- Digital Beans

- Posts

- Crypto Beans - Jan 15, 2023

Crypto Beans - Jan 15, 2023

Read time - 4 mins

Hey there everyone! 👋 This is Shivam

I bring to you the weekly edition of Crypto Beans for the year 2023. We are just two weeks into the year and have gotten amazing feedback on the newsletter🚀, I feel super stoked for what lies ahead.

What is in it for you?

For all my friends who are getting this for the first time, this is an effort through which I try to share my thoughts on the crypto space and help you stay updated on the basics of the industry.

This is your 0 to 1 guide in crypto if you are looking to learn more about crypto and what it stands for. Okay done selling it 😛

Let's take off on this journey together 🚀 🚀

State of Crypto affairs? A quick look at the market

The global crypto market currently stands at $1.1 Trillion (Yes, we crossed the 1000 Billion mark this week). It is still ~60% down(👎) from its all time high of $3 Trillion which it hit in November 2021.

New year new highs: The market has been going up since the beginning of the year.

The global cryptocurrency market cap today: $1.1 Trillion

Weekly change: 18.39% | Yearly change: -53.88%

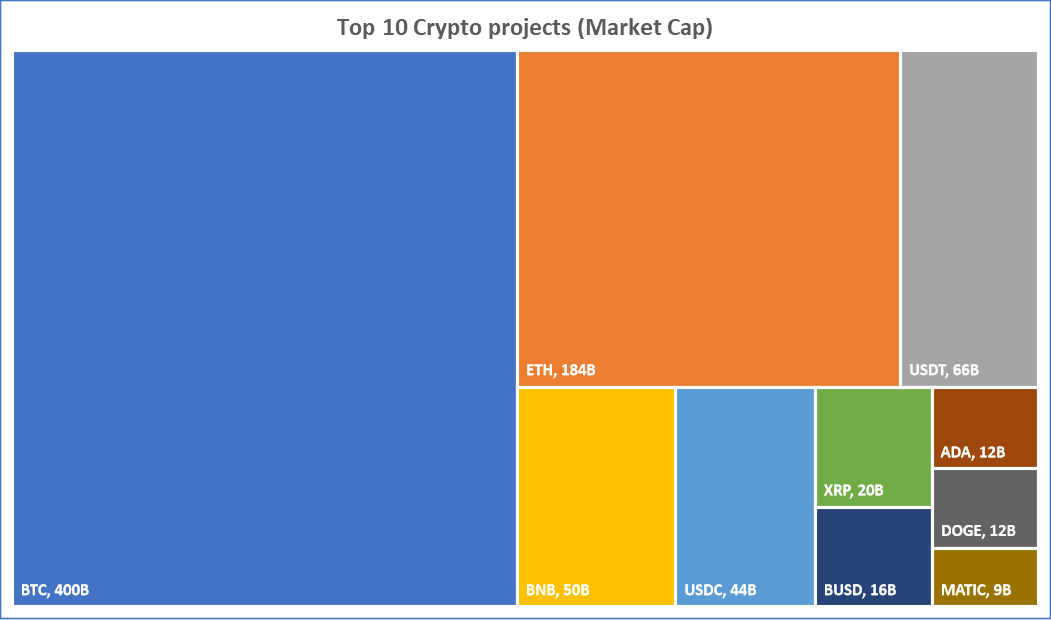

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $400 Billion.

Bitcoin price today: $20,802

Weekly change: 22.77% | YTD change: 24.91%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 40.38% | Last year (Jan 2022): 40.32%

