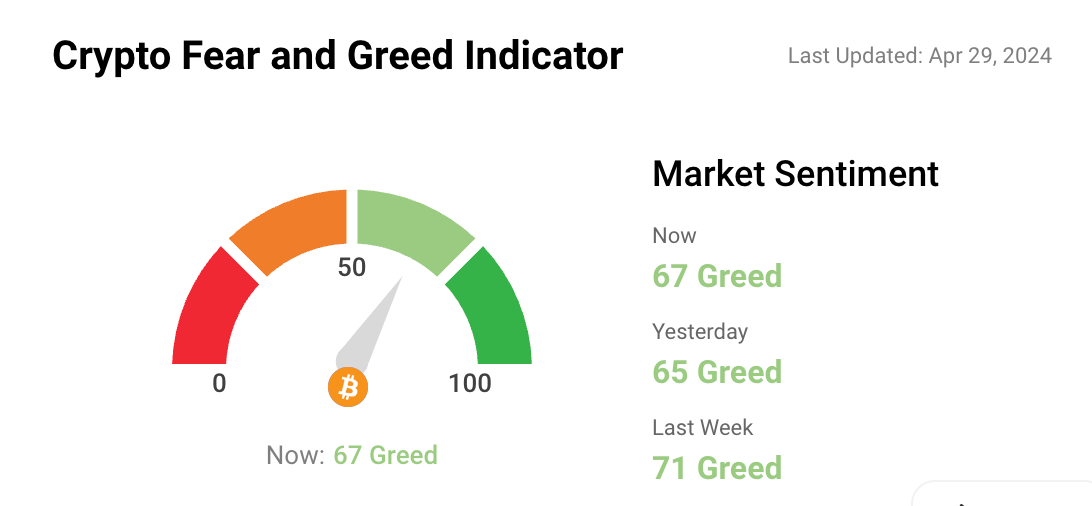

Greed and fear index

The market sentiment has been down for few weeks now as there was a broader correction with Bitcoin sell off before the halving

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain. Long term gives a sense of where the supply is headed

Its almost half a million ETH that has been burned.

Supply change since merge POS -437,334 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Bitcoin, Ether Nurse Losses as U.S. Stagflation Fears Grip Market The crypto market is balancing the threat of stagflation against a potential liquidity injection from the Treasury General Account (TGA), and the launch of Hong Kong's bitcoin ETFs.

Yuga Labs to Restructure and Renew Focus on Otherside CEO Greg Solano took aim at “labyrinthine corporate processes” in a message to employees.

What’s my tweet of the week?

Till we all understand this, we keep posting

The best video about #Bitcoin🔥

This should be taught in every school.

— Vivek⚡️ (@Vivek4real_)

12:54 PM • Apr 26, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research