- Digital Beans

- Posts

- Crypto Beans - Jan 22, 2023

Crypto Beans - Jan 22, 2023

Your 0-1 weekly crypto newsletter

Read time - 6 mins

Hey there everyone! 👋 This is Shivam

I bring to you the weekly edition of Crypto Beans for the year 2023. We are three weeks into the year and have received amazing feedback on the newsletter🚀, I feel super stoked for what lies ahead.

In this edition I also talk about "THE PROMISE OF CRYPTO", where I explore the history of money. Loading.....

What is in it for you?

For all my friends who are getting this for the first time, this is an effort through which I try to share my thoughts on the crypto space and help you stay updated on the basics of the industry.

This is your 0 to 1 guide in crypto if you are looking to learn more about crypto and what it stands for. Okay done selling it 😛

Let's take off on this journey together 🚀 🚀

State of Crypto affairs? A quick look at the market

The global crypto market currently stands at $1.07 Trillion. It is still ~60% down(👎) from its all time high of $3 Trillion which it hit in November 2021.

New year new highs: The market has been going up since the beginning of the year.

The global cryptocurrency market cap today: $1.07 Trillion

Weekly change: 5.98% | Yearly change: -36.20%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $439 Billion.

Bitcoin price today: $22,797

Weekly change: 9.76% | YTD change: 36.94%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 42.37% | Last year (Jan 2022): 41.77%

