- Digital Beans

- Posts

- Crypto Beans #11 Lindy Effect and Bitcoin!

Crypto Beans #11 Lindy Effect and Bitcoin!

Your 0-1 weekly crypto newsletter

Hey there everyone! 👋 This is Shivam. I bring to you the 11th weekly edition of Crypto Beans. This is an effort through which I try to share my thoughts on the crypto space and help you stay updated. Your 0 to 1 guide in crypto.

Read time - 3 mins

In this edition, the article I explore is "Lindy Effect and Bitcoin! " Hope you enjoy it.

State of Crypto affairs - A quick look at the market

The global cryptocurrency market cap today: $1.08 Trillion

Weekly change: -8.18% | Yearly change: -42.05%

Bitcoin (BTC) is the largest cryptocurrency with a market cap of $433 Billion.

Bitcoin price today: $22,435

Weekly change: -3.47% | YTD change: 34.83%

Another important metric is Bitcoin dominance which can be used as a rough indicator of the relative strength of Bitcoin versus other cryptocurrencies. A high Bitcoin dominance means that Bitcoin has a large market share and is potentially more influential in the overall cryptocurrency market and vice-versa.

Bitcoin dominance: Current Year: 41.98% | Last year (March 2022): 42.47%

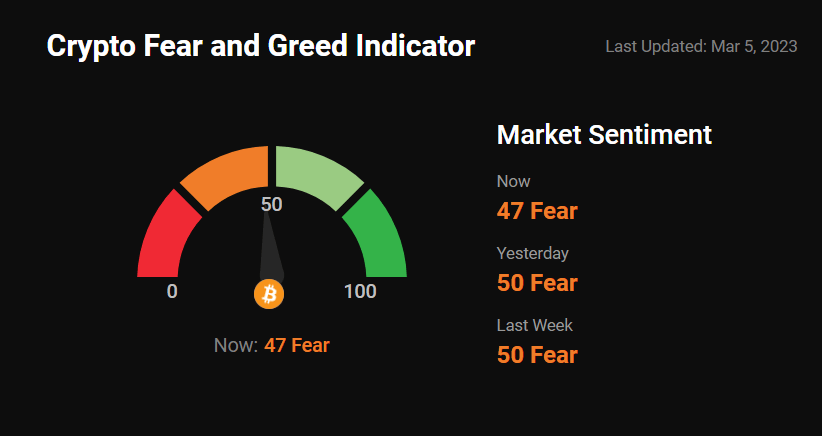

Greed and fear index

The market sentiment has been turning, now the market seems to be getting more cautious with the news around layoffs and looming recession.

Note: The data used is based on metrics like Volatility, Surveys, Bitcoin Dominance, Social and Google Trends. Source: Coinstats

Is ETH ultrasound money?

