- Digital Beans

- Posts

- Crypto Beans - Feb 19, 2023

Crypto Beans - Feb 19, 2023

Your 0-1 weekly crypto newsletter

Hey there everyone! 👋 This is Shivam. I bring to you the 9th weekly edition of Crypto Beans.

For all my friends who are getting this for the first time,

This is an effort through which I try to share my thoughts on the crypto space and help you stay updated. Your 0 to 1 guide in crypto. Let's take off on this journey together 🚀 🚀

Read time - 4 mins

Today at a Glance:

State of Crypto affairs

Top crypto projects/protocols

Greed and fear index

Is ETH ultrasound money?

Spill the beans (Explain to me like a 5 year old)

What's brewing today?

Whats meme-ing?

In this edition, the article I talk about "BLOCKCHAIN REVOLUTIONS"

Loading.....

State of Crypto affairs? A quick look at the market

The global crypto market currently stands at $1.17 Trillion. It is still ~60% down(👎) from its all time high of $3 Trillion which it hit in November 2021.

The global cryptocurrency market cap today: $1.17 Trillion

Weekly change: 9.67% | Yearly change: -38.16%

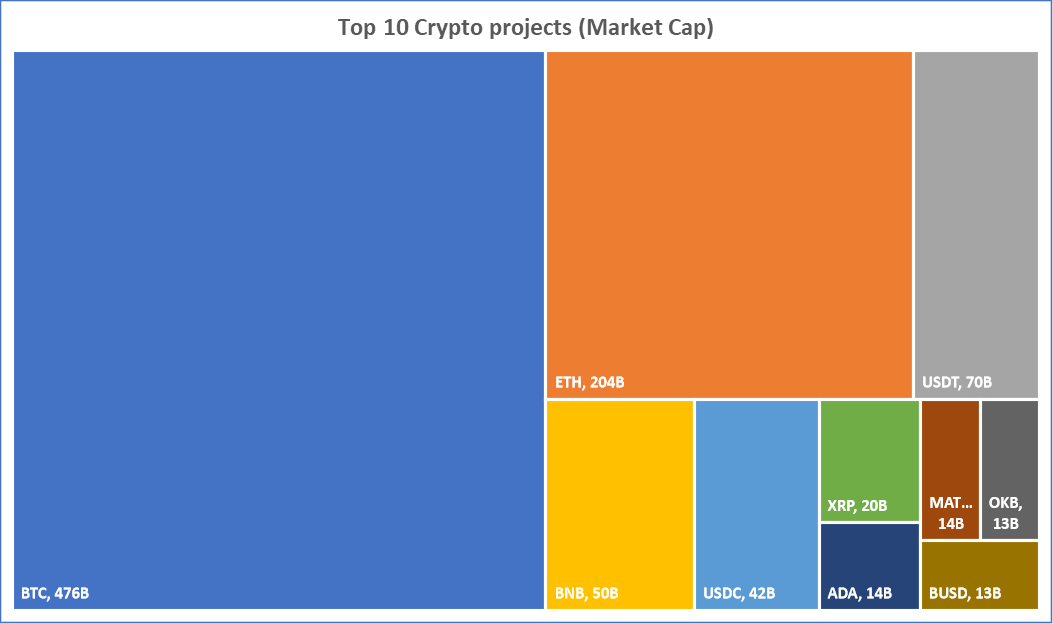

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $476 Billion.

Bitcoin price today: $24,700

Weekly change: 13.16% | YTD change: 48.50%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies.

A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 42.46% | Last year (Feb 2022): 41.76%

