- Digital Beans

- Posts

- Crypto Beans - Jan 8, 2023

Crypto Beans - Jan 8, 2023

Read time - 4 mins

Hey there everyone! 👋 This is Shivam

I bring to you the first weekly edition of Crypto Beans for the year 2023 (I can technically say I have been doing this since last year now😛), an effort through which I try to share my thoughts on the crypto space and help you stay updated on the basics of the industry.

What is in it for you?

If you are looking to learn more about crypto and what exact challenges does it aim to solve, this is for you. Okay done selling it 😛, lets get started:

State of Crypto affairs? A quick look at the market

The global cryto market currently stands at $860 Billion. It is still down more than 60% down(👎) from its all time highs of ~$3 Trillion which it hit in the month of November, 2021.

The global cryptocurrency market cap today : $860 Billion

Weekly change: 3.57% | Yearly change: -58.64%

Bitcoin (BTC) which is the largest cryptocurrency with a market cap of $326 Billion.

Bitcoin price today: $16,943

Weekly change: 2.07% | YTD change: 1.92%

Another important metric is the Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 39.61% | Last year (Jan 2022): 39.81%

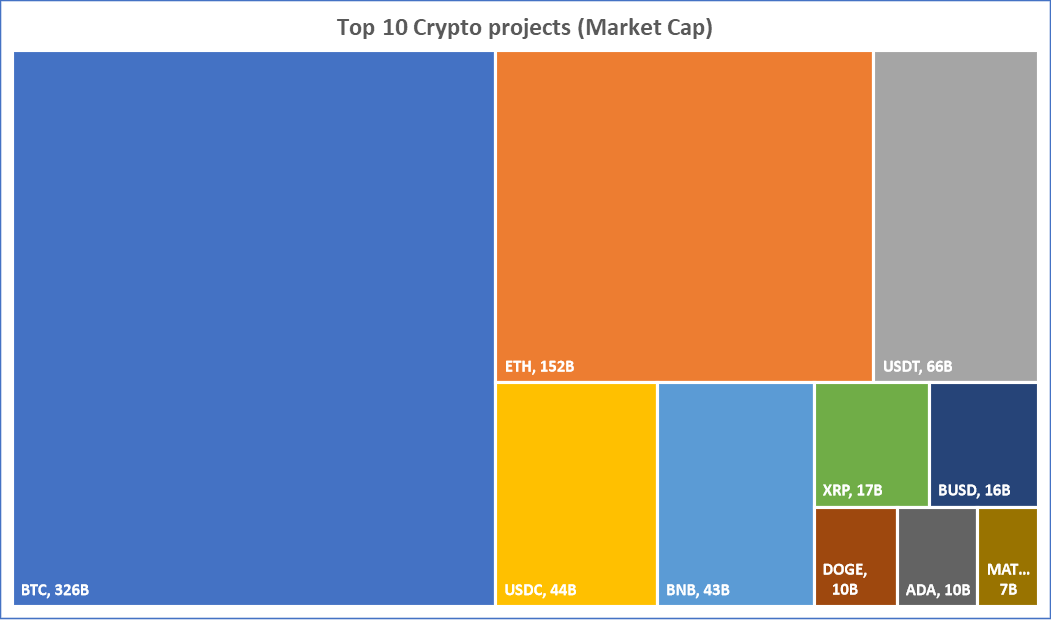

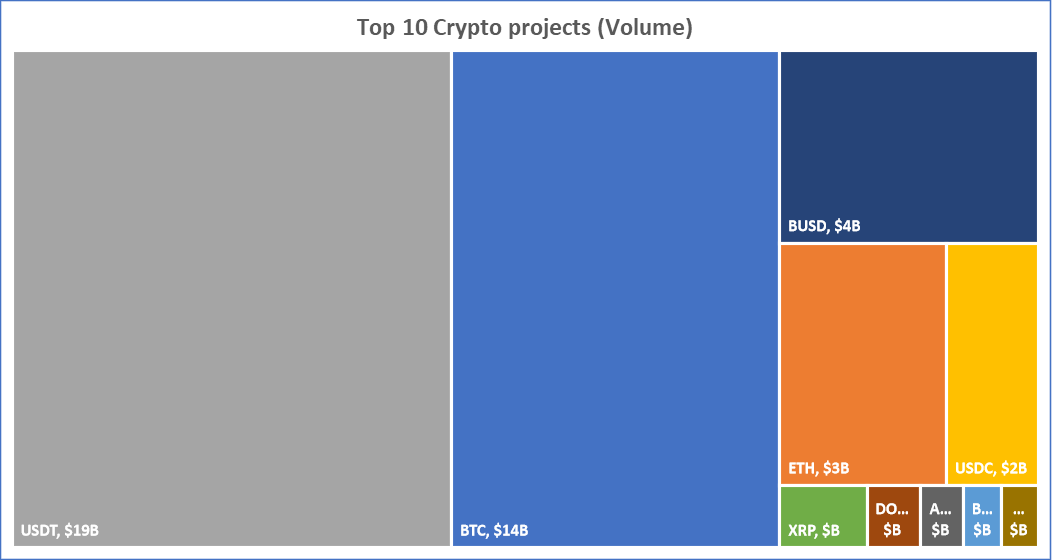

Top crypto projects/protocol by different metrics

Interesting thing to note here is that although Tether (USDT) has just $66B market cap, it is traded the highest with volume close to $19B given its use as a stablecoin for exchange of assets. Meanwhile, Stablecoins' market cap is at $138 Billion and has a 16.06% share of the total crypto market cap.