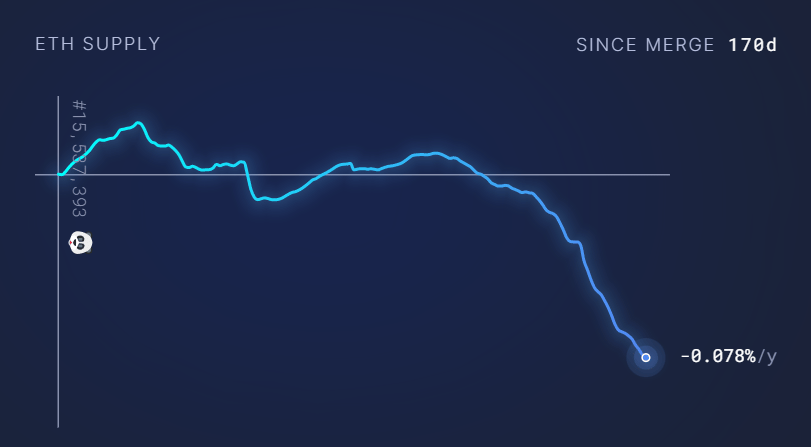

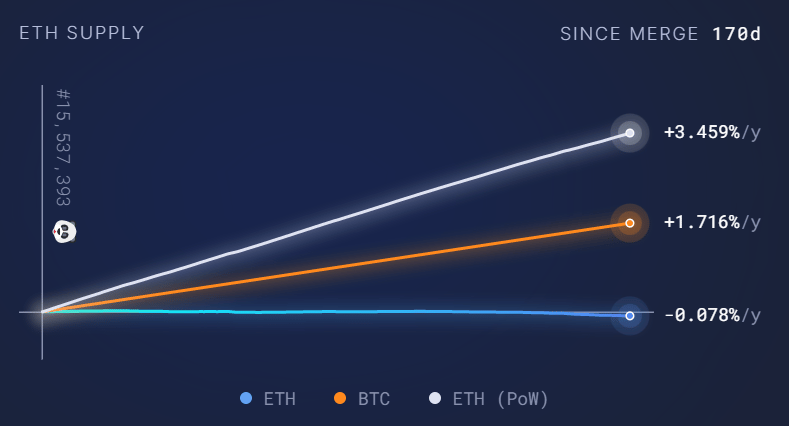

Let's have a look at Ethereum supply changes post its merge to a PoS blockchain from PoW, as there is a shift in the narrative for Ethereum to become a store of value due to the expected reduction in ETH emissions.

Supply change since merge POS -44,276 ETH

The graph highlights POS vs POW issuance since the merge. Impressive numbers, look super bullish for ETH long term given the supply of ETH is not growing as before

Spill the beans (Explain to me like a 5 year old)

The framework to understand Bitcoin's growth

Hear me out: In the world of cryptocurrencies, there is chaos and opportunity. One term that I have found useful to broadly understand where the world of blockchains is headed is the "Lindy Effect".

But what exactly does it mean, and how does it relate to Bitcoin?

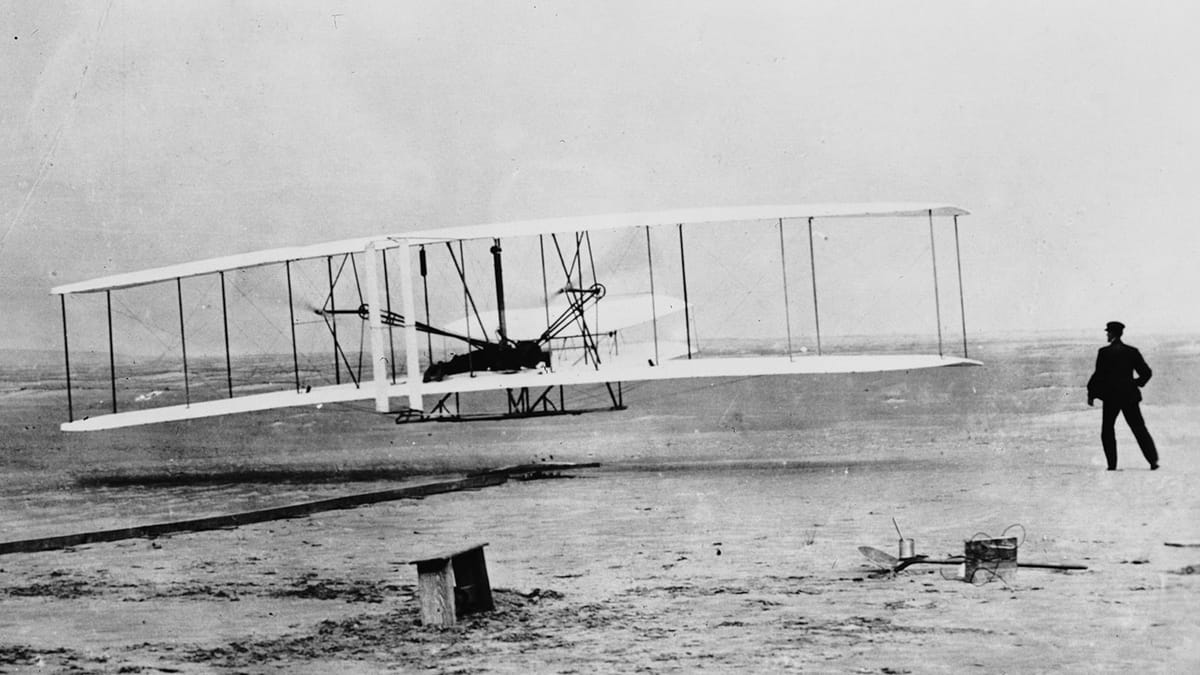

And why this picture of airplane?

In simple terms, the Lindy Effect is a theory that suggests that the longer a technology or idea has been around, the longer it is likely to continue to exist. The idea is named after the famous Lindy's Deli in New York City, where actors and comedians would gather and speculate on the longevity of Broadway shows.

At the core of the Lindy effect is human nature. As humans, we trust things more the longer they have existed. For example, most people thought the Wright brothers were insane when they built and flew the first airplanes in the early 1900’s. Today, we take air travel for granted (Rings any bells). The same phenomenon applies to mobile phones, computers, and Bitcoin.