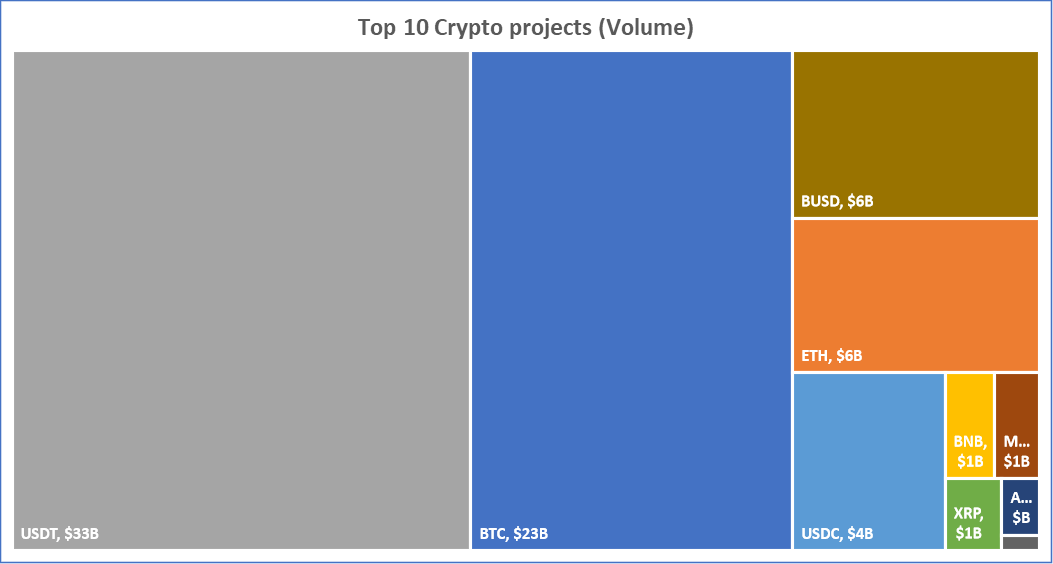

Top crypto projects/protocols by different metrics

The Interesting thing to note here is that although Tether (USDT) has just $70B market cap, it is traded the highest with volume close to $33B given its use as a stablecoin for the exchange of assets. Meanwhile, Stablecoin market cap is at $137 Billion and has a 11.71% share of the total crypto market cap.

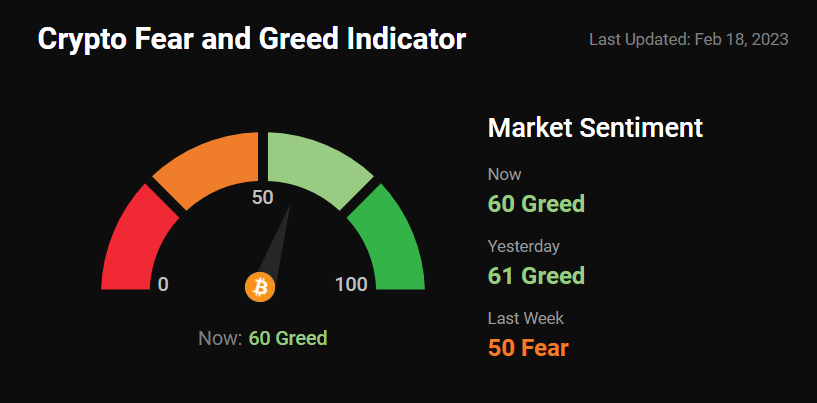

Greed and fear index

The latest rally took Bitcoin to over $25,000, so the index shows high greed sentiment in the market. Time to sell maybe?

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

Is ETH ultrasound money?

