- Digital Beans

- Posts

- Crypto Beans Newsletter Dec 24th

Crypto Beans Newsletter Dec 24th

Read time - 5 mins

Hey there everyone! Happy Holidays- 👋 This is Shivam

I bring to you the weekly edition of Crypto Beans, an effort through which I try to share my thoughts on the crypto space and help you stay updated on the basics of the industry.

What is in it for you?

If you are looking to learn more about crypto and what exact challenges does it aim to solve, this is for you. Okay done selling it 😛, lets get started:

State of Crypto affairs? A quick look at the market

The global cryto market currently stands at $844 Billion. It is still down more than 60% down(👎) from its all time highs of ~$3 Trillion which it hit in the month of November.

The global cryptocurrency market cap today : $844 Billion

Weekly change: 1.26% | Yearly change: -66.09%

Bitcoin (BTC) which is the largest cryptocurrency with a market cap of $320.8 Billion.

Bitcoin price today: $16,840

Weekly change: 0.76% | YTD change: -64.67%

Another important metric is the Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 39.92% | Last year (Dec 2021): 40.44%

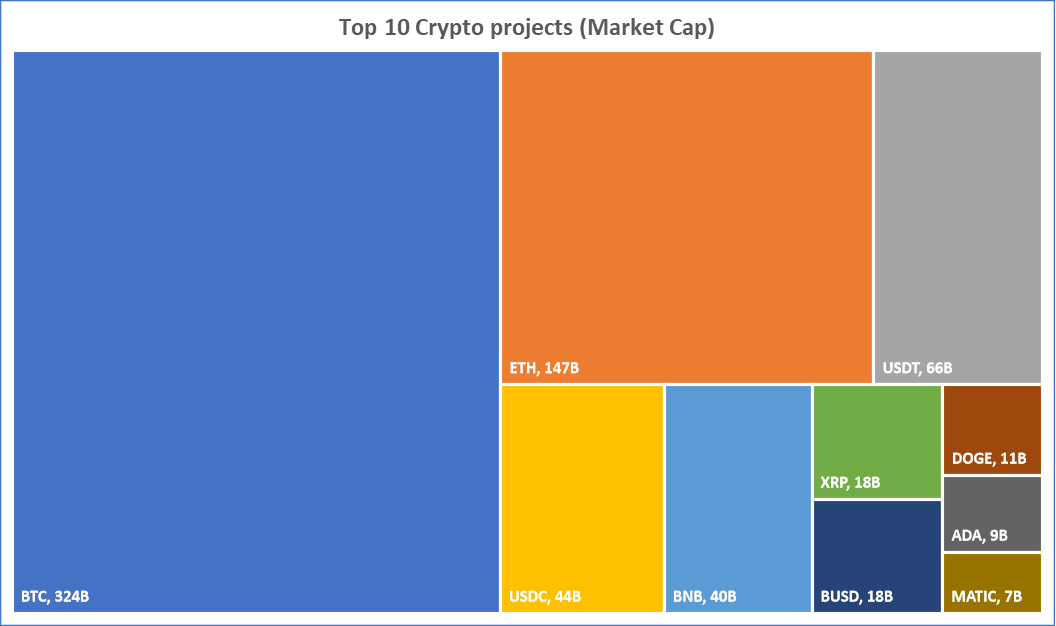

Top crypto projects/protocol by different metrics

Interesting thing to note here is that although Tether (USDT) has just $66B market cap, it is traded the highest with volume close to $18B given its use as a stablecoin for exchange of assets.

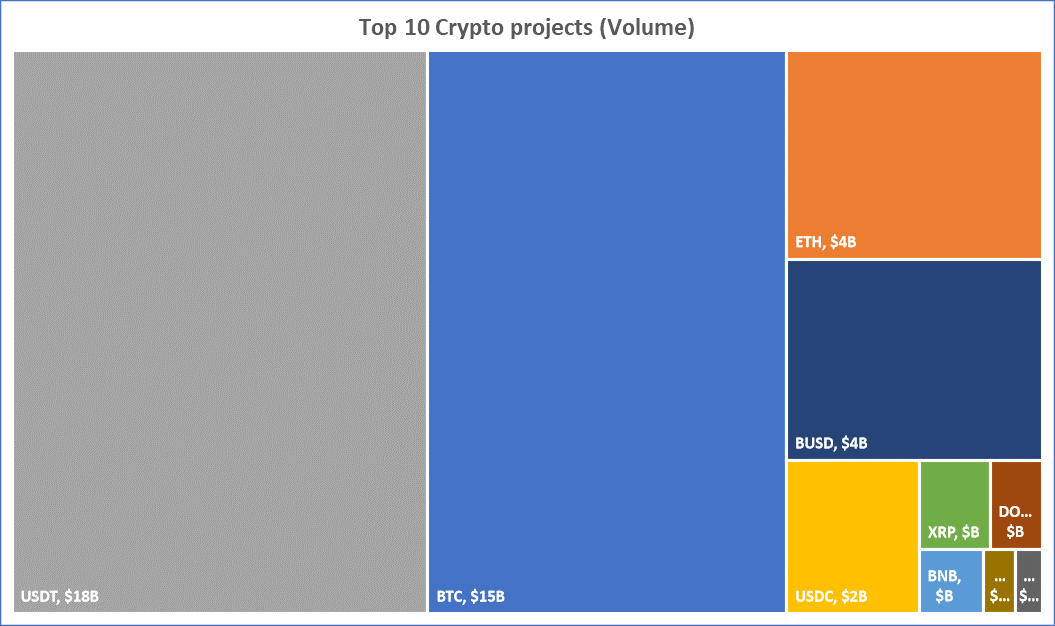

Greed and fear index

The market has been mostly bearish in 2022 with the Fed hiking the interest rates (story on that later) and lots of leverage being flushed out of the system.