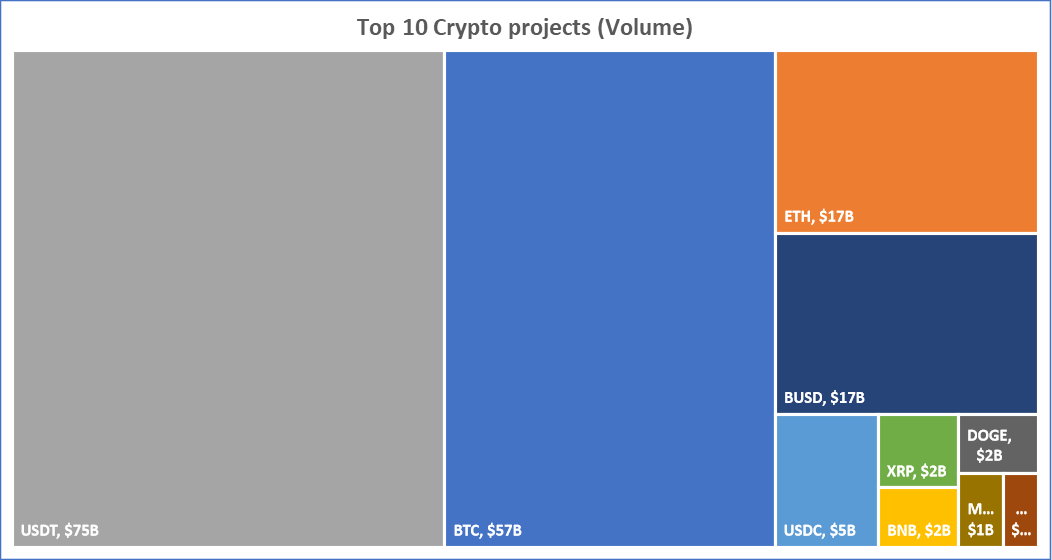

Top crypto projects/protocols by different metrics

The Interesting thing to note here is that although Tether (USDT) has just $66B market cap, it is traded the highest with volume close to $75B given its use as a stablecoin for the exchange of assets. Meanwhile, Stablecoins' market cap is at $138 Billion and has a 13.55% share of the total crypto market cap.

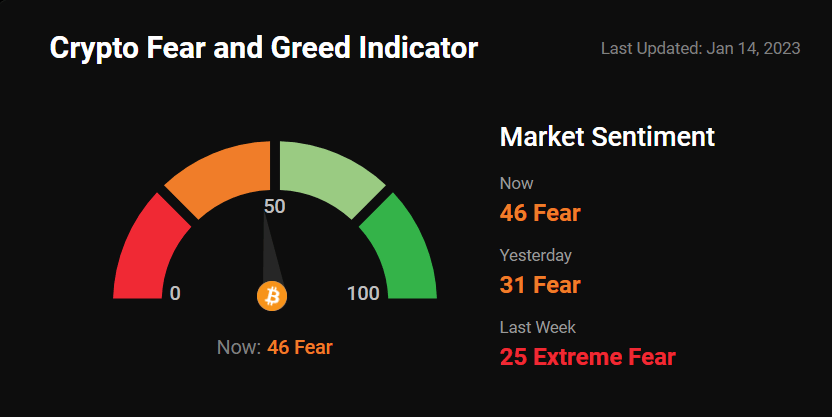

Greed and fear index

The market has been mostly bearish in 2022 with the Fed hiking the interest rates and lots of leverage being flushed out of the system. However,

The sentiment has improved in 2023 due to the market rising since the beginning of the year, and a decrease in CPI for Jan - Inflation is going downnnnnn....

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

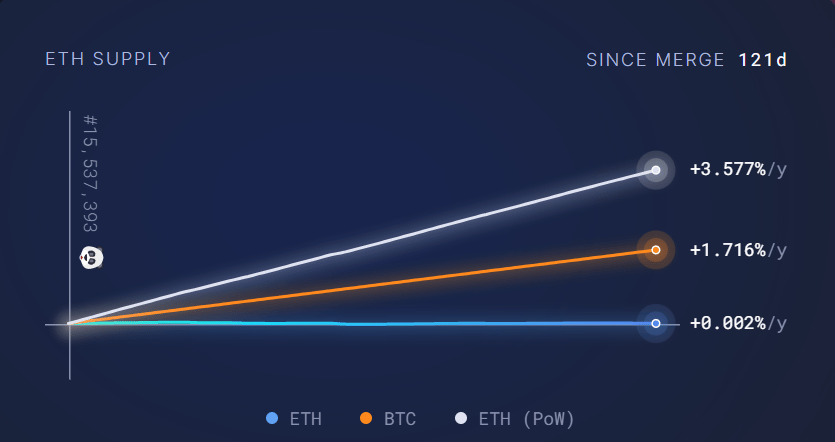

Is ETH really ultrasound money?

After Ethereum merged to a PoS blockchain from PoW, there is a shift in the narrative for Ethereum to become a store of value due to the expected reduction in ETH emissions. (Super Bullish)

The graph highlights POS vs POW issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

Supply change since merge POS - 333 ETH

Supply change since merge (If POW) - 1,432,375 ETH

Decrease in supply due to switch to POS - 99.98%

Spill the beans (Explain to me like a 5 year old)

In this edition we talk about NFTs and all the hype surrounding them:

NFTs !!! Are these just JPEGs, that nerds are freaking out about?