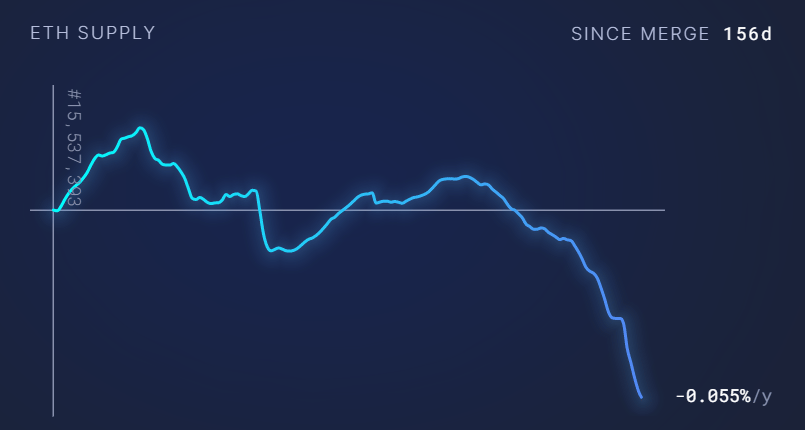

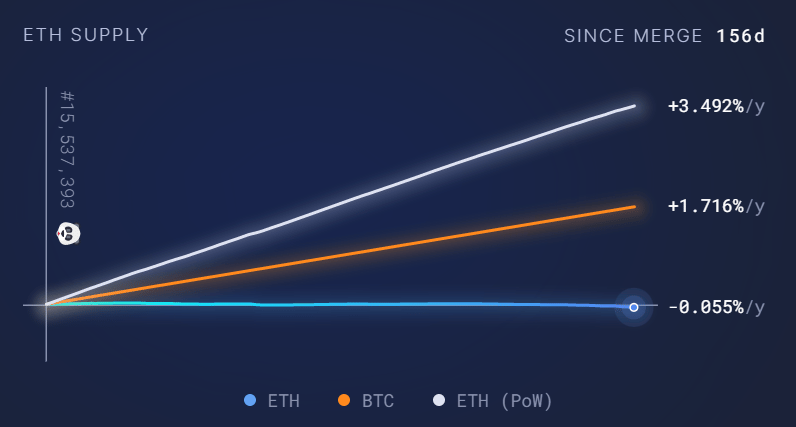

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW, as there is a shift in the narrative for Ethereum to become a store of value due to the expected reduction in ETH emissions. (Super Bullish)

Supply change since merge POS -28,245 ETH

The graph highlights POS vs POW issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

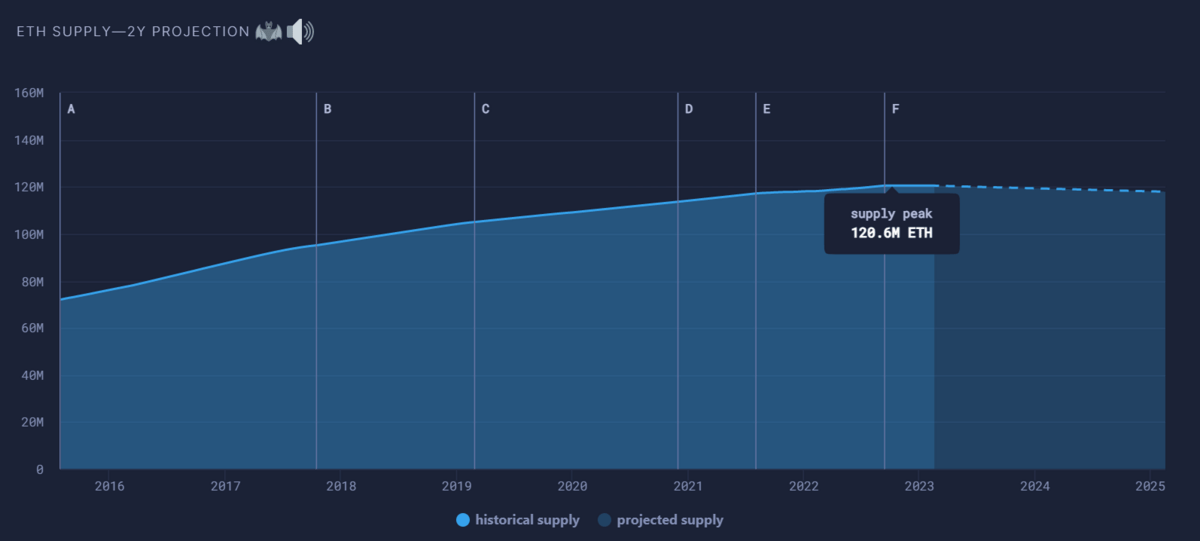

Eth has officially less supply post merge, here is a look at the 2 year supply projections

Spill the beans (Explain to me like a 5 year old)

