- Digital Beans

- Posts

- Digital Beans- Bitcoin Halving is few months away

Digital Beans- Bitcoin Halving is few months away

Digital Beans-Bitcoin Halving is few months away

Before we get into this, two quick requests I would want to make:

If you like reading my content, do Reply to this email with a “Hi” This helps my content land direct to your inbox and not to promotions

Do share my newsletter with folks you think can benefit from this effort. Here’s the link https://thedigitalasset.beehiiv.com/subscribe

Hey there everyone! 👋 This is Shivam. I bring to you the 40th weekly edition of Digital Beans.

This is an effort through which I try to share my thoughts on the Digital Assets Industry and Business Models in the space. Your 0 to 1 guide for Digital Assets Industry

Read time - 4 mins

In this edition, the article I explore is titled "Bitcoin halving is near" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

No other event comes close to the Bitcoin halving’s significance

1} Each for the simple reason that each prior Bitcoin halving has launched Bitcoin’s price to new heights.

No other event comes close to the halving’s significance on the horizon,

The hard part is understanding why & remaining steadfast on the long wait for the next halving.

Luckily, at this point, you don’t need to wait very long. The next Bitcoin halving is in April 2024.

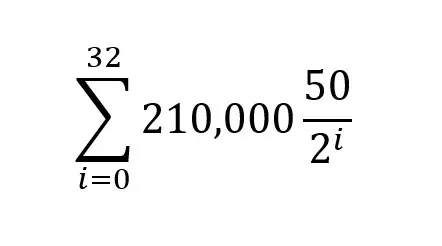

2} Bitcoin’s protocol is driven by a simple mathematical expression

This is all in terms of the monetary policy of Bitcoin. Its hardcoded and no one can tinker with it.

Here’s what this function says.

First, the code counts how many halvings have occurred. A halving is pre-set to occur every 210,000 blocks (~4 years, since there is a new block every 10 minutes on average)

Next,

The amount of new Bitcoin to be issued for each new block is determined. This is calculated by dividing 50 by 2, for each halving that has occurred

The result is that,

For the first 4 years, 50 new Bitcoin were issued to the miner of each block. After the first halving, 25 Bitcoin were issued per block until the next halving (4 years later), when it was cut to 12.5 Bitcoin per block. And this pattern of decreasing Bitcoin issuance every 4 years continues until 2140, when no more Bitcoin will be issued ever again

3} Right now, Bitcoin’s supply inflates by ~1.8% every year

In April 2024, the 4th halving will happen and suddenly, Bitcoin’s supply inflation will drop to 0.9% per year

This will make Bitcoin a “harder” asset than gold, whose supply grows 1.5-2% every year from global gold mining efforts

Choice is your to make!!

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $1.12 Trillion

Daily change: 2.66% | Yearly change: 15.84%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $546 Billion.

Bitcoin price today: $27,900

Weekly change: 0.68% | YTD change: 67.66%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 49.85% | Last year (Oct 2022): 39.91%

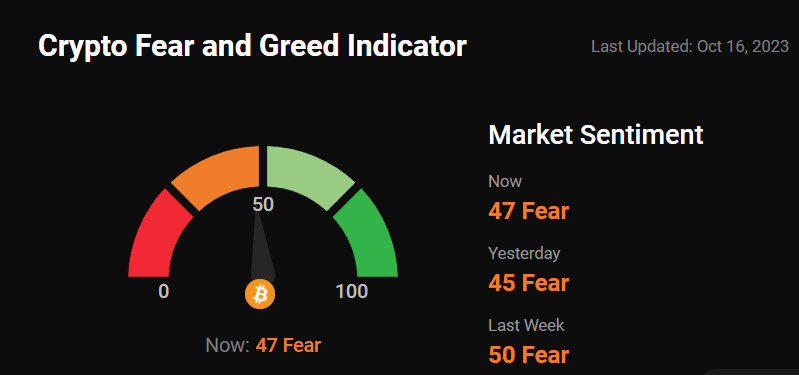

Greed and fear index

The market sentiment has gone back to fear levels now expecting “Sell Off” this month

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

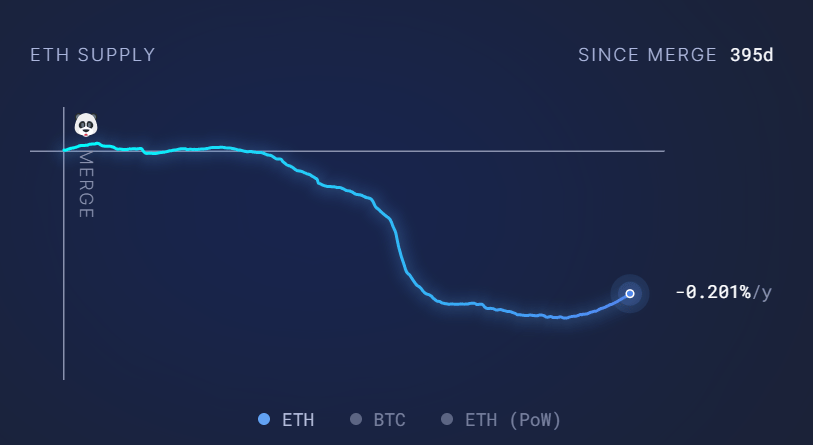

ETH as an ultrasound money narrative!

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW.

The significance of the chart - understand how the supply of Ethereum is decreasing post the merge, which means “deflationary economics” for the Blockchain

Supply change since merge POS -263,024 ETH

The graph highlights POS issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you

Ferrari to accept crypto payments in the US Ferrari’s decision to accept cryptocurrency payments was driven by market demand and dealer requests, with numerous clients investing in digital currencies.

Australia Proposes New Licensing Regime for Crypto Exchanges, Aims for Draft Legislation by 2024 The timeline indicates it could take till 2025 for an Australian digital asset platform to receive a license under the freshly proposed regime.

Whats meme-ing? Better make sure this is fun

And now the funny part,

Hey Legend, what is your weakness???

— Milk Road (@MilkRoadDaily)

2:52 PM • Oct 4, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research