NFTs are like special stickers that exist online. Actually these are more like trading cards, but instead of being physical cards, these are digital. These are special because these are one-of-a-kind and can't be copied. So, it's like owning a special, rare thing that only you have.

An analogy for NFTs with respect to their trading, ownership rules, and culture could be compared to collectible baseball cards.

Just like NFTs, baseball cards are unique and one-of-a-kind, and each card has its own value and rarity. Collectors will often trade and sell cards, just as people trade and sell NFTs.

Check out Opensea which an exchange doing million in NFT volumes

Everyone keeps talking how NFTs are Non-Fungible Tokens, is fungibility even important?

Yes, it is. Let me explain by talking about fungibility first. A good example of fungible assets is money: if you have $5, it is the same as someone else having $5. You can easily exchange them and they have the same value.

However, in the case of NFTs, each one is unique and has a different value, like a piece of art, for example. Each painting is one-of-a-kind and has different value, you can't substitute one painting for another. Because of this, NFTs are considered to be non-fungible.

NFTs are unique. It's like owning a piece of art, everyone may be able to see pictures of it or in person but eventually it belongs to the owner:

NFTs represent a new form of ownership for digital assets, which are not interchangeable or identical. They're a way to represent ownership and authenticity of one-of-a-kind digital items.

Take for example, baseball cards have their own grading system to determine authenticity and value, while NFTs use blockchain technology to verify ownership and authenticity.

NFTs represent culture and community, it's not rocket science or finance or tech. Just a bunch of people "trading culture". Remember wrestling cards and toys, it's just online now.

Like baseball cards, NFTs also have a culture surrounding them. There are communities of collectors and enthusiasts who follow the market, discuss new releases and speculate on which NFTs will increase in value.

Like baseball cards, NFTs can be a form of investment, and many people buy NFTs with the expectation that they will appreciate in value over time.

Also, the baseball cards or NFTs, can be considered exclusive, with certain cards or NFTs being highly sought after, and some people paying a premium to own rare or limited edition items.

In NFTs like in case of CryptoKitties project, each kitty is a unique NFT stored on the Ethereum blockchain, it's a game that allows players to buy, sell, and breed virtual cats.

NFTs are an opportunity for monetization and new business models?

NFTs as a new way of creation and monetization: NFTs represent a new frontier for digital creators, that now can monetize their work in a way that was not previously possible. It opens new ways for creators to have ownership and income from their digital creations, creating a new economy.

