- Digital Beans

- Posts

- Digital Beans- Bitcoin rewards ownership

Digital Beans- Bitcoin rewards ownership

Digital Beans- Bitcoin rewards ownership

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 53rd weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Bitcoin rewards ownership" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Bitcoin rewards ownership

I have always wondered how much of a difference it would have been had users been allowed to own part of companies and have skin in the game as they grow. From a user’s perspective, the major issue with how Web 2 companies are formed is that using the product or service doesn’t accrue equity in the company providing it. You don’t get shares of Meta by using and groiwing on Insta, however there are ways these platforms allow you to make money. But for most of the users like me, these centralised companies take our attention and provide a service or product we enjoy, but that’s it. And even if you want to invest, you can’t unless you are rich and well-connected.

1. Participation ≠ Ownership. Bitcoin changed that.

Through Bitcoin, it became possible to reward participants with ownership in the startup. Before you could purchase Bitcoin on an exchange starting in 2010, mining it was the only way to acquire it. Miners, by burning electricity, validate transitions, which creates and upkeeps the network. For this activity, they are rewarded with newly minted Bitcoin.

Participation = Ownership

The incentive to add more users is to protect your interest, that’s why even though we are the product but we own the network too. All together, and the rewards get distributed proportionately to the amount of ownership.

And this started a set of experiements that have shaped how Crypto has evolved and acquired users

The ICO phase:

The first major project that conducted an ICO was Ethereum in 2014. The Ethereum Foundation pre-sold Ether, the commodity that powered its virtual decentralised computer, in exchange for Bitcoin. In 2015, Ether was distributed to buyers. It was a successful ICO. The foundation pre-sold its token for funds that were used to develop the network further.

The Yield farming mania:

The project foundations allocated a large amount of tokens to be awarded to community members who performed valuable activities. In return for doing said actions, the protocols would instantly emit freely tradable tokens. And thus, yield farming was born.

But now we have another system that we see used by multiple platforms. Kamino, Marginfi to name a few. Building an amazing project without little, if any, VC funding is entirely possible.

2. The project needs money to acquire users, and POINTS are the new and exciting way to guerilla market.

With points, the project doesn’t lock itself into an aggressive token emissions schedule like with YIELD FARMING. That is because the points-to-token ratio can be changed at any time. There is no contract that says the project must match a specific points-to-token ratio.

With points, the project generates usage in the specific ways it believes will increase the long-term value of its service. Many of the most impactful crypto projects are some sort of two-way marketplace. Points help jumpstart network activity and overcome the cold-start or chicken-and-egg problem. The ability to surgically, dynamically calibrate points emissions to specific actions throughout the project’s ecosystem means that the project can be very effective in generating the exact type of user interaction it desires.

Finally, with points, the project doesn’t have to lean as heavily on signing token pre-sale deals with VCs and other high-net-worth investors. The major purpose of VC capital is to pay for user acquisition; points can accomplish this. The best part is that the project can implicitly sell its token at a much higher price via the opaque points program than a transparently priced round.

3. A points program is only effective if there is a high degree of trust between users and the project’s founders.

The user trusts that after interacting with the protocol, their points will convert into tokens at a reasonable price in a reasonable time frame. As points programs proliferate, there will be bad actors who abuse this trust. Ultimately, a breach of trust with large amount of money involved might be what kills points as a fundraising and user engagement tool. But we aren’t there yet, so I ain’t fussed.

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $1.96 Trillion

Daily change: 4.14% | Yearly change: 87.18%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $981 Billion.

Bitcoin price today: $50,000

Weekly change: 17.07% | YTD change: 18.28%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 52.59% | Last year (Feb 2023): 42.44%

