- Digital Beans

- Posts

- Digital Beans- Bitcoin passes all-time highs in 14 countries

Digital Beans- Bitcoin passes all-time highs in 14 countries

Digital Beans- Bitcoin passes all-time highs in 14 countries

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 53rd weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 5 mins

In this edition, the article I explore is titled "Bitcoin passes all-time highs in 14 countries" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Bitcoin passes all-time highs in 14 countries

1} No country can stop inflation!

Bitcoin has passed all-time highs in fourteen countries.

— Balaji (@balajis)

12:10 PM • Feb 22, 2024

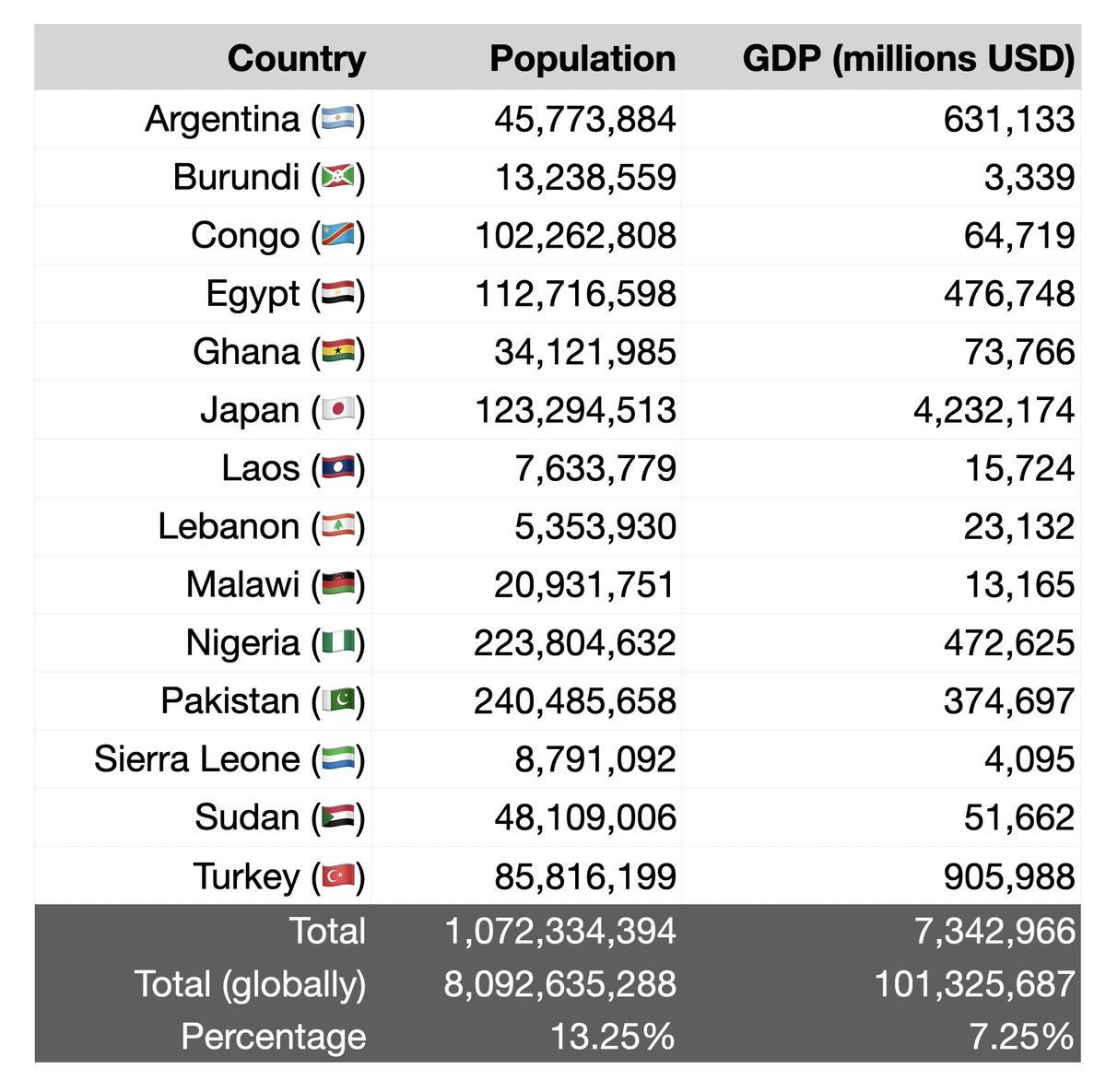

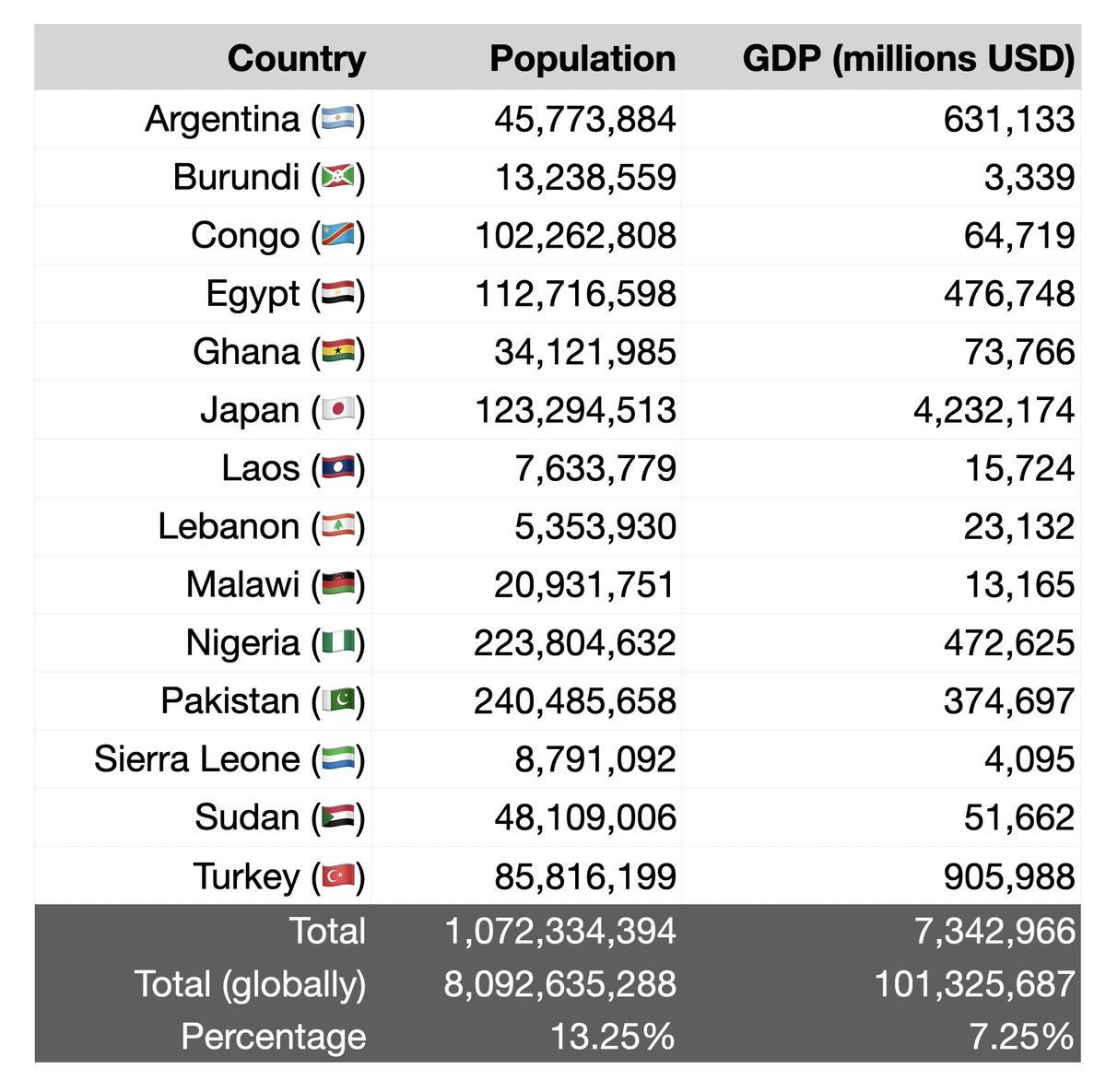

The following are some of the stats for 14 countries that have had Bitcoin ATHs. Countries globally are struggling with this. And it is simple to understand why? It is baked into the system, that's the reality we live in.

For starters, inflation is a hidden tax, that eats into our wealth. Fiat is in a way nationalistic. It needs enforcement by governments and that is why countries with the best militaries have stronger currencies.