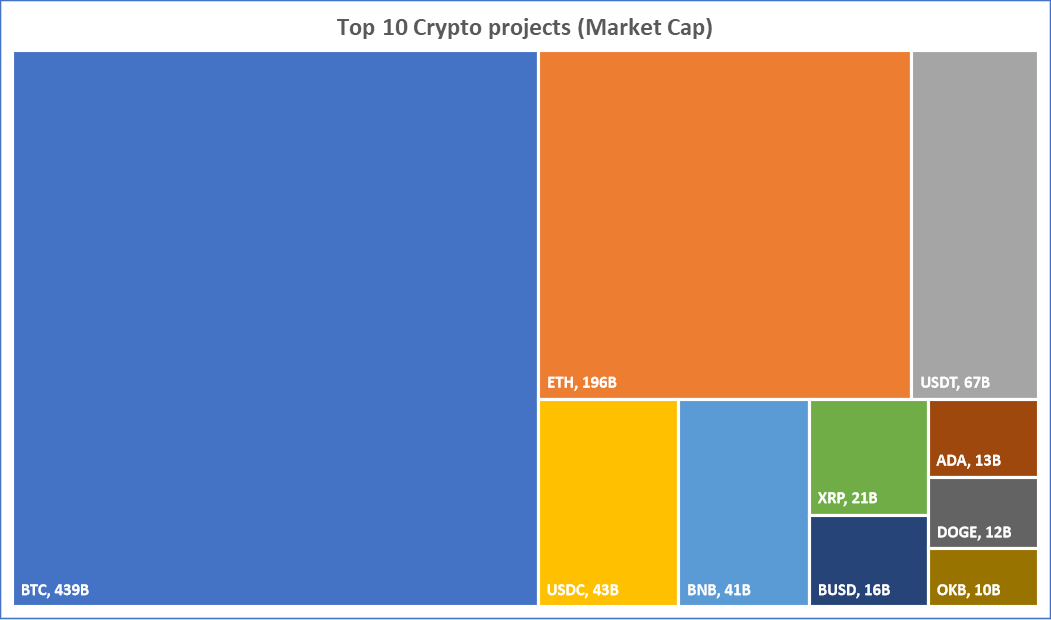

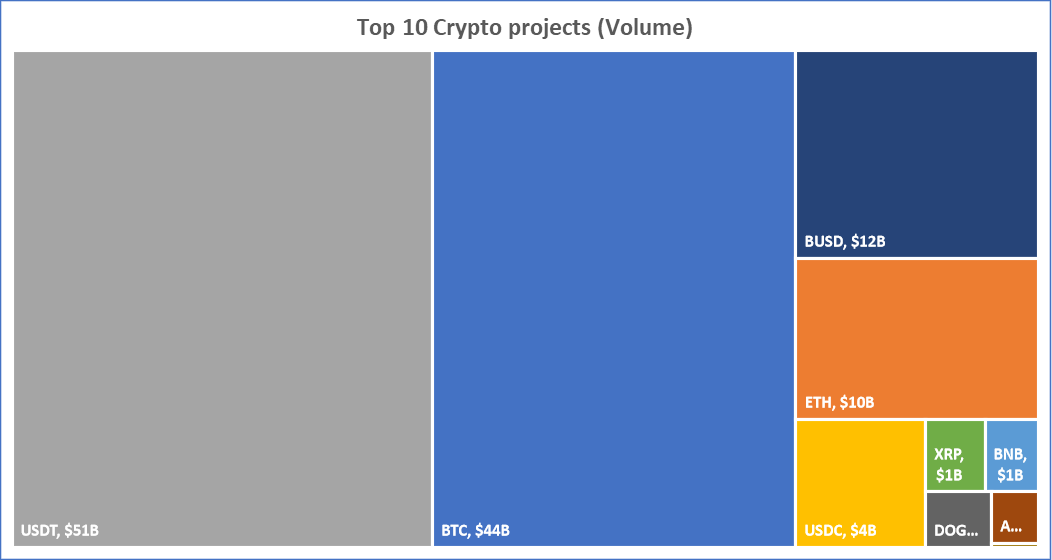

Top crypto projects/protocols by different metrics

The Interesting thing to note here is that although Tether (USDT) has just $67B market cap, it is traded the highest with volume close to $51B given its use as a stablecoin for the exchange of assets. Meanwhile, Stablecoin market cap is at $138 Billion and has a 12.85% share of the total crypto market cap.

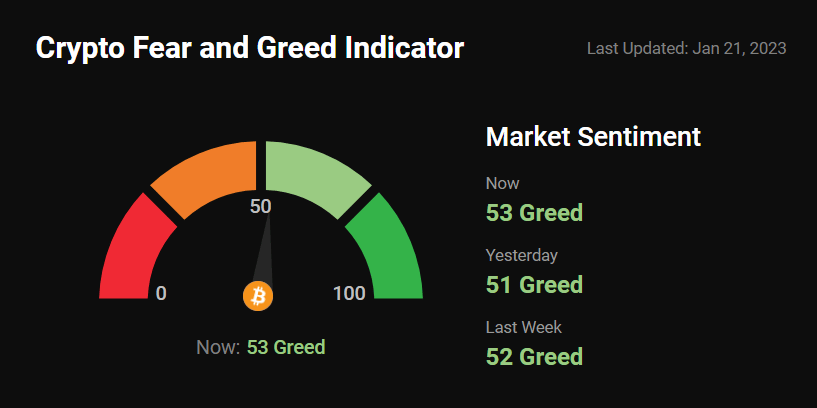

Greed and fear index

The market has been roaring in 2023 with renewed hopes of Bitcoin leading a rally to the moooooonnnnnn........ (get ready for the ride)

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

Is ETH ultrasound money?

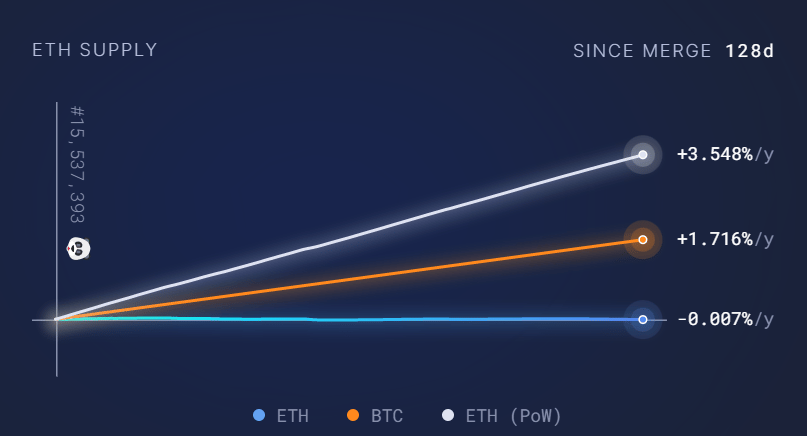

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW, as there is a shift in the narrative for Ethereum to become a store of value due to the expected reduction in ETH emissions. (Super Bullish)