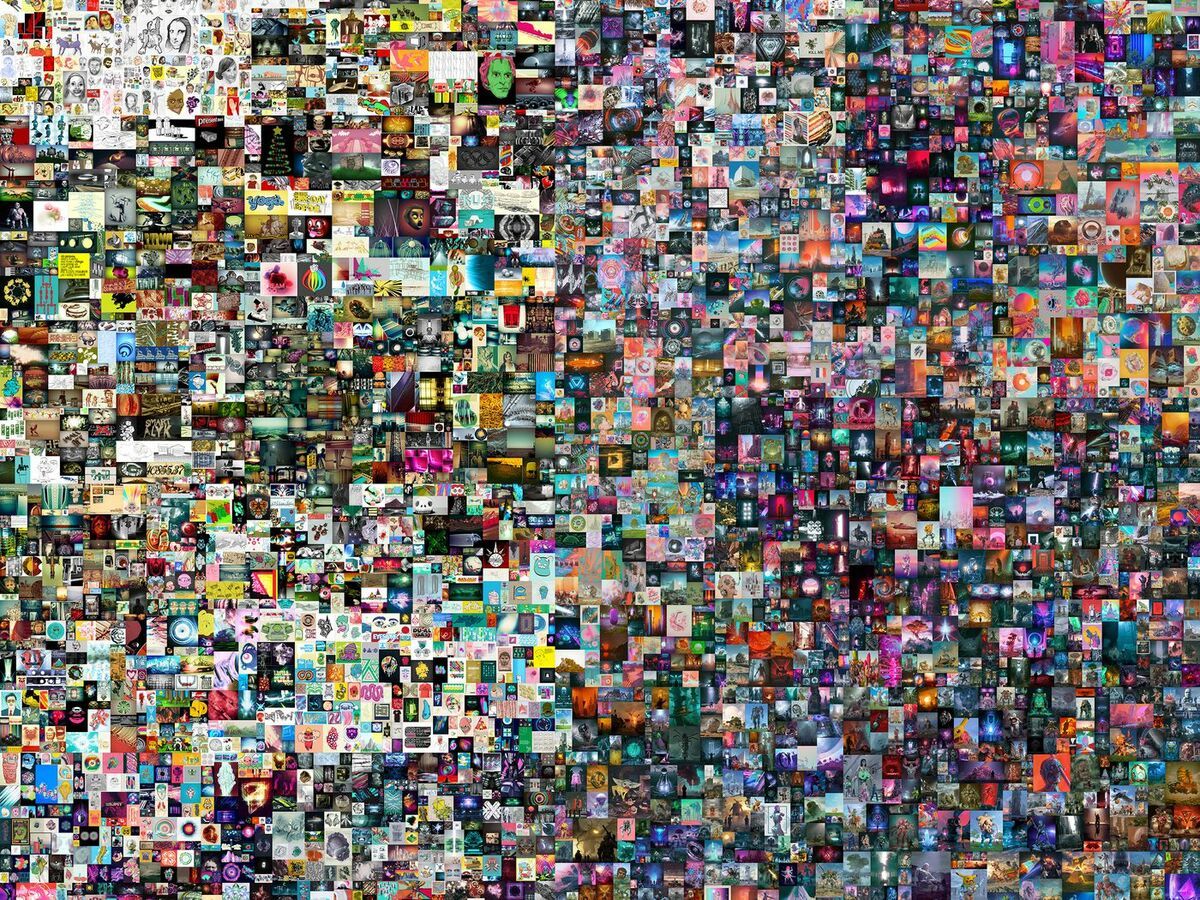

An example of a creator monetizing their work through NFTs is Beeple, a digital artist who sold an NFT of one of his digital artwork for $69 million on an auction.

Beeple’s collage, Everydays: The First 5000 Days, sold at Christie’s

NFTs create scarcity, they are one of a kind, and that creates value, as the uniqueness of an item increases its desirability, it is an important element of the NFT culture trading.

An example of scarcity in NFTs is a limited edition digital collectible such as CryptoPunks, a set of 10,000 unique characters that were created by the artist Larva Labs, only 10,000 of them were created, so they have value because of their rarity.

Guess at what floor price Crypto Punks are selling - $100,000 (cha-chinnn)

I heard Starbucks got into NFTs, infact lot of brands like Disney and Nike have joined the bandwagon. What do they aim to get out of it?

It's imperative that Starbucks experiments with creating and monetizing NFTs, there are a few ways they could potentially do this:

Starbucks Gift cards as NFTs: Starbucks could create NFT versions of their gift cards, making them unique and one-of-a-kind. These NFT gift cards could potentially have added value, such as a special artwork, exclusive discounts or limited edition card design. These NFTs could be traded and sold on NFT marketplaces.

Starbucks Digital collectibles: Starbucks could create a set of digital collectibles, such as virtual cups or avatars, that could represent different types of drinks or limited-time promotions. These NFTs would be unique, one-of-a-kind, and stored on a blockchain. These digital collectibles could also be traded and sold on NFT marketplaces.

Starbucks Rewards Program: Starbucks could also use NFTs to enhance their rewards program, by giving out unique NFTs to customers as rewards for their loyalty. These NFTs could represent different levels of the rewards program or special perks, such as free drinks or priority access to new products. These NFTs could also be traded and sold on NFT marketplaces.

Surely, we are about to see a lot more happening in the space. Stay tuned. More articles on that soon.

What's brewing today? Bringing fresh beans to you:

From 'Bitcoin Billionaires' to SEC Charges: A Brief Crypto History of the Winklevoss Twins: Cameron and Tyler Winklevoss went from being the co-originators of Facebook deceived by Mark Zuckerberg (as dramatized in the film “The Social Network”) to early crypto adopters who became "Bitcoin billionaires." Now their firm has been charged by the United States Securities and Exchange Commission (SEC).

Why NFTs Were Invented: Everything ever invented came into existence in order to solve a problem. In the case of NFTs, they were created to address the limitations of their predecessors, which were created on the Bitcoin blockchain.

Top crypto funding stories of 2022: 2022 was a watershed year for crypto venture capital (VC). Investors poured billions of dollars into blockchain-focused startups despite the overwhelmingly bearish trend in asset prices. Is the VC-dominated crypto funding model good for the industry? Only time will tell.

Whats meme-ing?

And now the funny part,

ChatGPT going really strong !!

Fundraising in 2023 😂

— Julia MacDonald (@julia_m_mac)

1:54 PM • Jan 14, 2023

Market Bears when Bitcoin rises again....

Les bears quand le #Bitcoin repart à la hausse 🐻

— Kaeru 🐸 (@MemeCryptoFR)

9:46 AM • Jan 13, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.