Wikipedia states: “The Lindy effect (also known as Lindy's Law) is a theorized phenomenon by which the future life expectancy of some non-perishable things, like a technology or an idea, is proportional to their current age. Thus, the Lindy effect proposes the longer a period something has survived to exist or be used in the present, it is also likely to have a longer remaining life expectancy. Longevity implies a resistance to change, obsolescence or competition, and greater odds of continued existence into the future.”

So, how does this relate to Bitcoin?

Well, Bitcoin has been around since 2009, which means it's been around for over a decade now. According to the Lindy Effect, the longer Bitcoin exists, the more likely it is to continue to exist in the future. first Bitcoin block was added to the blockchain on January 3, 2009. So, we can calculate that Bitcoin has been in existence for 12, almost 13, years.

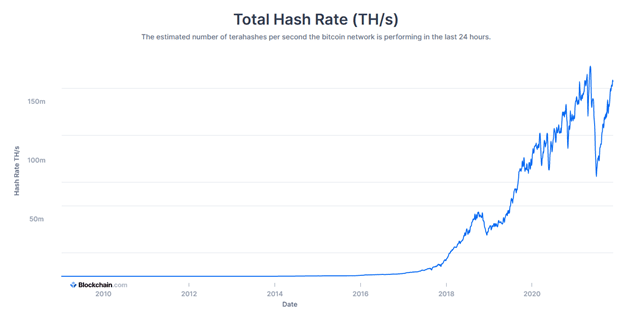

“Has Bitcoin crossed the threshold as it relates to the Lindy effect?” To answer that question, we examine the following topics: Bitcoin’s mining growth rate (hash rate) & Bitcoin’s user growth rate.

BITCOIN’S MINING GROWTH RATE

As we can see, the hash rate has increased exponentially throughout Bitcoin’s 12-year life In addition to the Bitcoin network hash rate (security) increasing over time, the distribution of mining is also increasing.

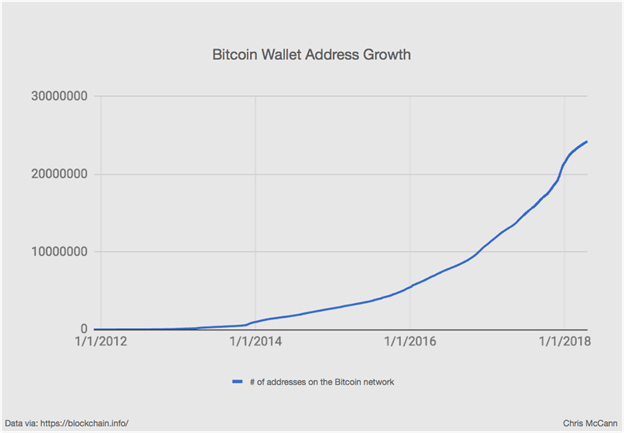

BITCOIN’S USER GROWTH RATE

Let’s also examine Bitcoin’s user growth rate (wallet addresses) in order to determine if it has achieved a strong network effect. The below graphic shows Bitcoin wallet address growth since inception. As we can see, the number of users joining the Bitcoin network has increased at an exponential rate. The estimated number of users topped 100 million earlier this year. It is safe to say that Bitcoin has achieved impressive network effects in its first 12 years.

Lindy Effect and Bitcoin as a Long-Term Investment

The Lindy Effect suggests that Bitcoin has a high likelihood of continuing to exist in the future, given its decade-long existence. And with its unique features and attributes, Bitcoin has become an increasingly popular long-term investment option for businesses and individuals alike.

But like any investment, it's important to do your research and understand the risks involved before diving in. So, whether you're a seasoned investor or just getting started, make sure to do your due diligence and consider Bitcoin as a potential long-term investment option.

What's brewing today? Bringing fresh beans to you:

The Rise and Fall of Silvergate’s Crypto Business: The bank’s own data shows the rapid acceleration of its novel crypto-banking business and how leaning into digital assets made it vulnerable to the industry’s drama.

What Is Yield Farming? Beginner's Guide: At its core, yield farming is a process that allows cryptocurrency holders to lock up their holdings, which in turn provides them with rewards.

India explores offline functionality of CBDCs — RBI executive director: In addition to offline functionality, RBI is gauging CBDC’s potential for cross-border transactions and linkage with legacy systems of other countries.

Whats meme-ing? Better make sure this is fun

And now the funny part,

NFT founders earning 0% royalties watching their floor price drop

— alexjm 🍿 the blue roo 🦘 (@alexjmingolla)

12:20 AM • Mar 2, 2023

What did you think of today's edition?

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.