The graph highlights POS vs POW issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

Supply change since merge POS -2,880 ETH

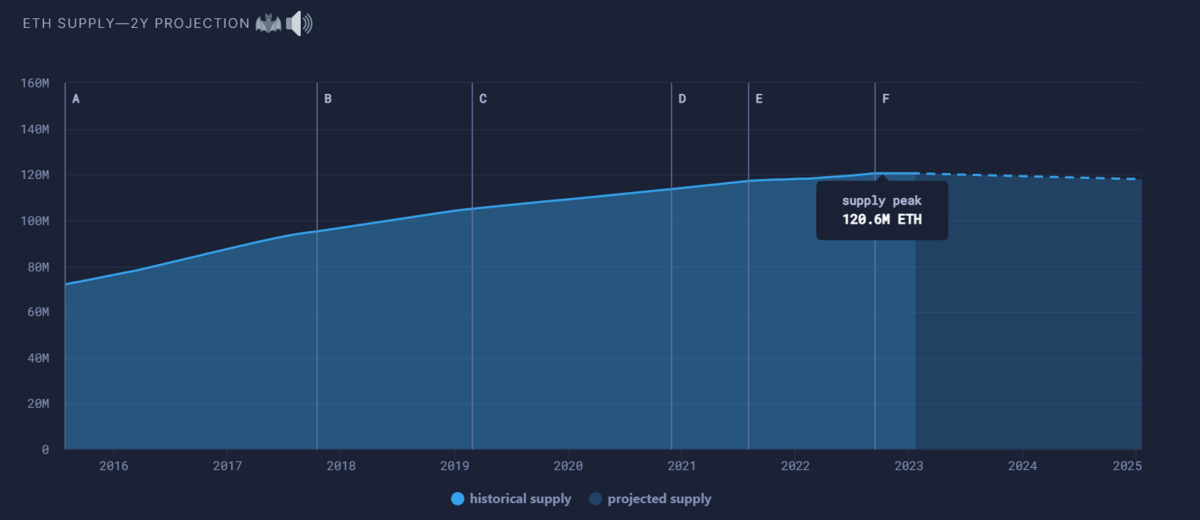

(Eth has officially less supply post merge, here is a look at the 2 year supply projections)

Spill the beans (Explain to me like a 5 year old)

The History of Money – From Barter to Fiat Currency to Cryptocurrency

It all started with the need for trade....

In ancient times, people used the barter system to trade goods and services. This means that they would directly exchange one item for another without using a medium of exchange, such as money.

For example, A farmer who grows wheat may have a surplus of wheat and need apples. A fruit seller, on the other hand, may have a surplus of apples and need wheat to make bread. In this scenario, the farmer and the fruit seller can engage in a barter trade.

The farmer could offer the fruit seller a certain amount of wheat in exchange for apples. The fruit seller could then decide whether or not to accept the offer. If they both agree on the terms of the trade, the farmer would give the fruit seller the wheat and the fruit seller would give the farmer some apples.

But barter is not scalable....

As the economy becomes more complex, you can have greater the number of possible combinations of barter between different types of goods and services providers, so the economy starts requiring some standard unit of account, or money.

Specifically, the society begins requiring something divisible and universally acceptable. An apple farmer, for example, that needs some tools (a blacksmith), meat (a cattle rancher), repair work (a carpenter), and medicine for her children (a doctor), can’t spend the time going around finding individuals that have what she needs, that also happen to want a ton of apples.

Instead, she simply needs to be able to sell her highly seasonal apples for some unit, that she can use to save and buy all of those things with over time as she needs them.

So back to the story....

As time passed, bartering became less and less practical. It was difficult to find someone who had exactly what you wanted and who wanted exactly what you had. So, people began to use items that were widely accepted, like shells or beads, as a medium of exchange. These items were known as commodity money, as they were valuable in and of themselves, not just for the value they represented.

As civilizations developed, other forms of commodity money like metal coins, were created. Coins were made of precious metals like gold and silver and were widely accepted as a form of payment. People started to trust these coins as they knew the value of the metal they were made of. This is how gold became the first form of standardized money.

What happened next? Isn't gold difficult to carry?