Let's look at US for instance, If I reduce it to just two premises,

1. Can the US print infinite money

2. Does the US have an invincible military

This is equivalent to being able to print infinite money and having invincible energy. And these two different pillars support each other, because if you can print infinite money, well, of course you can buy all the guns and weapons and soldiers and so on that you want

Conversely, if you have an invincible military, then no matter how much you devalue your currency, others will be forced to accept itThe dollar is a vampire. It is the closest we have to an international gloabl currency. It drains the life out of every other fiat currency.

But then Bitcoin flips the dollar.

Because since Bitcoin's inception...USD has collapsed against BTC by six orders of magnitude. There are reasons for that.

2} Imagine you had a million dollars today in your company or in your family

You hold your wealth in cash, let’s say in dollar. And the world reserve currency at a 7% inflation rate (real inflation), then, in 100 years, you will have in today's dollars $977. You will go from a million to 1000. You'll lose 1000x, it's one divided by two to the 10th.

If you hold it in let’s say a currency like INR or Yuan you will probably lose more.

Currencies are by design going to steal your economic wealth, Assets are by design going to preserve it or grow it.

Investing in equities or startups is one of the ways to gain financial wealth and leverage. Bitcoin is another and historically Bitcoin has performed the best, even better than other asset classes like Real Estate and Equities

Now you may say that the time horizon for Bitcoin has been just 15 years, well agreed! Its a fairly new asset class but at the same time, one that is designed to run via code. Just supply and demand dynamics and that is brilliant.

Bitcoin is the fastest horse

Till then, hold on to your dear assets

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $2.08 Trillion

Daily change: 1.42% | Yearly change: 88.75%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $1010 Billion.

Bitcoin price today: $51,650

Weekly change: 0.51% | YTD change: 22.15%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 51.14% | Last year (Feb 2023): 42.02%

