- Digital Beans

- Posts

- Crypto Beans #19 Government deficits and debt, how Bitcoin could be your hedge and more

Crypto Beans #19 Government deficits and debt, how Bitcoin could be your hedge and more

Your 0-1 weekly crypto newsletter

Hey there everyone! 👋 This is Shivam. I bring to you the 19th weekly edition of Crypto Beans. This is an effort through which I try to share my thoughts on the crypto space and help you stay updated. Your 0 to 1 guide in crypto.

Read time - 4 mins

In this edition, the article I explore is titled "Government deficits and debt, how Bitcoin could be your hedge and more" Hope you enjoy it.

Spill the beans (Explain to me like a 5 year old)

Why do governments default on debt and the secret of how governments work

1} A government runs ultimately on the same simple accounting rules as we all have learnt. We will take the case of US for ease of understanding

The two basic ingredients:

Revenue (money coming in)

Expenses (money going out)

There are two scenarios:

When revenue exceeds expenses, an individual has “savings” — a government has a “surplus.” When expenses exceed revenue, an individual has a problem — a government has a “deficit.”

This imbalance is concerning for an individual but a government has more leeway to solve this. Governments can simply kick the can and borrow from the future to meet the deficit.

The graph below shows how the deficit for US in 2023

2} The government is borrowing more debt from the future to cover the fiscal deficit

More the debt, more is the future obligation to service the debt and it keeps on growing until it spirals out of control in most cases. When a bigger economy like US, China or India borrows too much, a few things happen:

Their financial position worsens (they have a lot of debt)

People and countries begin to view them as higher risk borrowers (interest rates go up)

They have to spend more on interest expense (now that they have higher interest rate debt)

3} How do governments try to get out of the debt situation

Going back to the basic accounting measure that we discussed, the idea is to come out of the deficit by either increasing revenues or decreasing spending or both

Well there are few ways the governments can do that:

Spending cuts - This would mean that the budget has lesser allocation of capital to different departments and developmental activities. Subsidies are reduced and freebies taken away. This means - unhappy public and politically anyone would not be incentivized to do this

Higher taxes - Governments eventually have to tax the people to get a larger share of their revenue in the form of taxes to cover for the deficit. This is because major source of revenues for governments are through taxes. Again politically dis-incentivization to do this

However we see that this is not happening, and hence the only way left to cover the deficit is still.... You guessed it right - taking more debt

And with raising the debt ceiling, the govt has kicked down the can again.

Now that we understand what governments tend to do when there is a deficit, its clear that taking more debt by printing money out of thin air will eventually reduce purchasing power of your currency and your net worth. This has the direct implications for all of us:

Loss of purchasing power of the currency

Higher inflation rates

Higher interest payments of debt leading to increasing deficit and eventually more debt

This can quickly turn into something bad as it has happened in the history with Germany and today with Argentina and Venezuela who are close to the debt spiral black hole than ever

4} Store of Value assets like: Bitcoin could be very attractive right now

This brings us to Bitcoin which unlike traditional currencies, has value not linked to the global economy or a policy goal of losing value every year. Instead, Bitcoin's value is linked to increasing scarcity. Its design is based on a simple mathematical principle of decreasing issuance over time, making it the only asset in the world that is becoming more scarce with each passing day.

Think of it as Real Estate or Gold but on Steroids!!

It's an asset that's becoming more scarce every day, and its value is only going to increase as demand continues to rise. If you're an investor, what matters most is how your assets will perform over time. And right now, Bitcoin is the fastest horse in the race.

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $1.26 Trillion

Weekly change: 3.04% | Yearly change: -31.05%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $567 Billion.

Bitcoin price today: $29,290

Weekly change: 6.18% | YTD change: 76.57%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 47.17% | Last year (April 2022): 41.62%

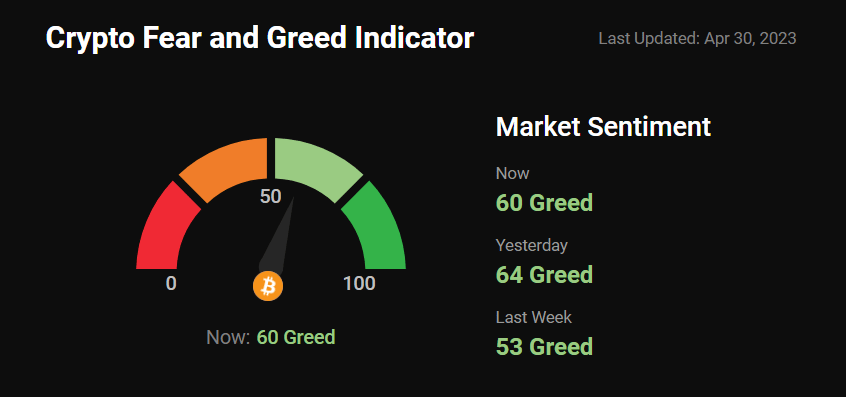

Greed and fear index

The market sentiment has been greedy for sometime now as the market seems to expect rate cuts this year even with a looming recession

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

Is ETH ultrasound money?

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW, as there is a shift in the narrative for Ethereum to become a store of value due to the expected reduction in ETH emissions.

Supply change since merge POS -124,688 ETH

The graph highlights POS vs POW issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

What's brewing today? Bringing fresh beans to you:

Marvel Studios Founder Says Web3 Has 'Same Seed' of His Early Marvel Days: “I think there's so much noise that we have," he said. "In our lives, there are so many pulls on our time, so many distractions, that for something new to break through ... there needs to be a visual identity to it and a primal feeling from it. And art does that for me."

Lightning Labs Aims to Help 'Bring Bitcoin to Billions' With Latest Upgrade: The team at Bitcoin tech startup Lightning Labs, one of the main developers of Bitcoin's speedy and scalable Lightning Network, released an update to its Litd node management tool designed to make Bitcoin and Lightning easier to use.

First Republic’s crisis is not an isolated incident - suggests JPMorgan exec: An executive at JPMorgan Asset Management is unsure how United States regional banks are “going to operate” when the Federal Deposit Insurance Corporation (FDIC) and Federal Home Loan Bank (FHLB) emergency lending programs expire – warning that the possible collapse of First Republic Bank may cause a domino effect.

Whats meme-ing? Better make sure this is fun

And now the funny part,

#Bitcoin changes you.

— The ₿itcoin Therapist (@TheBTCTherapist)

12:23 AM • Apr 25, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.