Well, as trade expanded across borders, it was difficult to transport large amounts of gold. To solve this problem, governments began to issue paper money that could be exchanged for a certain amount of gold.

People could deposit their gold into banks and receive paper credit representing redeemable claims on that gold. This system was known as the gold standard. Under the gold standard, the value of paper money was directly linked to the value of gold.

But banks were smart....

Banks, knowing that not everyone would redeem their gold at once, went ahead and issued more claims than the gold they held, beginning the practice of fractional reserve banking.

The banking system then consolidated into central banking over time in various countries, with nationwide slips of paper representing a claim to a certain amount of gold.

This led to a system known as FIAT currency....

Fiat currency is interesting, because unlike the history of commodity money, it’s a step down in terms of scarcity. Gold beat out all of the other commodity monies over centuries of globalization and technological development, and then gold itself was defeated by… pieces of paper?

WHY did this happen?

We can think of reasons like technology and government power. As clans became kingdoms, and as kingdoms became nation states, along with the creation of banking systems and improvements in communication systems, governments could become a larger part of everyday life.

Once gold became sufficiently centralized in the vaults of banks and central banks, and paper claims were issued against it, the only remaining step was to end the redeemability of that paper and enforce its continued usage through legal obligation.

(So we moved from a gold standard to a FIAT system)

If we go back to the gold standard for a moment, the key reason why paper claims were built on gold was to improve its medium-of-exchange capabilities.

Because carrying a lot of metal money around is risky and inconvenient and creating credit is attractive to both lenders and borrowers, credible parties arise that put the hard money in a safe place and issue paper claims on it. These parties came to be known as “banks” though they initially included all sorts of institutions that people trusted. Soon people treat these paper “claims on money” as if they are money itself.

So, What is Fiat Currency Really Worth?

Fiat money is a currency without intrinsic value that has been established as money, often by government regulation. (Rings any bells) Fiat money does not have use value, and has value only because a government maintains its value, or because parties engaging in exchange agree on its value.

Fiat money started to dominate in the 20th century. Since the decoupling of the US dollar from gold by Richard Nixon in 1971, a system of national fiat currencies has been used globally.

Finally: The arrival of Bitcoin

Satoshi Nakamoto’s found an answer to the FIAT riddle in 2008 with Bitcoin with the aim to avoid a centralized cluster and make a peer-to-peer money system based on a distributed ledger.

Bitcoin is safe to self-custody in large amounts and can be sent peer-to-peer around the world over the internet. Therefore, it removes the need for paper abstraction. Unlike gold, bitcoin in large quantities is easy to transfer globally, and take custody of.

From the start, the bitcoin network was designed as a peer-to-peer network for the purpose of being a self-custodial medium of exchange. It’s not the most efficient way to exchange value, but it’s the most unstoppable way to do so online.

It has no centralized third parties, no centralized attack surfaces, and sophisticated ways of running it can even get around rather hostile networks.

To conclude, bitcoin fulfills most qualities as ideal money. Its supply is also fixed in contrast to that of fiat currency. It may take longer for bitcoin to become a true medium of exchange, but the process for mankind to search for better money never stops, and It may be possible that bitcoin (and cryptocurrencies in general) will be a very strong candidate to position itself as the future of money.

What's brewing today? Bringing fresh beans to you:

In Davos, Blockchain Yields More Promises Than Problems: A United Nations official makes the case for the underlying technology behind cryptocurrencies. One of the most notable topics being discussed – on panels, at events, over live broadcast – was the future of money. Of course, when talking about the future of money you must also mention crypto.

Crypto to play 'major role' in UAE trade: foreign trade Minister: Crypto will play a “major role” in the United Arab Emirates' global trade moving forward, says the UAE’s minister of state for foreign trade Thani Al-Zeyoudi who provided a host of updates regarding the UAE’s trade partnerships and policies heading into 2023.

US Charges Crypto Exchange Bitzlato With Laundering $700M: The U.S. Justice Department and Treasury Department have charged Bitzlato Ltd. with money laundering and arrested its founder in Miami, officials said at a press conference in Washington on Wednesday.

Whats meme-ing?

And now the funny part, Last year bear market was hell of a ride

Navigating crypto markets the past year

— Milk Road (@MilkRoadDaily)

10:10 PM • Jan 16, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.