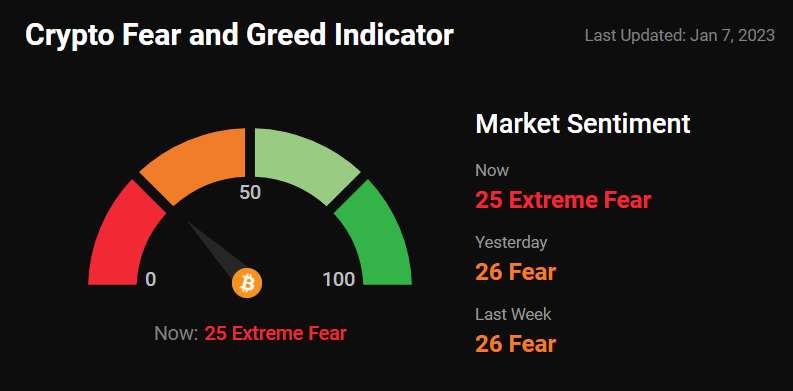

Greed and fear index

The market has been mostly bearish in 2022 with the Fed hiking the interest rates (story on that later) and lots of leverage being flushed out of the system.

The sentiment is most likely going to carry over to early 2023 as well until the macro environment improves.

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

This week US Job Growth came higher than expected which could mean that we can expect more rate hikes going forward from the fed, although the %age hike may be lower.

Why is this important? Because what the Fed does, affects the global economy directly or indirectly because of the change in dollar liquidity in the global economy.

BREAKING: US job growth exceeded expectations last month, the unemployment rate fell and wage gains slowed more than anticipated.

More details here: trib.al/Q5MxVjQ

— Bloomberg TV (@BloombergTV)

1:38 PM • Jan 6, 2023

Is ETH really ultrasound money?

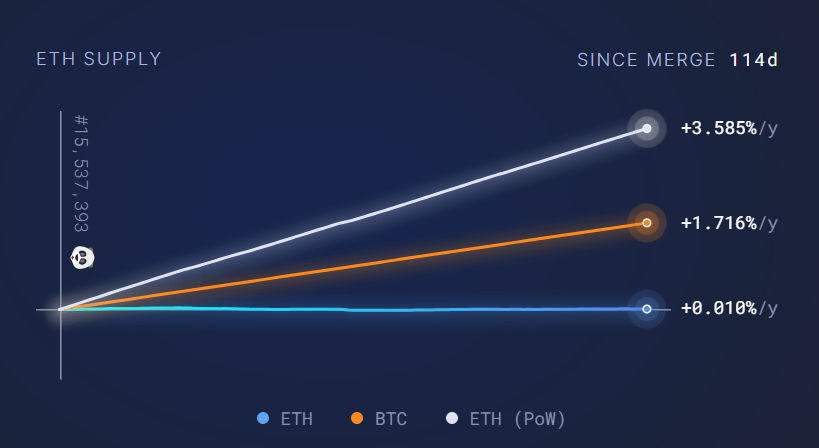

The most anticipated event of 2022 was Ethereum merging to a PoS blockchain from PoW. This shifts the narrative to Ethereum becoming a store of value due to expected reduction in ETH emissions.

The graph highlights POS vs POW issuance since the merge. Impressive numbers, which look super bullish for ETH long term given the supply of ETH is not growing as before

Supply change since merge POS - 3,961 ETH

Supply change since merge (If POW) - 1,353,357 ETH

Decrease in supply due to switch to POS - 99.71%

Spill the beans (Explain to me like a 5 year old)

In this edition I present an interesting analogy I use to understand blockchains:

"What is a Blockchain"?