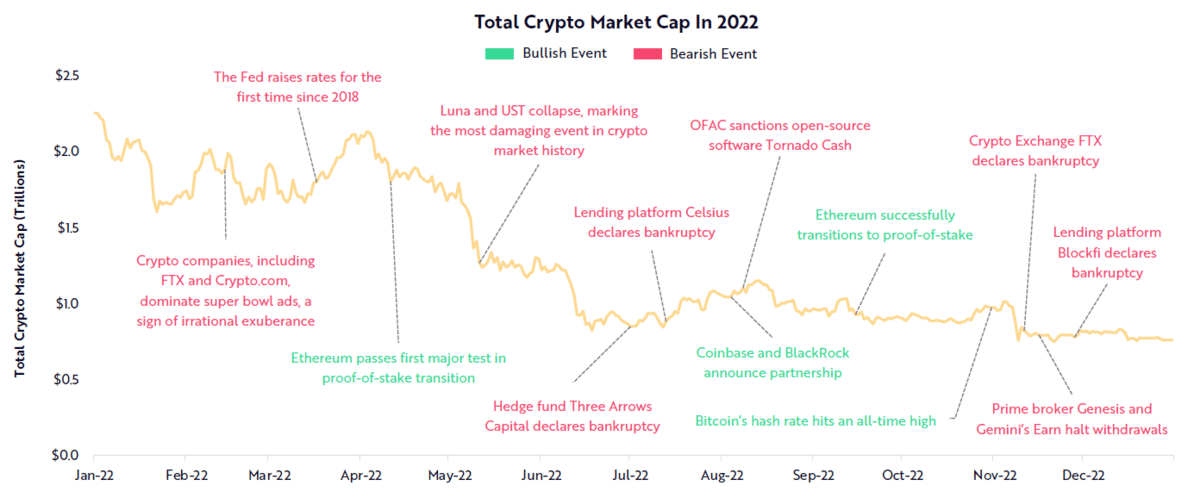

Public Blockchains are Gaining Traction In The Midst Of Crisis

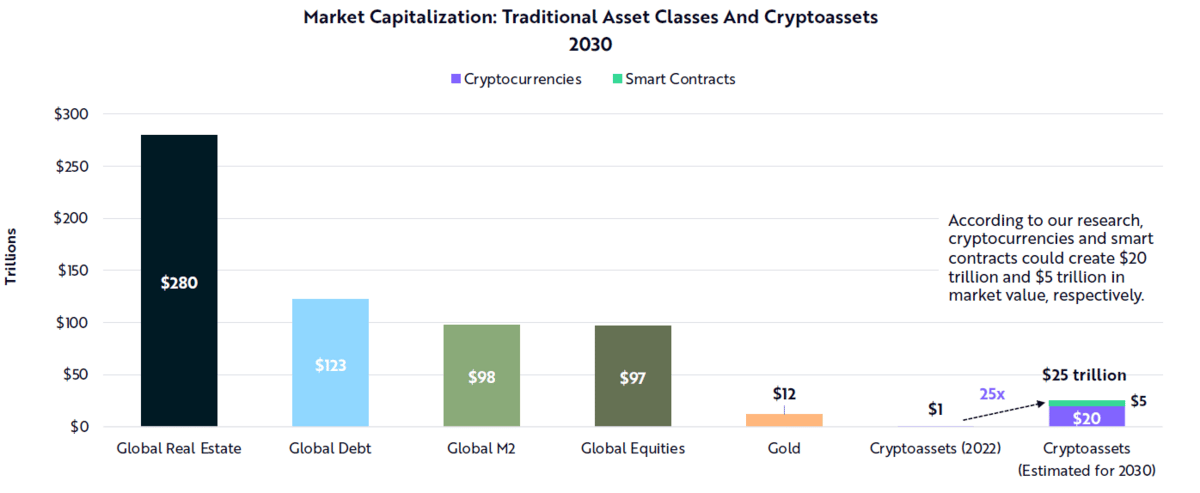

The chart above looks full of contagion that happened across 2022. However, as per reports, Cryptocurrencies and smart contracts could command $20 trillion and $5 trillion in market value, respectively, during the next ten years.

Despite the severe downturn, public blockchains continue to foster innovation and adoption. The main reason is not just the utility but the IDEA and the VISION it represents. More like a once in a decade tech idea or better, a "REVOLUTION"

In this article, "REVOLUTION" from an understanding POV can be categorized into The Monetary, Financial, And Internet Revolutions. If this idea holds true, the long-term opportunity for Bitcoin, DeFi, and Web3 is strengthening.

Let's dive into the 3 revolutions to understand more:

Monetary Revolution | Bitcoin’s Long-Term Opportunity Is Strengthening

It resonates with the idea of Coordination of value transfer and property rights outside the purview of centralized authorities, governments, and top-down control. Imagine what has happened in countries where GOVTs fail, people have nowhere to go with their money because it risks becoming worthless. Bitcoin changes that by decentralizing the control over money.