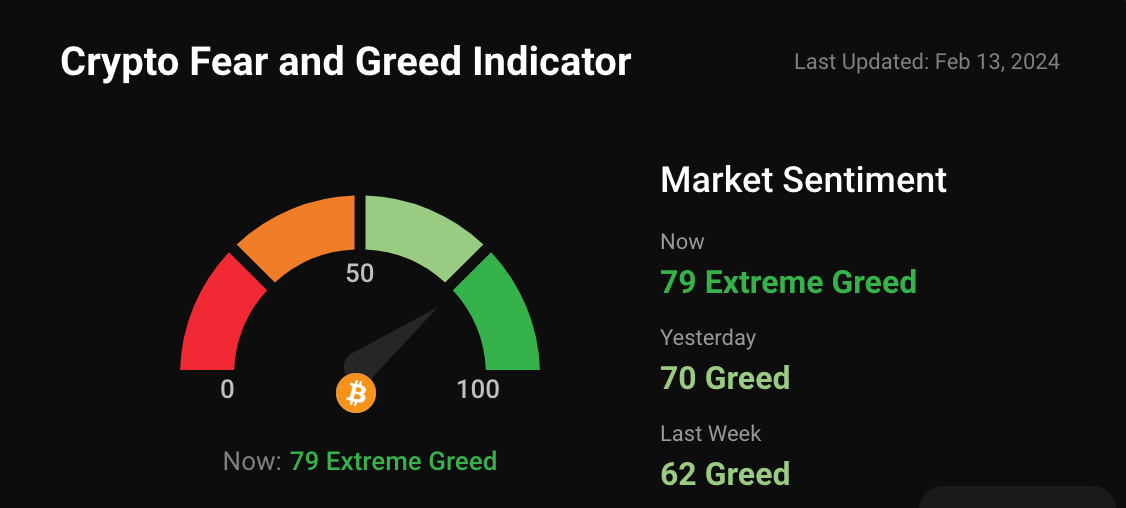

Greed and fear index

The market sentiment has greed levels in the higher range with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

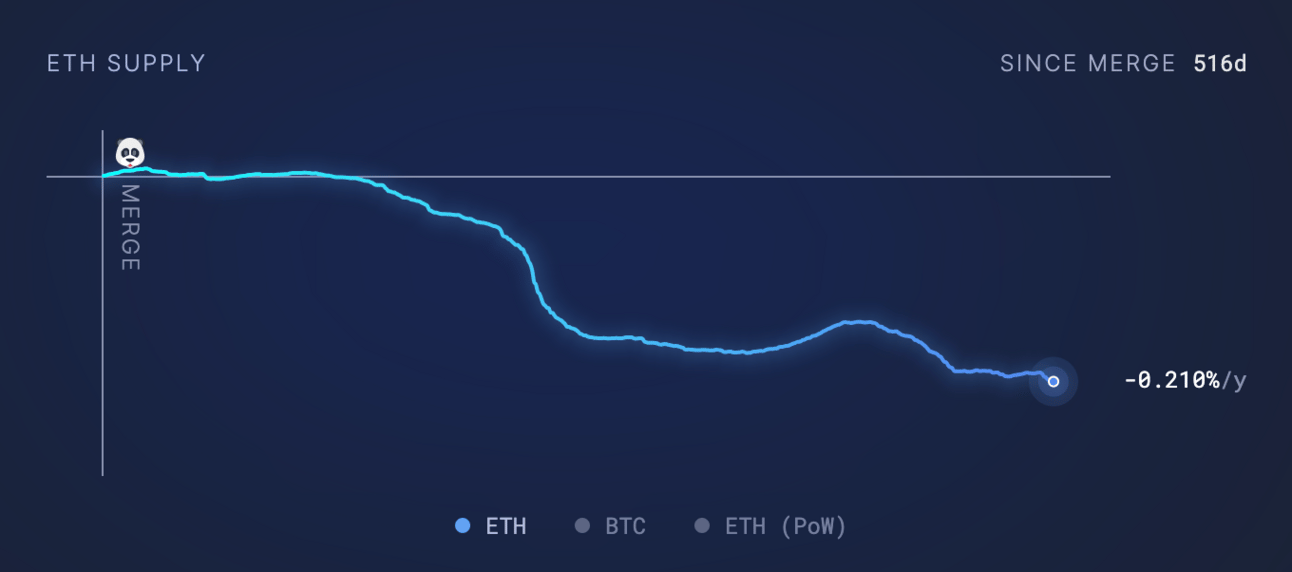

ETH as an ultrasound money narrative!

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain

Supply change since merge POS -357,135 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Peter Thiel Made $200M Investment in BTC, ETH Before Bull Run: Reuters A source said that the investment was split evenly between the two digital assets.

Michael Saylor Believes Demand for Bitcoin Products Is 10x the Supply MicroStrategy co-founder and executive chairman says his company is re-branding as a bitcoin development company during CNBC interview.

What’s my tweet of the week?

Looking to find narratives to invest, look no more

If you want to maximise this bull run, you must pick the right narratives.

Last cycle, we saw L1s, DeFi and metaverse coins explode.

This cycle, institutions are pouring capital into THESE narratives.

You have a chance to be EARLY.

🧵: My top 7 sectors for this bull run.👇

— Miles Deutscher (@milesdeutscher)

6:34 PM • Feb 3, 2024

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research