The sentiment is most likely going to carry over to early 2023 as well until the macro environment improves.

The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Goggle Trends

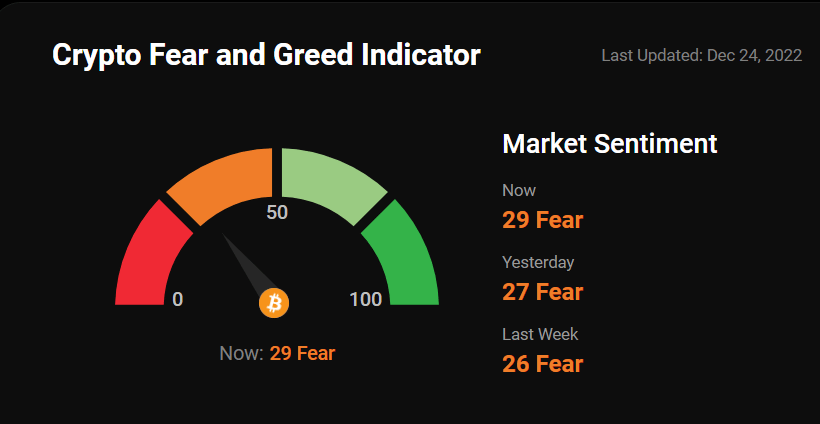

Is ETH really ultrasound money?

The most anticipated event of the year was Ethereum merging to a PoS blockchain from PoW. Experts, ETH developers and Vitalik himself had estimated that the ETH inflation will go down significantly as a result of merge taking place.

The graph highlights POS vs POW issuance since the merge. Impressive numbers, this seems to be super bullish for ETH long term given the supply of ETH is not growing as before

Supply change since merge POS - 2,992 ETH

Supply change since merge (If POW) - 1,184,752 ETH

Decrease in supply due to switch to POS - 99.75%

Spill the beans (Explain to me like a 5 year old)

In this edition we start with the basics:

"What is Bitcoin"?

Bitcoin is a kind of money that you can use to buy things online or in some stores. It's special because it's not like the money we use every day, like dollars or euros. Instead, it's a digital currency, which means it exists only on the internet and is not made of paper or metal like coins and bills.

Oh great, but then how do you use it?

To use bitcoin, you need a special program called a "wallet" that lets you send and receive bitcoin. You can get bitcoin by buying it from someone who already has it, or by "mining" it.

Umm but what do you mean by Mining?

Mining is when you use your computer to help process transactions for other people using bitcoin. You can also earn bitcoin by providing a service or selling something online and getting paid in bitcoin instead of regular money.

Alright I seem to get it, isn't that similar to how fiat money works?

One thing that makes bitcoin different from regular money is that it is not controlled by a government or bank. This means that no one can tell you what you can or can't do with your bitcoin, or take it away from you without your permission.

However, it also means that you have to be careful with your bitcoin and make sure you keep it safe, because if you lose your wallet or someone else gets access to it, they could spend your bitcoin without your permission.

Still thinking if it does anything else?

Well, the unique selling proposition (USP) of bitcoin is that it is a decentralized digital currency that is not controlled by any government or financial institution. This means that it is not subject to the same rules and regulations as traditional fiat currencies, and it can be used to make financial transactions without the need for a bank or other intermediary.

Other notable features of bitcoin include its use of blockchain technology, which allows it to be secure and transparent, and its limited supply, which is capped at 21 million bitcoins. This means that there will never be more than 21 million bitcoins in circulation, which can make it appealing as an investment or store of value.

Additionally, bitcoin has gained a reputation as a relatively fast and cheap way to make international payments, as it is not subject to the same fees and restrictions as traditional money transfer methods. It is also highly portable and can be easily stored and accessed using a digital wallet.

Overall, bitcoin offers a new and innovative way to store and transfer value, and it has the potential to disrupt traditional financial systems and the way we think about money.

What's brewing today? Bringing fresh beans to you:

Judge in SBF Case Recuses Herself Over Husband’s Firm’s Past Work for FTX: The judge assigned to oversee the blockbuster criminal trial of Sam Bankman-Fried recused herself from the case late Friday, citing a potential conflict of interest stemming from the fact that her husband’s law firm previously advised FTX, Bankman-Fried’s now-defunct crypto exchange.

Brazil’s Securities Regulator Allows Investment Funds to Invest in Crypto: The Brazilian Securities and Exchange Commission (CVM) on Friday approved the ability for investment funds to include crypto assets among their holdings.

Vitalik Buterin reveals 3 ‘huge’ opportunities for crypto in 2023: Ethereum co-founder Vitalik Buterin has shared three “huge” opportunities yet to be realized in crypto: mass wallet adoption, inflation-resistant stablecoins and Ethereum-powered website logins.

Whats meme-ing?

And now the funny part, all those with Indian dads would understand 😂.

If SBF had an Indian Dad!

Like & retweet

#mem#memeF#SBFp

— Crypto India (@CryptooIndia)

2:01 PM • Dec 23, 2022

What did you think of today's edition?

Reach out to me on Twitter for any feedback :)

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.