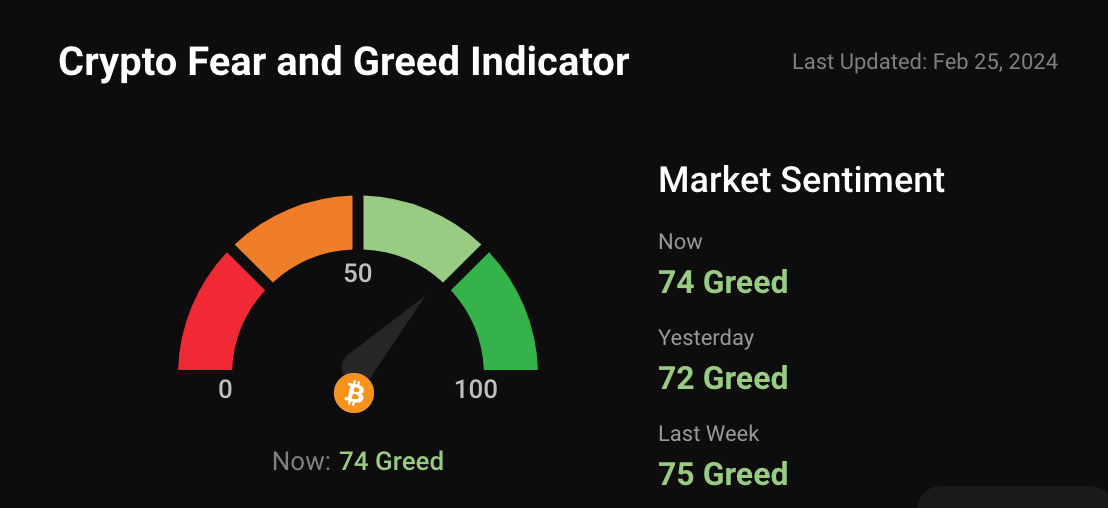

Greed and fear index

The market sentiment has greed levels in the higher range with current Bitcoin and Altcoin rally

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

ETH as an ultrasound money narrative!

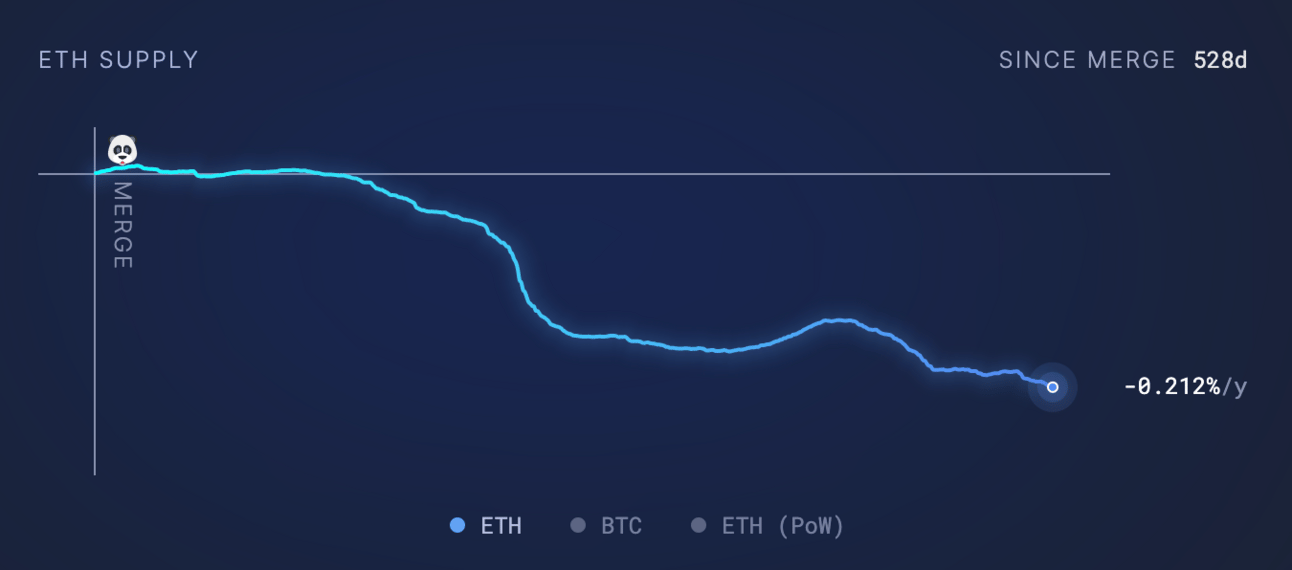

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain. Long term gives a sense of where the supply is headed

Supply change since merge POS -369,117 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

What Reddit’s IPO Filing Says About Crypto Regulation Of the Web 2 giants, the message board king is arguably most invested in crypto. Its filings to go public have interesting things to say about how a Silicon Valley company views digital asset regulation.

Pudgy Penguins Announces Unstoppable Domains Partnership and Walmart Expansion Unstoppable Domains users can link their wallets to a “.pudgy” domain name for use across web3

What’s my tweet of the week?

Explainer on how technology has evolved

Once a disruptive technology is unleashed on the world, things can change very quickly. So it's imperative that you be prepared.

— Anil ⚡ (@anilsaidso)

11:29 PM • Dec 22, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research