Bitcoin has settled ~$100 trillion of value in ~791 million transactions since its inception.

Independent of price, miners continued to validate transactions, mining ~53,000 blocks and generating ~$10 billion of revenue in 2022.

What is the PROBLEM?

Centralized Monetary Systems Have Failed To Provide Strong Economic Assurances.

> 4 billion people live under authoritarian regimes.

> 2 billion people suffer from double-digit inflation.

> 1 billion people cannot use traditional payment transfer apps.

How does BTC solve this?

Bitcoin is censorship-resistant — The barriers to transacting on Bitcoin are low, the only requirement being possession of a private key.

Bitcoin is inflation-resistant — The number of bitcoin created is mathematically metered and predictable, according to a predefined schedule. The supply of bitcoin outstanding is 19 million now and capped at 21 million units.

Bitcoin is seizure-resistant — Bitcoin combines elliptic curve cryptography and secure custody to ensure independent property rights.

Bitcoin is auditable and transparent — Bitcoin decision making is transparent and decentralized. Running a full node, a user is free to validate transactions and audit supply.

Financial Revolution | Decentralized Finance Powered Through The Crypto Crisis

It is the idea of Coordination of financial services and contracts outside the purview of traditional financial institutions. To give an example, Remember in 2007 crash, where banks were so overleveraged that governments had to bail them out. Who suffered in the end — The common man.

What is the PROBLEM?

More than 2 billion people lack access to basic banking services, including account management and credit.

The opacity of traditional financial institutions has caused catastrophic financial collapses.

Counterparty risk among traditional financial institutions results in single points of failure, and centralized decision making enables rampant rentseeking.

How does DeFi solve this?

DeFi eliminates traditional intermediaries — Automated smart contracts guarantee execution without the need for trusted toll-takers.

DeFi is global — Financial services deployed on open protocols enable anyone with an internet connection access to custody, trading, and lending facilities.

DeFi is interoperable — Financial services are open-source and interoperable, allowing for rapid innovation and experimentation.

DeFi is auditable and transparent — Users govern risk and functions, while collateralization and asset flows are open for inspection.

Internet Revolution | The Case For Web3 Is Reaching A Tipping Point

It is the idea of Coordination of identity, reputation, and data outside the purview of tradition.

What is the PROBLEM?

The Internet relies on tech monopolies that exploit, own, and monetize user data.

Online identity and reputation are not interoperable.

Centralized decision makers dictate the discovery of information, subjectively moderating content and communication.

How does Web3 solve this?

Web3 is user owned — Web3 introduces digital property rights for the first time.

Web3 relies on protocols, not platforms — Decentralized protocols enable the governance of—and open access to — distributed data, limiting central aggregator control.

Web3 enables new monetization paradigms — Web3 embeds economics into software, enabling users to monetize and participate in network development.

Web3 enables the convergence between consumption and investment — Consumer behavior is shifting as the economy becomes digitally native, enabling a new paradigm for purchasing, owning, and using goods and services.

To wrap things up : If things fall in place, we can expect a run to $25 trillion asset which is a 25x in a decade.

The opportunity is too huge to miss. Just LITs up my everyday.

Here's a link to the complete report

What's brewing today? Bringing fresh beans to you:

OpenSea Goes Zero-Fee, Creator Royalties Optional: The top NFT marketplace’s policy shift stems from competition with popular zero-fee marketplace Blur.

YouTube appoints Web3-friendly exec as new CEO: YouTube’s new CEO Neal Mohan previously emphasized that NFTs could be an important tool for the platform’s content creators to develop additional revenue streams.

Polygon Labs President Ryan Wyatt: 'The Next Jeff Bezos Will Come From Web3': The former YouTube Gaming head joins Decrypt’s gm podcast to reflect on his path into crypto and how it can all go mainstream.

Whats meme-ing? Better make sure this is fun

And now the funny part,

Converting a “crypto investor” to a bitcoiner #bitcoin

— The Bitcoin Mindset ⚡️ (@thelevelupexp)

11:51 PM • Feb 16, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.