A blockchain is like a special kind of online ledger that is used to store and keep track of information. It's called a "blockchain" because it is made up of lots of different pieces of information, called "blocks," that are all stacked together in a chain.

Each block contains information about different things, like money, or transactions that have happened. When a new block is added to the chain, it is connected to all the other blocks that came before it, so that everyone can see the information that is stored in the block.

This makes the blockchain a really good way to store and keep track of important information, because it is hard for people to change or delete the information once it is added to the chain. This digital ledger helps us keep track of things in a safe and secure way.

How to think of Blockchains? Any analogies here?

Blockchain technology can be compared to cities in the way that it functions and the role it plays in society.

Just as cities are hubs of activity and commerce, with various systems and structures in place to support and facilitate the exchange of goods, services, and ideas, blockchain technology can be thought of as a virtual city where value is transferred, transactions are recorded, and a diverse community of stakeholders interact and collaborate.

For e.g Ethereum can be thought of as Mumbai city (Yessss, hear me out):

Mumbai has limited space, high rent prices but huge economic opportunity. Similary Ethereum has lesser block space, high gas fees to do a transaction but huge amount of projects exchanging value due to demand and adoption.

Interesting!! but this is not enough, how would you justify that cities resonate with blockchains?

One key similarity between cities and blockchain is the way that they both rely on technology to support their operations.

Just as cities use infrastructure like roads, bridges, and utilities to facilitate the flow of goods and people, Blockchain uses a decentralized network of computers to record and validate transactions, ensuring the integrity and security of the system.

Both cities and blockchain also rely on a set of rules and protocols to govern their operations, whether it be laws and regulations in the case of cities, or consensus algorithms in the case of blockchain.

Another parallel between cities and blockchain is the way that they facilitate the transfer of value.

In cities, value is transferred through the exchange of goods and services, whether it be through traditional markets or through more informal channels.

Similarly, blockchain allows for the transfer of value in the form of cryptocurrency or other digital assets, enabling peer-to-peer transactions without the need for a central authority.

I know I am protected in a city, who would do the same in a blockchain?

Security is also a key concern for both cities and blockchain.

Cities rely on various systems, such as police and security forces, to protect their citizens and prevent crime. Blockchain, on the other hand, uses cryptographic techniques and decentralized record-keeping to ensure the security and integrity of its transactions.

Both cities and blockchain also rely on a diverse and decentralized network of stakeholders to ensure the resilience and stability of their systems. (Remember Miners....)

How does a business/project grow on a blockchain? I know cities have opportunities to grow

Let me explain,

Just as cities have economies that are driven by various factors, including the businesses and industries that operate within them, blockchain has its own economy that is driven by the demand for and supply of various cryptocurrencies and digital assets.

Both cities and blockchain also have communities of developers and entrepreneurs who are constantly working to build new applications and improve upon existing ones.

Finally, both cities and blockchain have their own unique forms of money and governance.

Cities have their own currencies and financial systems, while blockchain relies on cryptocurrencies and decentralized governance structures.

When it comes to governance, both also have their own systems for decision-making and resolving disputes, whether it be through elected officials or through community-driven voting systems. (Yes everyone gets to vote...:P)

All this said, there could be other analogies that someone could use to understand Blockhains and that could work too, specially with the addition of L2 ecosystem on top of existing L1 layers like Ethereum. Definitely an artice on that someday.

What's brewing today? Bringing fresh beans to you:

Mastercard Taps Polygon for Web3 Artist Accelerator: Mastercard announced Friday at the Consumer Electronics Show in Las Vegas, Nevada, that it will use the Polygon blockchain to launch its Mastercard Artist Accelerator.

This Week in Coins: Solana Rallies as Crypto Market Sees Green to Start 2023: In the first week of the new year, the leading cryptocurrencies are all in the green after a brutal 2022. None of the top 20 cryptocurrencies posted major losses this week.

Solana vs. Polygon: A Developer’s Perspective: A look at the scalability, security and performance of two of the most popular smart contract blockchains, written by someone who has built on both and chose Solana for an upcoming wallet app.

Whats meme-ing?

And now the funny part,

$Bonk going up in last 2-3 days has been a big surprise😂.

Looking at the $BONK chart realizing that a meme coin has outperformed all your trades in a year combined.

— 𝕽𝖔𝖒𝖊𝖔 🦇🔊 (@RomeoTrades)

4:41 PM • Jan 5, 2023

Just because the bank says so....

Central Banks everyone!

#Memes#Bitcoin#Crypto#Cryptomemes#bitcoinmemes#redditmemesbank

— Reddit Memes Bank (@redditmemesbank)

4:30 PM • Jan 5, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.